Bitcoin surpasses key resistance, potential for new highs solidifies.

Key Takeaways

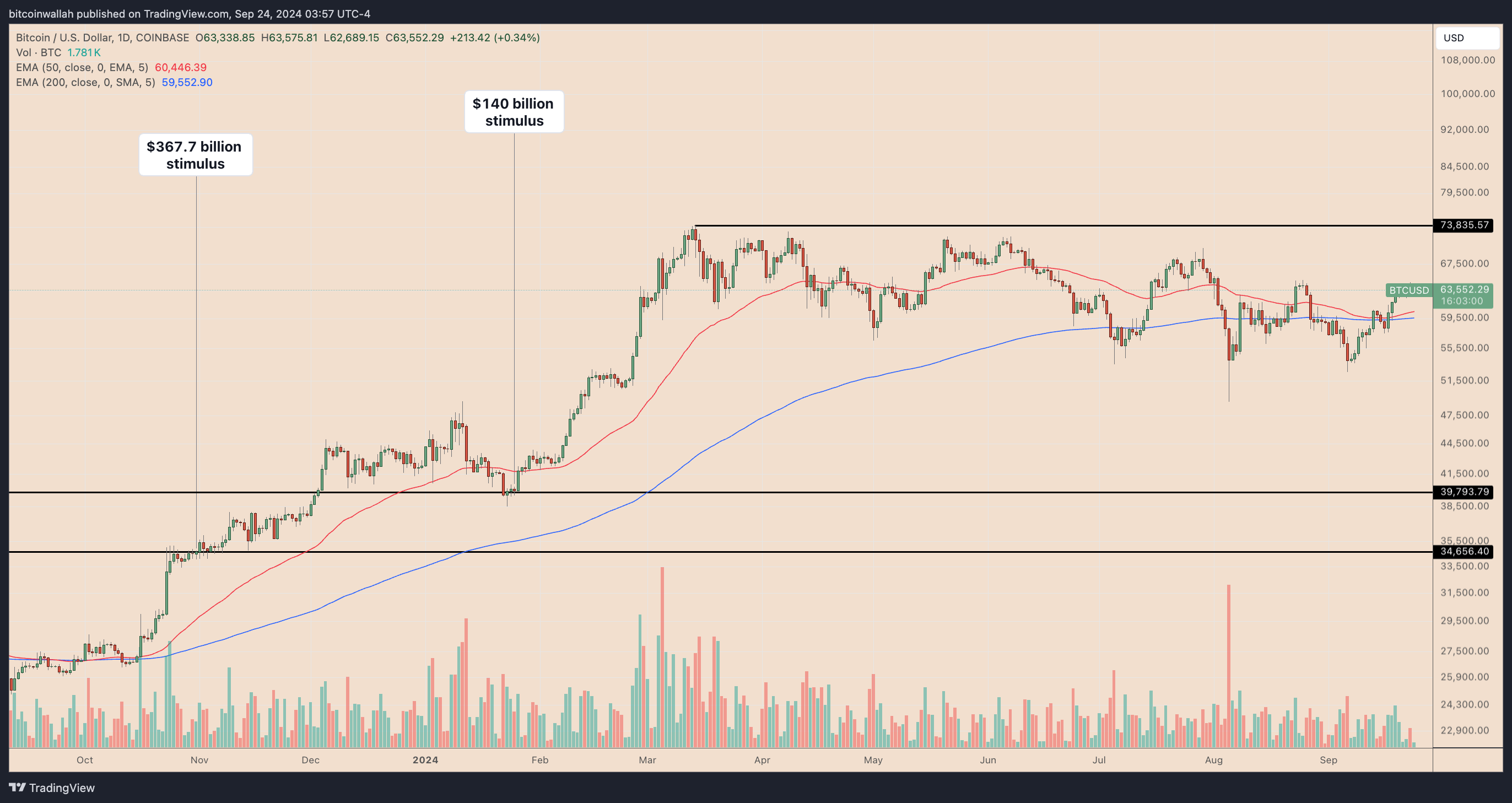

- China's $140 billion stimulus could drive Bitcoin to surpass $70,000.

- Bitcoin's technical breakout suggests a potential rally to new all-time highs.

Bitcoin appears positioned for a potential rally following China’s recent announcement of a pandemic-level stimulus package. This development, alongside recent interest rate cuts by the US Federal Reserve, has contributed to a macro environment that could push Bitcoin to new all-time highs.

China’s latest liquidity injection

This week, the People’s Bank of China (PBOC) revealed plans to inject around $140 billion into the economy by cutting the reserve requirement ratio by 50 basis points.

Following previous stimulus efforts, Bitcoin’s price increased by over 100%, and some analysts suggest that the latest injection of liquidity could have a similar effect.

The rise in M2 money supply and global liquidity index further supports the possibility of upward movements in Bitcoin’s price, as these factors have historically driven asset price gains.

Technical indicators show potential for gains

From a technical perspective, Bitcoin has broken out of a falling wedge pattern, which is often seen as a bullish reversal signal. This breakout has created momentum, pushing the price toward a key resistance level at $64,500. Analysts suggest that if Bitcoin breaks through this level and establishes support, it may pave the way for a move to new highs.

If we flip the red line, new #Bitcoin ATHs are imminent! pic.twitter.com/kHRdBSrgWz

— Crypto Rover (@rovercrc) September 26, 2024

In addition, the Relative Strength Index (RSI), has shown upward movement after a period of decline, indicating renewed strength in Bitcoin’s price. Some projections suggest that this could result in a price increase to around $85,000 by the end of the year, contingent on the continuation of favorable market conditions.

#Bitcoin $85,000: Intermediate Target 🎯

The Weekly RSI breakout signals an explosive move by the end of the year for #BTC. 🚀 pic.twitter.com/M7slgFSCop

— Titan of Crypto (@Washigorira) September 21, 2024

Global stimulus and Bitcoin’s market performance

Historically, expanding liquidity has supported Bitcoin’s performance, particularly during periods of low interest rates and inflationary pressures. However, concerns remain.

While China’s measures aim to support its struggling economy, which is facing high unemployment and deflationary pressures, some analysts warn that these actions could lead to further inflation. Additionally, China’s real estate sector remains under pressure, exemplified by Evergrande’s recent bankruptcy filing.