Indeed, the Bitcoin price has been on a hot streak in recent weeks, returning to its past heights most investors have become accustomed to. However, the past week was a somewhat quiet one for the premier cryptocurrency, as it was for most of the digital asset market.

Interestingly, the latest on-chain insights suggest that the crypto market, specifically the Bitcoin market, might not be inactive for too long.

BTC Price Momentum Shifts To Positive – Impact On Price?

In a recent post on the X platform, popular crypto pundit Ali Martinez revealed that Bitcoin miner capitulation has seemingly come to an end. This on-chain observation is based on a shift in the Glassnode Hash Ribbon indicator, which measures BTC’s hash rate.

Typically, the Hash Ribbon features two moving averages; including the short-term (30-day) and long-term (60-day) hash rate. A cross of the short-term moving average below the long-term moving average implies miner capitulation, which is characterized by widespread sell-offs by miners.

On the other hand, when the 60-day ribbon falls under the 30-day ribbon, it indicates the end of capitulation and the potential start of a recovery phase for the network. As shown in the chart below, this positive cross appears to be the current situation for Bitcoin, signaling an optimistic future for the flagship cryptocurrency.

Ultimately, this means that Bitcoin miners are returning to the network and restarting operations, as they become more profitable. From a historical standpoint, the end of miner capitulation is a bullish sign, as it often precedes significant price leaps for the premier cryptocurrency. Martinez highlighted this in his post on X, saying “this could present good buying opportunities.”

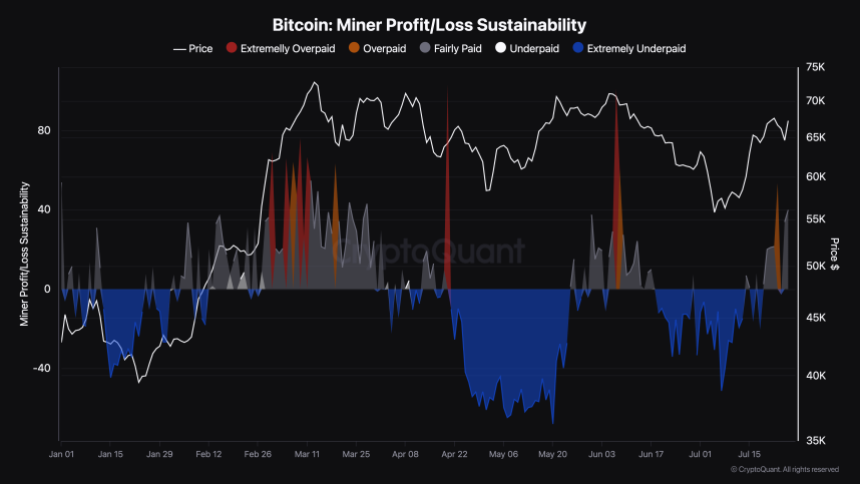

Another indicator that supports this on-chain revelation is the Bitcoin Miner Profit/Loss Sustainability metric, which measures how fair miner revenues are. According to the latest data from CryptoQuant, the BTC miners have been making some profit over the past few days, putting them in the fairly paid region of the indicator.

Bitcoin Price At A Glance

As of this writing, the price of Bitcoin stands at around $68,230, reflecting a mere 0.7% increase in the last 24 hours. As earlier inferred, the premier cryptocurrency had an uneventful week in terms of price action, dancing between the $64,000 and $68,000 range.

According to data from CoinGecko, the BTC price increased by barely 1% in the past week. Nevertheless, the cryptocurrency retained its position as the largest digital asset in the sector, with a market capitalization of more than $1.33 trillion.

Featured image from iStock, chart from TradingView