After several weeks of sustained upward momentum, Bitcoin is currently holding above $66,000. The price has recently encountered resistance at the crucial $69,000 level, which is expected to take time and significant liquidity to overcome.

Key data from Binance reveals that more than half of futures traders have shorted BTC in the past few hours, creating a divisive environment for price action.

The futures market often serves as a barometer for momentum and liquidity, signaling potential shifts in Bitcoin’s price movement. As BTC consolidates just below the $69,000 resistance, maintaining support above $66,000, the coming days will be pivotal.

Investors and analysts are closely watching to determine whether Bitcoin will break through to new all-time highs or if the accumulation period will continue. The outcome could set the tone for the next phase of the market.

Bitcoin Future Traders Remain Bearish (For Now)

Bitcoin is currently in a consolidation phase after weeks of impressive price appreciation. Despite this pause, analysts and investors remain optimistic about Bitcoin’s price trajectory in the coming weeks, with many believing that BTC will begin a massive rally once it breaks its all-time highs. However, this breakout may take some time, as key data from Binance indicates bearish sentiment among futures traders.

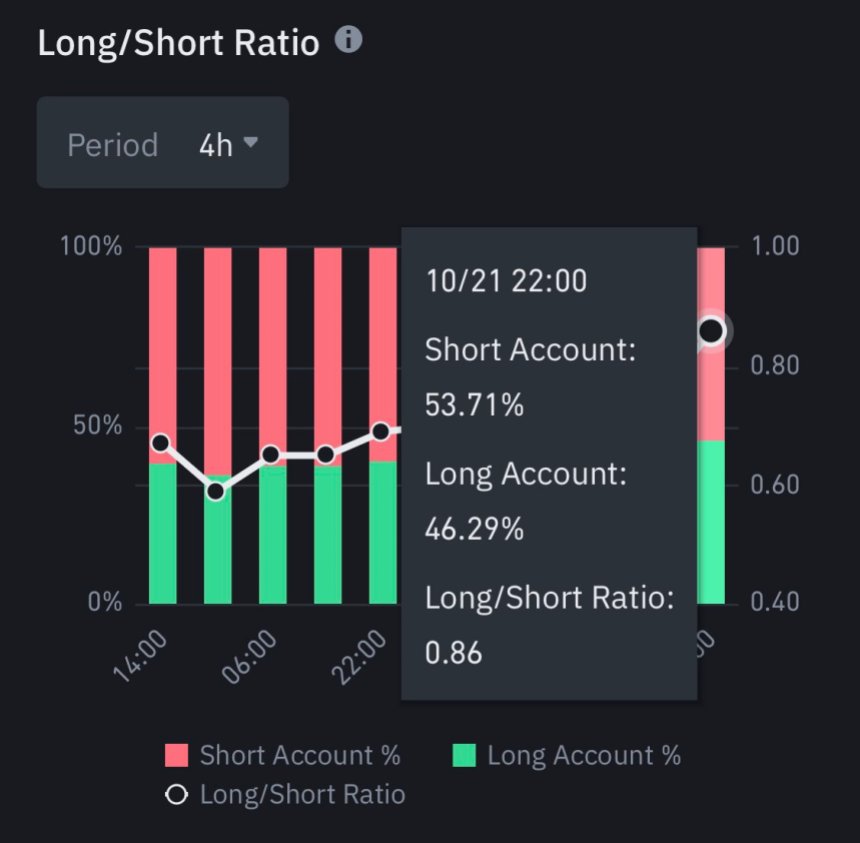

Top analyst and investor Ali Martinez shared the 4-hour long-short ratio on Binance, revealing that 53.71% of futures traders are shorting BTC. This bearish positioning suggests indecision in the market, as traders remain uncertain when Bitcoin will surpass the critical $69,000 level. The ongoing shorting trend could be a temporary barrier to Bitcoin’s momentum.

However, the outlook could shift quickly, as spot investors might take advantage of the current dip and start buying Bitcoin. Increased spot buying could provide the liquidity needed to push BTC higher, reversing the bearish sentiment in the futures market.

If buying pressure intensifies, Bitcoin could soon challenge and break through the $69,000 resistance, potentially paving the way for a new all-time high. In the short term, investors are closely watching to see whether Bitcoin will consolidate further or gain enough momentum to continue its upward trend.

BTC Testing Key Liquidity Levels

Bitcoin is trading at $66,800 after facing a rejection from the $69,000 supply level. Despite the pullback, BTC remains strong, holding above the $66,000 mark. This price level is critical, as it will likely determine Bitcoin’s direction in the coming days.

Should BTC fail to hold above $66,000, the price could seek liquidity at lower levels, with $64,000 as the next target. This level coincides with the 4-hour 200 moving average (MA) and exponential moving average (EMA), making it a key interest for buyers and sellers.

On the other hand, if Bitcoin maintains its position above $66,000, the next likely move will be a renewed challenge of the $69,000 resistance or potentially a push toward $70,000.

The coming days will be crucial in deciding whether BTC will resume its upward momentum or face further consolidation around these key levels. Traders and investors are closely watching to see how Bitcoin reacts at the $66,000 support, which could set the stage for the next big move.

Featured image from Dall-E, chart from TradingView