ARB, the native token of Arbitrum, the Ethereum layer-2 solution, is down 68% from January 2024 highs.

However, there is good news: While ARB holders “suffer” in the face of unrelenting bears, positive on-chain developments reveal a platform that is not only the largest by total value locked (TVL) but also brimming with potential.

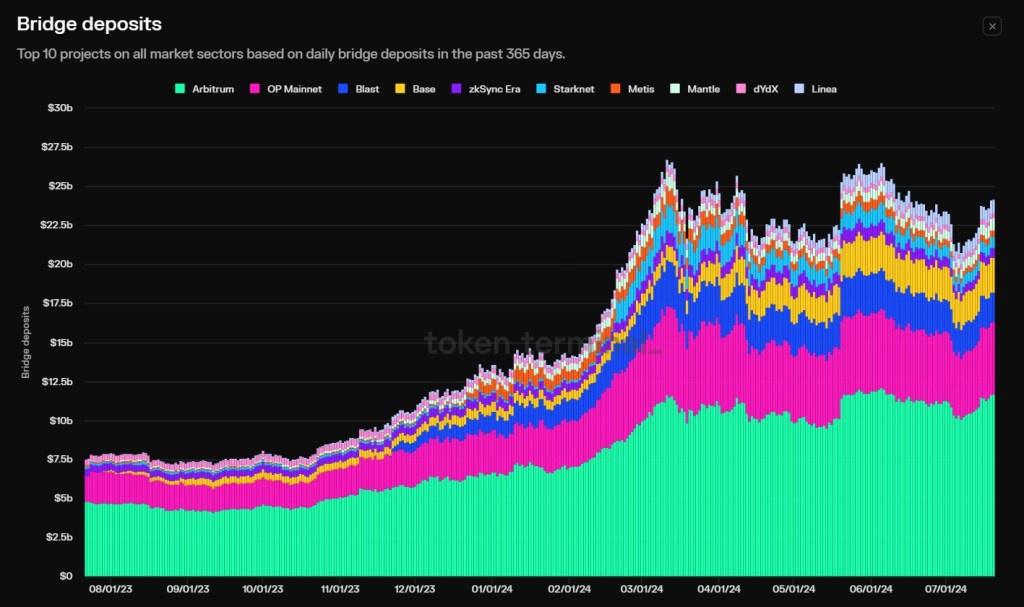

Over 48% Of Ethereum Bridged Assets End Up In Arbitrum

Taking to X, one analyst notes a surge in user activity on Arbitrum and that the platform leads across multiple key performance indicators (KPIs).

Of importance, the analyst observed that though there are other Ethereum layer-2 solutions to choose from, including Base–which is backed by one of the world’s largest exchanges, Coinbase, and Optimism, over 48% of all assets bridged from the mainnet find their way into Arbitrum.

Having users opt for Arbitrum, and notBase or other competitors, is a huge confidence boost. It also indicates its technical ability to address scaling challenges plaguing the mainnet.

Beyond this dominance, the analyst, citing Token Terminal data, also notes that Arbitrum, as mentioned, reigns supreme regarding TVL. According to on-chain asset flow from the blockchain analytics platform, Aave, a lending and borrowing platform, is the major contributor.

At the same time, Arbitrum is the most active network, looking at the number of daily active addresses. Gauging from activity levels, the analyst notes that Arbitrum is even more busy than the mainnet.

Interestingly, while activity could be a factor to consider, Arbitrum, the analyst also said, leads other layer-2s in the number of unique token holders. It indicates that layer 2s also lead in depth and breadth, indicating high engagement.

Will ARB Rise After Falling By 68% In 7 Months

Considering these impressive on-chain statistics, it remains to be seen when ARB will recover. The token dropped by 68% in seven months. The token remains under immense selling pressure and is a shadow of its former self.

As Ethereum recovers, ARB could follow suit. Platform-led initiatives will also support the token. For instance, the team recently launched the Gaming Catalyst Program (GCP) to accelerate the building and deployment of GameFi platforms in its ecosystem.

Voting is ongoing and ends on August 1, when three candidates will be elected to form the GCP Council. The council will be a decentralized autonomous organization (DAO) overseeing the GCP’s functions.

Feature image from Shutterstock, chart from TradingView