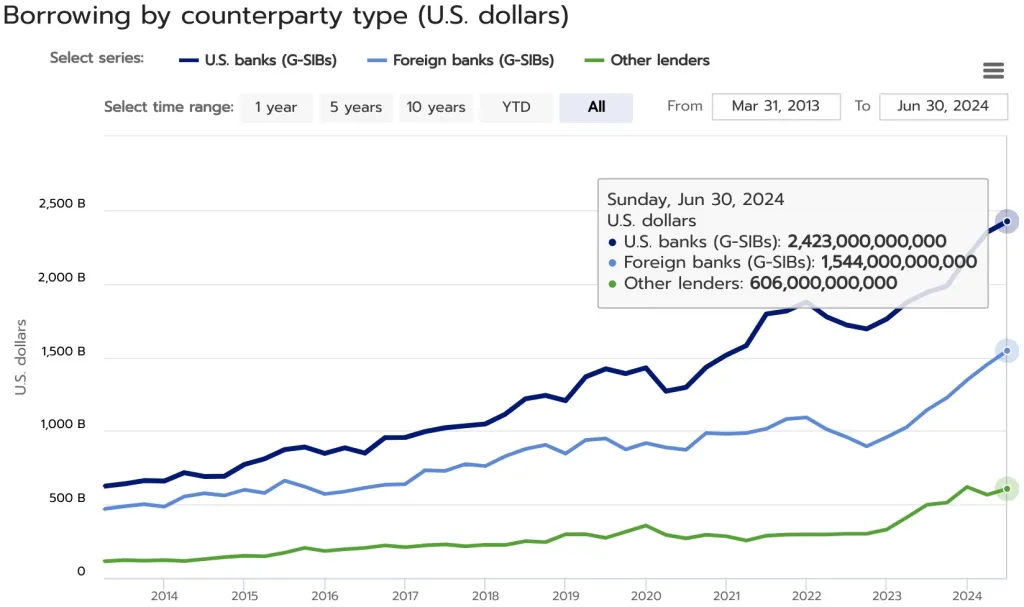

JPMorgan Chase, Wells Fargo, Bank of America and other systemically important US banks are now financing $2.423 trillion in leveraged bets on Wall Street, according to new numbers self-reported by the industry.

The Financial Industry Regulatory Authority (FINRA) says the big banks’ total margin loans to hedge funds have hit a new record high, according to data dating back to March of 2013.

Both US and foreign banks are fueling large levels of leverage in American markets, with foreign systemically important banks financing an additional 1.544 trillion in margin debt.

Margin debt played a major role in the 2008 financial crisis, as outlined in a 2014 study from the Federal Reserve Bank of San Francisco.

“Hedge funds may be the most important transmitters of shocks during crises, more important than commercial banks or investment banks…

Hedge funds are opaque and highly leveraged. If highly leveraged hedge funds are forced to liquidate assets at fire-sale prices, these asset classes may sustain heavy losses. This can lead to further defaults or threaten systemically important institutions not only directly as counterparties or creditors, but also indirectly through asset price adjustments.

One channel for this risk is the so-called loss and margin spiral. In this scenario, a hedge fund is forced to liquidate assets to raise cash to meet margin calls. The sale of those assets increases the supply on the market, which drives prices lower, especially when market liquidity is low. This in turn leads to more margin calls on other financial institutions, creating a downward spiral.”

Lawmakers tackled margin debt in several ways in the aftermath of the 2008 financial crisis.

New legislation imposed stricter leverage and capital requirements on banks while limiting their ability to conduct proprietary trading using their own capital.

In addition, the Dodd-Frank Act required financial firms to use clearinghouses that post collateral and act as a middleman on both sides of the transaction, a process designed to increase transparency and mitigate the risk of one party defaulting.

Generated Image: Midjourney