In what has been an “unusual” September, Bitcoin (BTC) has now recorded another positive weekly performance. According to data from CoinMarketCap, the maiden cryptocurrency surged by 5.07% in the last seven days, moving its cumulative gain in this month to 11.30%. Interestingly, with Bitcoin halving since gone, analysts remain highly expectant of the traditional market bull run by the largest digital asset.

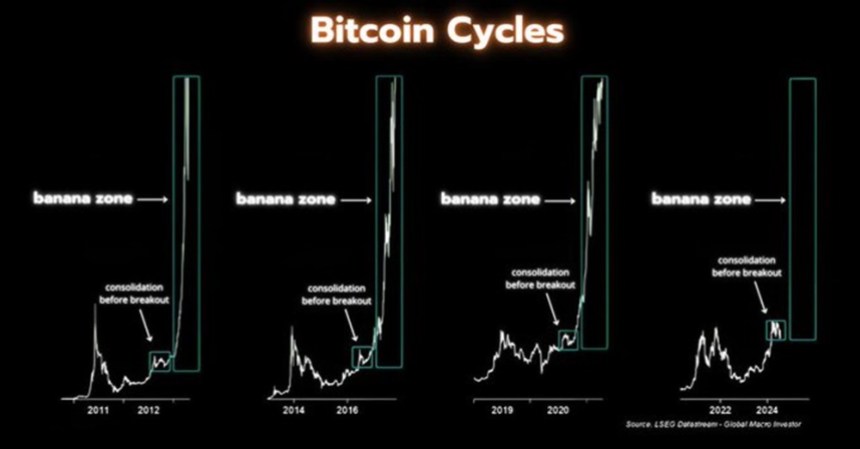

BTC In Consolidation As It Gathers Momentum For Breakout

In an X post on Friday, popular analyst Crypto Rover predicted BTC will hit a $290,000 price mark in the upcoming bull run.

Interestingly, this price projection tallies with previous statements from analysts who put a six-figure price target for BTC following the introduction of the Bitcoin spot ETFs which represents an increased institutional demand for the crypto market leader.

Notably, BTC has been moving between $55,000 – $70,000 over the last seven months which represents a state of consolidation. According to Crypto Rover, following a breakout from this current sideways movement, Bitcoin is likely to enter the “banana zone” i.e. the phase of outrageous price growth, as seen in previous bull cycles.

The crypto analyst predicts that during this period which traditionally lasts for 12-18 months, BTC could trade as high as $290,000 representing a 339.39% gain on the asset’s current price.

For many crypto enthusiasts, it is likely that the much-anticipated breakout will occur in the fast-approaching weeks as Bitcoin has now formed an inverse head and shoulders pattern as highlighted by Crypto Rover in another post. To explain, the inverse head and shoulders pattern is a common bullish indicator of potential reversals of a downtrend. If the price breaks above the neckline with significant volume, it indicates a shift to bullish control.

These sentiments on a price breakout are further strengthened by the upcoming Q4 which has proven to be the most bullish period for Bitcoin with an average gain of 88% over the last 11 years.

Bitcoin Exchange Stablecoins Ratio Shows Bullish Signal

In more positive news for the Bitcoin community, the Bitcoin Exchange Stablecoin Ratio is currently indicating a buy signal. According to CryptoQuant analyst with username EgyHash, this metric which measures BTC reserves (in USD) to the combined stablecoin reserves on exchange is currently at the low levels seen at the start of 2024.

EgyHash explains that a low ratio indicates traders have an increased buying power due to high stablecoin holdings which could translate into investments in Bitcoin, thus resulting in a price gain. Therefore, the current low Bitcoin Exchange Ratio adds to the list of bullish signals for Bitcoin investors.

At the time of writing, the premier cryptocurrency continues to trade at $66,064 with a 1.14% gain in the last day. Meanwhile, Bitcoin’s daily trading volume is down by 12.92% and valued at $32.01 billion.

Featured image from Cwallet, chart from Tradingview