Giving credit where it's due, Tesla (NASDAQ: TSLA) mainstreamed electric vehicles (EVs). Although they existed before Elon Musk became head of Tesla, the company made them cool. Consumers also loved the idea of an environmentally friendly automobile. Accordingly, Tesla shares are well up since the company's 2010 initial public offering.

On the flip side, Tesla stock is also down 47% from its late 2021 peak, seemingly stuck in neutral.

What gives? Simply put, the reality of battery-powered vehicles is settling in. These cars aren't quite as practical as first hoped. Tesla shares weren't priced for this adverse development.

Waning EV interest

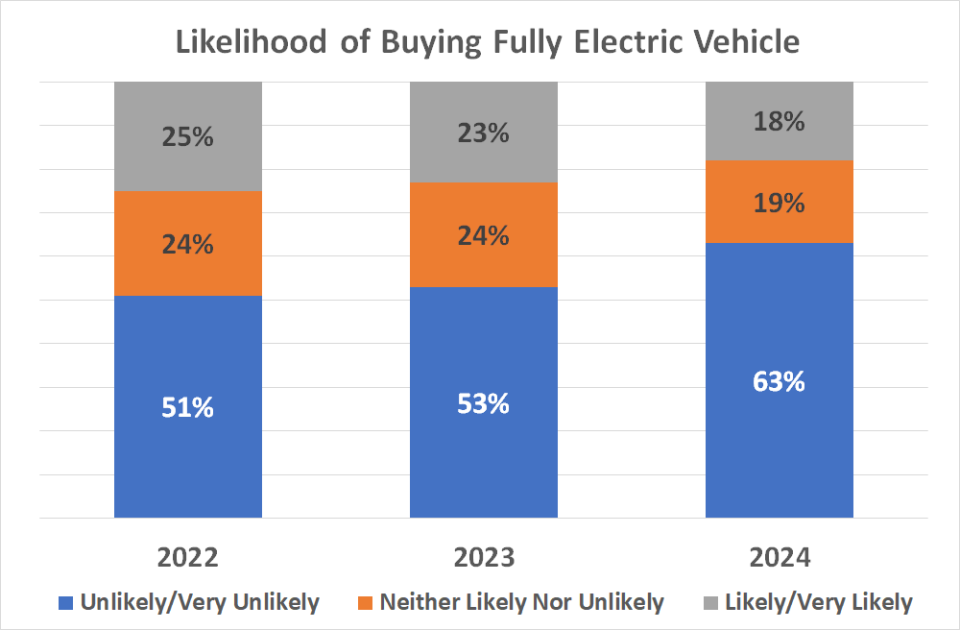

The data comes from the American Automobile Association; you know it better as AAA, or just "Triple-A." In a recent survey, AAA found that 63% of U.S. drivers are unlikely to purchase a fully electric vehicle in the foreseeable future, up from 2023's 53%. Conversely, the proportion of drivers likely to buy an EV fell from last year's 23% to only 18% for 2024. In both cases, the shift is an extension of trends that began a year earlier.

The reason interest in EVs is waning isn't surprising -- consumers are concerned about a lack of driving range and/or the subsequent inability to quickly recharge these vehicles' batteries. Their above-average cost is also a factor.

Tesla stock's historical premium is under pressure

Don't read too much into the message. The EV business isn't doomed. The United States' electric vehicle market's unit sales grew 52% last year, and the International Energy Administration believes sales of electric vehicles within the U.S. will swell another 20% this year. The EV market is going to be bigger in the future than it is right now. And Tesla is still a premier name in the EV business.

Nevertheless, Tesla shares have historically been priced for the company's sheer dominance of the market and the brand's pricing power. Both are now fading as these automobiles' downsides are becoming clear at the same time real competition is creeping in. Investors are still trying to figure out the new normal for this ticker.

Should you invest $1,000 in Tesla right now?

Before you buy stock in Tesla, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Tesla wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

1 Unfavorable Trend That Explains the 47% Decrease in Tesla Stock was originally published by The Motley Fool