Bitcoin (BTC) could be gearing up its last explosive rally of a four-year market cycle, which traditionally kicks off at the beginning of a halving event and culminates just before the next one. A crypto analyst has boldly predicted that the price of Bitcoin could surge to $200,000 and above, markingnew All-Time Highs (ATHs) and the peak of the long-awaited bull market.

Bitcoin Enters Final Pump Stage

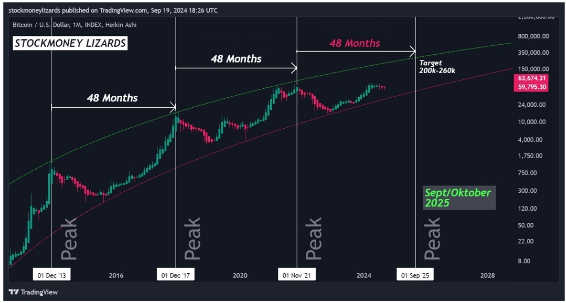

On September 19, ‘Stockmoney Lizards,’ a crypto analyst took to X (formerly Twitter) to discuss his new prediction about the crypto market, particularly zeroing in on the cyclical nature of Bitcoin’s price movements and its halving events.

The analyst believes the market is currently at the start of the “final pump of the Bitcoin bull cycle.” Based on historical trend patterns following past halving events, Stockmoney Lizards has stated that he has high expectations that Bitcoin will reach its cycle top between September and October 2024. Cycle top here typically means the highest price level BTC can achieve during a bull market.

Stockmoney Lizards has unveiled his personal price targets for Bitcoin during this seemingly last pump stage. He forecasts that the crypto could reach a price between $200,000 and $260,000, identifying these targets as the potential cycle top for this market cycle.

Sharing a detailed chart depicting Bitcoin’s historical price movements from 2016 till date, Stockmoney Lizards illuminated the bullish and bearish events following each halving event. He referenced the last three cycle tops during past halving events, identifying a unique trend pattern where the market experiences an extended bull run after the Bitcoin halving, roughly every 48 months.

The analyst observed that this trend pattern is repeating in the current market cycle, leading him to predict that Bitcoin’s price will peak between $200,000 and $260,000. This dramatic increase represents a price surge of approximately 218% to 313% from Bitcoin’s current price of $63,000, as of writing.

Bitcoin 200-Day SMA To Confirm Bull Market

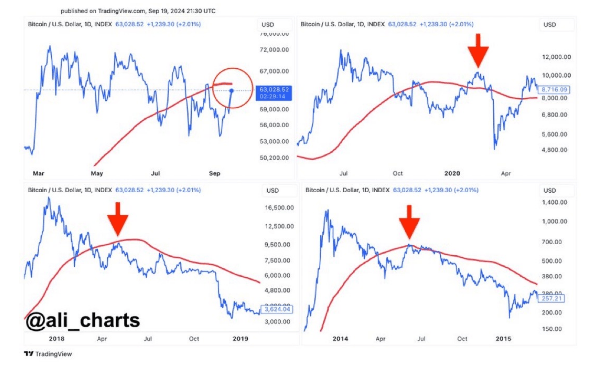

While some would argue that the Bitcoin bull market has already begun, others believe that it is yet to arrive, potentially ushering in one of the biggest rallies in Bitcoin’s history. According to reports from Ali Martinez, a prominent crypto analyst, the timing for the highly anticipated Bitcoin bull run may soon be confirmed, as Bitcoin is once again testing the 200-day Simple Moving Average (SMA).

Martinez disclosed that historically failing to claim this critical support level has led to steep price corrections for Bitcoin. He pointed to similar bearish trends observed in 2014, 2018 and 2020, when Bitcoin failed to reach this support.

As a result, the analyst has urged investors and market experts to pay close attention to Bitcoin’s current market trends, warning that a rejection at this point would spell trouble for the cryptocurrency.

Featured image from Pexels, chart from TradingView