Investors have an ambivalent relationship with low-cost stocks. While they often seek to buy shares at a relatively low price, they also know that many "cheap" stocks are such because of a weakened investment case.

Nonetheless, the late Charlie Munger advised investors that it is better to buy a great company at a fair price than a fair company at a great price. Thus, investors should look for bargains in a relative sense rather than seeking the lowest valuations possible.

Fortunately, the tech market offers such value stocks, and investors should consider these three stocks while they sell at a low price.

1. Alphabet

Investors seem to have perceived Google parent Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) as less attractive amid the rise of generative AI. But it is much too early to count out this company.

First, it has a long history of AI innovation and has declared itself an "AI first" company since 2016. And it recently combined some of its AI-related entities into Google DeepMind to focus its efforts. It also responded to perceptions that it had fallen behind by developing Google Gemini to remain a force in the generative AI field.

Moreover, it has a $100 billion cash hoard and has shown it is willing to spend it to stay competitive. In the first six months of 2024, it spent $25 billion on property and equipment, almost double the $13 billion during the same period in 2023.

It has a price-to-earnings (P/E) ratio of 27. While not a record low, it is the cheapest stock with a market cap above $2 trillion. Considering its long history in AI, its research efforts, and its tremendous cash position, Alphabet is a low-cost stock that belongs on investors' watch lists.

2. Qualcomm

Among AI chip companies, most of the focus centers on Nvidia, even as companies like Advanced Micro Devices and Intel try to take market share.

However, the company that might emerge as the one best able to compete is Qualcomm (NASDAQ: QCOM). As the leading smartphone chipset maker, it has developed a Snapdragon 8 Gen 3 chip that supports AI applications for smartphones. This could help Qualcomm stock as AI fosters a need for an upgrade cycle in the smartphone market.

And it has diversified into other products. Besides developing Internet-of-Things and automotive applications, it has also created a chip that supports PCs, making it a direct competitor to AMD and Intel.

Furthermore, revenue has returned to growth, with $19 billion in revenue reported in the first two quarters of fiscal 2024 (ended March 24), up 3%. That should continue to rise amid an industry recovery.

Over the previous year, the semiconductor stock is up 55%, likely in anticipation of strong sales for its AI-capable chipset. And given the attention surrounding that topic, investors will probably see its 25 P/E as a bargain that is too good to ignore.

IBM

If you had not paid attention to International Business Machines (NYSE: IBM) lately, you might have assumed that the tech industry passed it by. That was arguably becoming true until IBM acquired Red Hat in 2019.

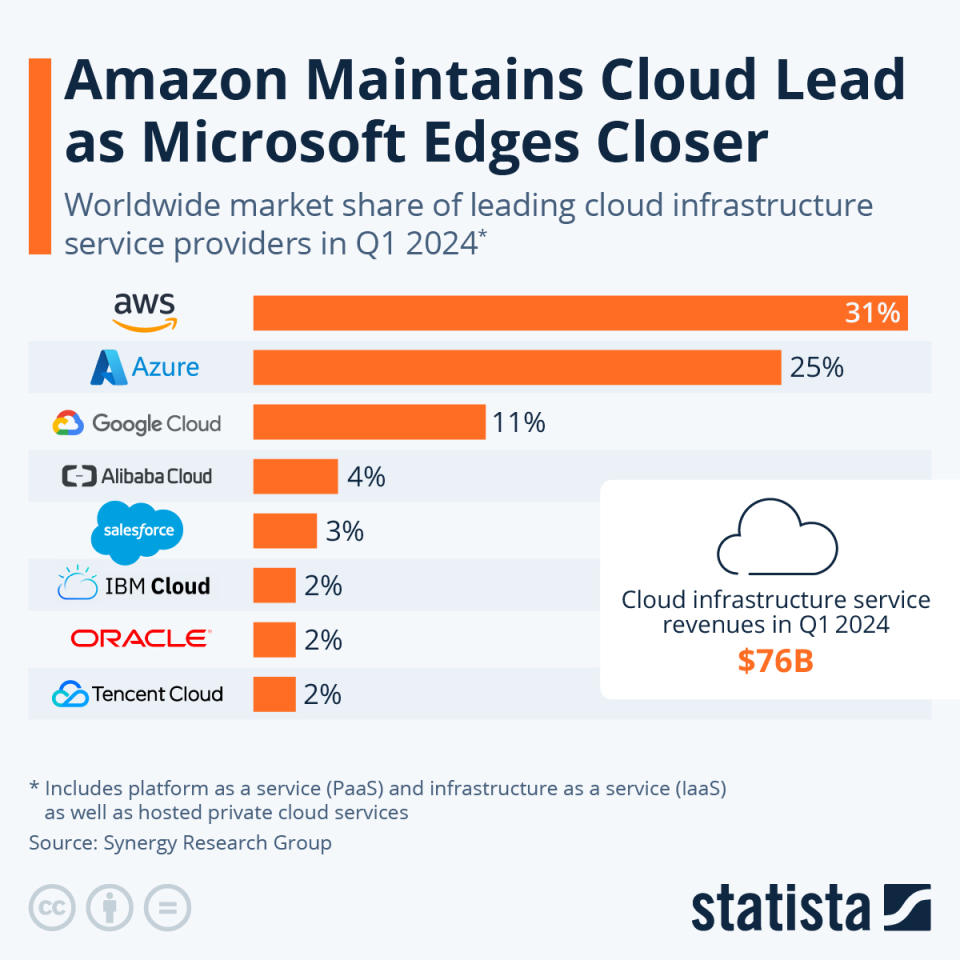

Through that purchase, IBM redefined itself as a cloud company, particularly with its ability to leverage the hybrid cloud. Today, it is the sixth-largest cloud infrastructure company by market share.

Also, its position in the cloud necessitated its AI development, and through watsonx, it can support generative AI applications for its clients, reinforcing its position in today's tech market. Perhaps no other stock combines these elements better than IBM.

Meanwhile, the company has increased its payout for 29 straight years, and at $6.68 per share, it offers a dividend yield of 3.6%, almost triple the 1.3% return of the S&P 500.

Investors have begun to take notice of IBM's value proposition, and the stock is up more than 35% over the last year, and at a P/E ratio of 21. As shareholders continue to benefit from IBM's recovery and rising stock price, they can still add shares at a low cost.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $692,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 22, 2024

3 Cheap Tech Stocks to Buy Right Now was originally published by The Motley Fool