Global snacking juggernaut Mondelez International (NASDAQ: MDLZ) is home to a wide array of recognizable brands, including Oreo, Ritz, CLIF Bar, Chips Ahoy!, Triscuit, Toblerone, and Sour Patch Kids. Since its spinoff from Kraft Heinz in 2012, Mondelez has delivered consistent 10% annualized total returns.

While these returns have slightly lagged the S&P 500 index's 14% yearly increase over those 12 years, the company's returns have matched the index's historical annualized return of 10% over the last century.

So what makes Mondelez a magnificent dividend stock to buy, considering it has only matched the market's historical returns?

Perhaps the most compelling reason to own the company is that it can deliver market-matching returns in a less stressful manner. Currently, Mondelez has a five-year beta of just 0.5. Betas measure the systemic risk of an investment, and when this figure is below 1, it indicates that the stock is less volatile than the overall market. And Mondelez certainly fits that billing.

Over the very long haul, the company may lag in bull markets, but it should win in bear markets -- all while providing the stability some investors need from blue chip dividend stocks.

Best yet for investors, despite benefiting from these stable operations and consistent returns, Mondelez's growth story could be far from over.

Mondelez is writing the next chapter of its growth story

While Mondelez is known as a snacking juggernaut, generally speaking, it considers chocolate, biscuits, and baked snacks to be its "priority categories." Laser-focused on growing these most important products, Mondelez has grown these core categories from 59% of sales in 2012 to around 80% today and hopes to reach 90% over the long term.

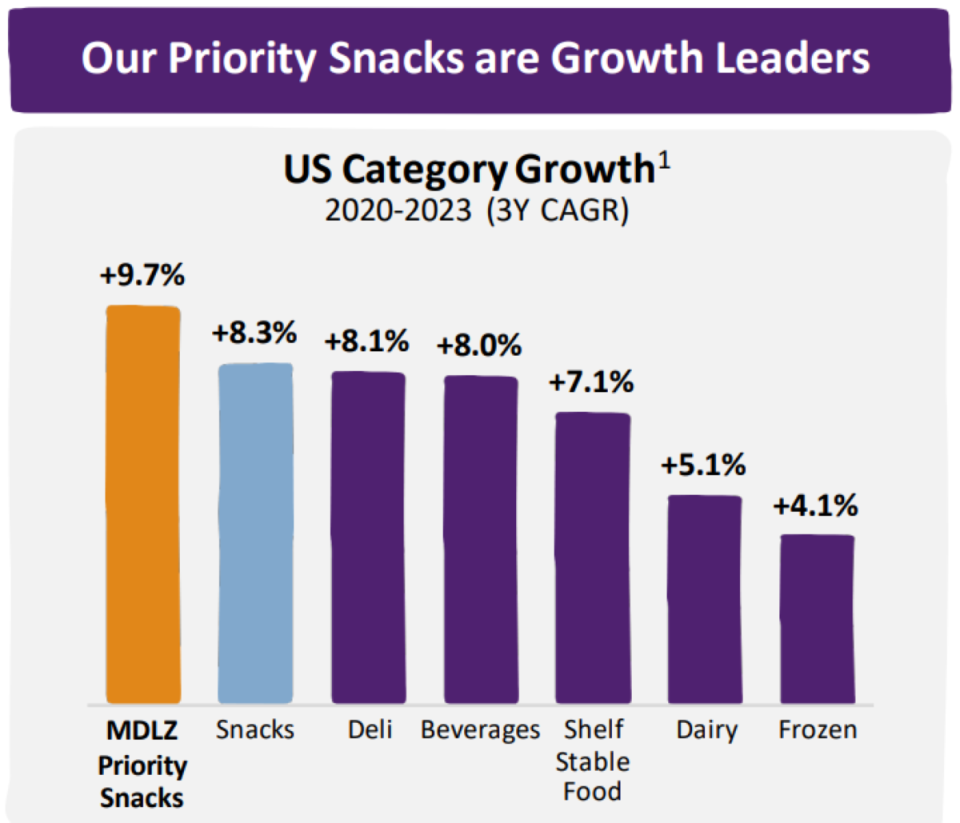

One reason the company focuses on these priority snacks is that they are the fastest-growing category, delivering annualized 10% growth in the United States over the last four years.

