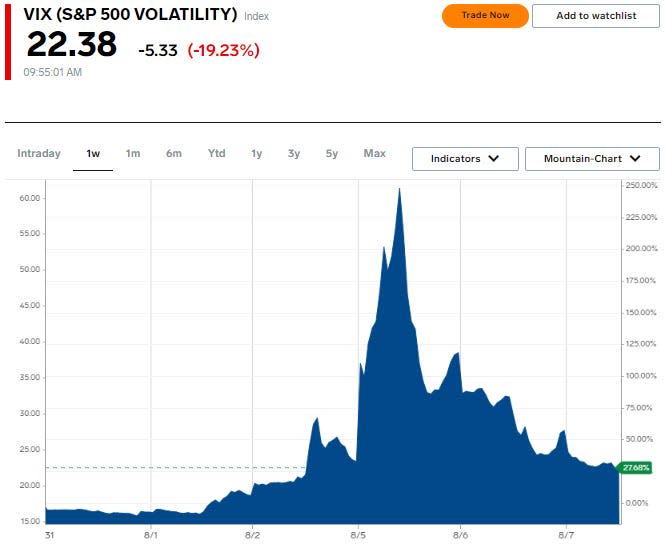

Wall Street's fear gauge has reversed course after a historic surge earlier this week.

The VIX hit its third-highest level ever on Monday due to a violent unwind of the yen carry trade.

The degree of the VIX's reversion since then shows the worst of the scare is over, says Fundstrat's Tom Lee.

The historic surge and subsequent decline of Wall Street's fear gauge suggests that the worst of the stock market's "growth scare" is over.

That's according to Fundstrat's Tom Lee, who said in a Wednesday note that the CBOE Volatility Index, better known as the VIX, is behaving like a bottom in the stock market is in.

The VIX made history on Monday when it soared a record 172% intraday to the 65.73 level, representing its third-highest level ever. The surge came amid a violent unwind of the yen carry trade, which knocked down risk assets across the globe.

The only time the VIX hit a higher level was at its 89.53 peak reached during the Great Financial Crisis in October 2008 and its 85.47 peak hit during the COVID-19 pandemic in March 2020.

But since hitting its third-highest level ever on Monday, the VIX has sharply declined, falling from 65.73 to 27.71 on Tuesday, representing a peak-to-trough decline of 58%. Still, it remains markedly above where it was trading prior to the market sell-off.

"VIX falling from 66 to 27 is a positive sign and further sign this is a 'growth scare' with the worst likely behind us," Lee said, adding that the normalizing VIX affirms that the stock market plunge over the past week is not a systematic crisis.

On a closing basis, the VIX closed down 28.2%, representing its second-sharpest daily decline on record, only being eclipsed by the 29.6% decline seen on May 10, 2010, which was the trading day after a flash crash sent the Dow Jones Industrial Average plunging about 9% in a matter of minutes.

Carson Group chief market strategist Ryan Detrick told Business Insider on Wednesday that when the VIX experiences such swift declines, the stock market tends to see some sizable gains going forward.

"The VIX closed down more than 10 points yesterday, which is very rare. This last happened after the Flash Crash in May '10, the US debt downgrade in August '11 and March 2020. All three of those times were quite bullish times for investors and a year later the S&P 500 was higher each time and up 37% on average," Detrick said.

Fundstrat's new note from Wednesday referenced commentary from last Friday suggesting stocks could bottom this week. At that point the VIX was up 65% over the course of three days. Note that it spiked another 65% on Monday as the S&P 500 saw its worst day in two years.

The firm's finding showed that since the VIX's inception in 1990, there have been nine times when the VIX saw a three-day surge of more than 65% and closed above the 25 level.

In nearly half of those instances, stocks found their bottom within a few short days and the S&P 500 delivered a three-month median return of 7% over the next three months with a 100% win rate.

"Whenever the VIX surges like this, half the time you're at the end of a decline and you bottom within two days, so I think the rally that started today kind of falls within those parameters," Lee said in a video update to clients on Tuesday.

Since the VIX peaked on Monday, the S&P 500 has rebounded 4% while the Nasdaq 100 is up about 5%.

Looking ahead, lower interest rates have long been viewed as a positive catalyst for stocks. As of right now, investors expect the Fed to cut rates by 100 basis points between now and the end of the year, according to the CME FedWatch Tool.

"There is going to be a real cost of money decline," Lee said, which should "benefit tremendously" for consumers taking out home loans, auto loans, and other types of lending vehicles like credit cards and business loans.

"Bottom line, markets are certainly showing strong signs of gaining their footing. And we also view this panic as ultimately being a growth scare," Lee said.

Read the original article on Business Insider