The number of US banks with major issues is on the rise, according to the Federal Deposit Insurance Corporation (FDIC).

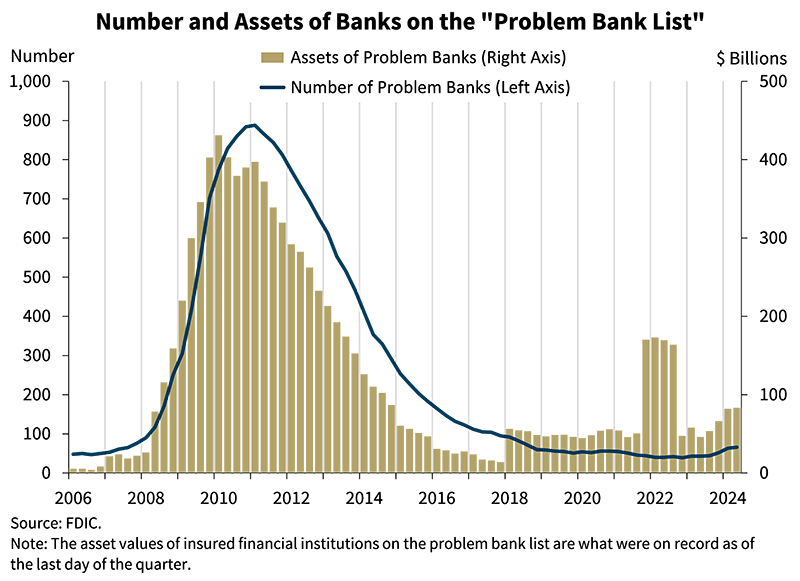

The agency’s Second Quarter 2024 Quarterly Banking Profile shows the number of lenders on its “Problem Bank List” rose quarter-on-quarter from 63 to 66.

This is the fifth consecutive quarterly increase of banks rated 4 or 5 on the CAMELS ratings system since the second quarter of 2023.

A rating of 4 on the CAMELS system indicates a bank is suffering from financial, operational or managerial issues that could reasonably threaten viability if unresolved, while a rating of 5 indicates a bank is critically deficient and requires immediate remedial attention.

“The number of problem banks represent 1.5% of total banks, which is within the normal range for non-crisis periods of 1% to 2% of all banks. Total assets held by problem banks increased $1.3 billion to $83.4 billion.”

Meanwhile, US banks continue to saddle billions of dollars in unrealized losses on securities. The FDIC reports $512.9 billion in total unrealized losses in the second quarter, a 0.7% quarter-on-quarter decrease.

Says FDIC chairman Martin Gruenberg,

“Interest rates increased modestly in the second quarter, putting downward pressure on bond prices, but the resulting increase in unrealized losses was more than offset by the sale of bonds by several large banks that resulted in substantial realized losses.

This is the tenth straight quarter that the industry has reported unusually high unrealized losses since the Federal Reserve began to raise interest rates in first quarter 2022.”

The dangers of unrealized losses came into focus last year amid the collapse of Silicon Valley Bank, when concerns about the lender’s balance sheet triggered a bank run.

Today, Gruenberg says the US banking industry continues to demonstrate resilience, but risks remain.

“…The industry still faces significant downside risks from uncertainty in the economic outlook, market interest rates, and geopolitical events. These issues could cause credit quality, earnings, and liquidity challenges for the industry.

In addition, weakness in certain loan portfolios, particularly office properties, credit cards, and multifamily loans, continues to warrant monitoring. These issues, together with funding and margin pressures, will remain matters of ongoing supervisory attention by the FDIC.”

Generated Image: Midjourney