In addition to these priority snacks growing at a faster rate, Mondelez holds the No. 1 market share globally in biscuits, the No. 2 share in chocolate, and the No. 3 share in cakes, pastries, and snack bars. Additionally, the company is the market leader in key markets such as chocolate in India and the United Kingdom, and biscuits in China, Europe, and the U.S. Mondelez generates 39% of its sales from emerging markets, including 73% of its revenue from outside the U.S., making it a truly global enterprise.

Powered by the massive distribution network needed to be a global snacking powerhouse, Mondelez loves to grow through acquisitions in adjacent verticals or new geographies. Since 2018, the company has spent roughly $3 billion on nine acquisitions. Today, these purchases generate around $2.8 billion annually in sales and grow by high single digits.

A perfect example of the opportunity these acquisitions bring is the company's $1.3 billion purchase of Mexican confectioner Ricolino from Grupo Bimbo. Not only did this immediately make Mondelez the largest confectioner in a quickly growing snacks market, but it tripled the coverage area for Oreos and biscuits in Mexico, bringing in 500,000 new direct points of sale.

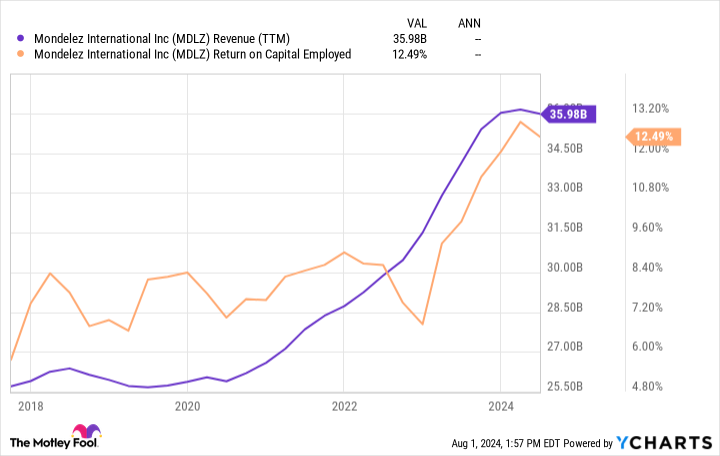

Most importantly for investors, the company's return on capital employed (ROCE) has been steadily improving alongside its rising sales since these acquisitions were made.

Comparing the rising 12% ROCE with the company's 6% weighted average cost of capital (WACC) shows that Mondelez is starting to hit its stride when it comes to generating outsize profits from the capital it deploys on acquisitions.

Eyeing further expansion into Latin America -- its fastest-growing geography -- while monitoring the M&A market for better-for-you snacking options, Mondelez will likely keep up its streak of being a serial acquirer.

As promising as the company's past sales growth and improving ROCE have been, the stock has struggled lately. Revenue dipped 2% in the company's most recent quarter, and profitability continues to be weighed down, with cocoa prices remaining near all-time highs.

These temporary struggles have left Mondelez trading at its lowest price-to-sales (P/S) ratio since 2018.

Thanks to this discounted valuation, the company's 2.5% dividend yield is now at a once-in-a-decade high. Best yet, despite raising this dividend for 10 consecutive years -- during which it grew by 9% annually -- the company only uses 57% of its net income to fund its payments. This percentage indicates that the dividend is well funded and should be able to continue rising higher, especially as Mondelez restarts its growth story.

The cherry on top for investors?

In addition to the company's dividend yield being at a decade-long high, management has repurchased 2.3% of its outstanding shares annually since the spinoff.

Thanks to these shareholder-friendly cash returns, the company's discounted valuation, its elevated dividend yield, and a safe but steadily growing business, Mondelez is a magnificent S&P 500 dividend stock to buy and hold forever.

Should you invest $1,000 in Mondelez International right now?

Before you buy stock in Mondelez International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Mondelez International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $657,306!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Josh Kohn-Lindquist has no position in any of the stocks mentioned. The Motley Fool recommends Kraft Heinz. The Motley Fool has a disclosure policy.

1 Magnificent S&P 500 Dividend Stock Down 10% to Buy Right Now While Its Dividend Yield Is at a Once-in-a-Decade High was originally published by The Motley Fool