Well-chosen dividend stocks can help you build bountiful streams of passive income that you can count on to grow steadily year after year. To aid your search for these wealth-builders, here are two high-yield stocks with proven histories of rewarding their investors with ample and dependable dividends.

No. 1 high-yield stock to buy: Verizon Communications

Verizon Communications (NYSE: VZ) excels at turning connectivity services into cash for its shareholders. The telecom leader is currently offering a great way to boost your passive income with its hefty dividend yield of 6.2%.

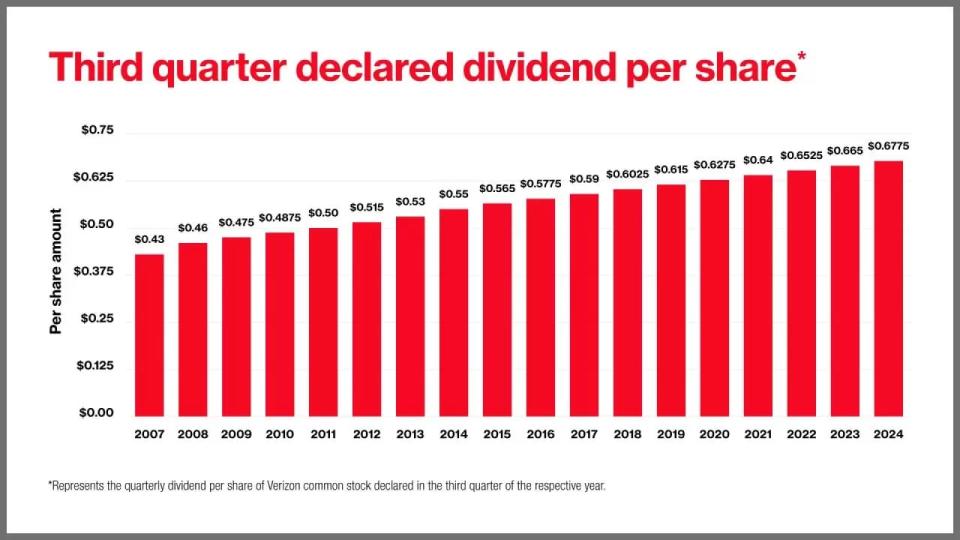

Verizon delivers fast 5G wireless services to over 114 million retail customers and 30 million business clients. With retention rates that are typically over 98%, these accounts produce reliable profits, which Verizon passes on to its shareholders via rising cash payments. The telecom giant generated nearly $14 billion of free cash flow over the trailing 12 months. That allowed Verizon to raise its dividend for the 18th straight year earlier this month.

The dividend stalwart also recently struck a $20 billion deal to acquire fiber internet provider Frontier Communications, which should help it extend this impressive dividend-growth streak. Management expects the deal to bolster Verizon's ability to bundle home internet, TV, and phone services, which can reduce customer churn by as much as 50% compared to those who subscribe to its wireless service alone.

Frontier would add over 2 million fiber subscribers to Verizon's roughly 7.4 million Fios internet connections. The combined company will have a potential fiber customer base of more than 25 million, based on the number of households connected to Verizon's and Frontier's fiber networks.

Verizon's acquisition of Frontier is anticipated to close in about 18 months, subject to shareholder and regulatory approval. Verizon expects the deal to boost its adjusted earnings soon after closing.

No. 2 high-yield stock to buy: Realty Income

Real estate can be another excellent source of passive income. Realty Income (NYSE: O) offers investors an easy and low-risk way to cash in on this lucrative asset class.

Realty Income is structured as a real estate investment trust (REIT). That means it's built to buy properties and pass the income it earns on to shareholders. With 650 consecutive months of cash payments, including 107 straight quarterly increases, Realty Income's dividend is as reliable as they come.

The real estate giant owns over 15,000 commercial properties across the U.S. and Europe. It leases these properties to over 1,500 different tenants in 90 industries. This broad diversification is a key part of Realty Income's prudent risk-management strategy.

A focus on businesses that tend to hold up well during challenging economic times also helps to reduce the risks for investors. Convenience stores, automotive repair shops, and grocery chains are well represented in Realty Income's portfolio. It's a smart strategy that's helped the REIT sustain impressive occupancy rates of 96% or higher since 1992.

Today, Realty Income's dividend yield stands at a solid 5%. With the Federal Reserve set to begin to reduce interest rates as early as this month, the REIT's financing costs should decline in the coming year. That ought to make its real estate investments more profitable -- and lead to higher dividend payments for investors who buy Realty Income's shares today.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $716,375!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Realty Income. The Motley Fool recommends Verizon Communications. The Motley Fool has a disclosure policy.

2 Ultra-High-Yield Dividend Stocks to Buy Now was originally published by The Motley Fool