Joe Raedle / Getty Images

Key Takeaways

Bank of America analysts are predicting increased electricity demand, with certain power companies likely to benefit the most.

Analysts wrote that they like DBA Sempra, Pinnacle West Capital, TXNM Energy, Entergy, and Northwestern Energy Group.

The bank explained that those firms operate in areas likely to see the greatest rise in power demand.

Bank of America is predicting a big jump in electrical demand—with some power companies better-positioned to capitalize than others.

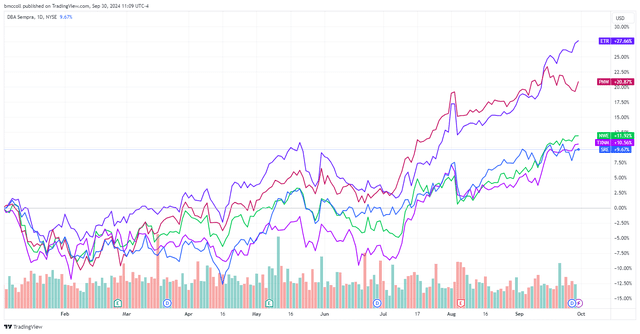

The bank said the utilities it sees as benefiting the most from regional growth are DBA Sempra (SRE), Pinnacle West Capital (PNW), TXNM Energy (TXNM), Entergy (ETR), and Northwestern Energy Group (NWE). The analysts have buy ratings on all five stocks.

BofA analysts wrote in a note to clients that after two decades of stagnant electricity demand expansion, “there is now evidence that demand growth has returned, driven by the re-shoring of industry, the development of data and crypto mining centers and the electrification of buildings, transportation, and infrastructure.”

By 2035, they estimate, there will be a need for an incremental 100 gigawatts of effective capacity, with the high-end scenario of 300 GW.

The analysts said that they have targeted those five companies because the regions they cover— Texas, the Southwest, the Northwest, and the 14 states in the Southwest Power Pool—are likely to have the greatest growth rates. Shares of all five are higher year-to-date.

TradingView

Read the original article on Investopedia.