On-chain data shows the Bitcoin miner exchange inflows have been dropping recently, a sign that may be bullish for the asset’s price.

Bitcoin Miner Exchange Inflow Has Been Declining Recently

As explained by CryptoQuant author Axel Adler Jr in a newpost on X, miners have gradually been reducing their exchange inflows recently. “Exchange inflows” here naturally refer to transactions heading to wallets attached to centralized exchanges from self-custodial addresses.

In the context of the current topic, the exchange inflows made by miner-related wallets specifically are of interest. Generally, the main reason why miners transfer to these platforms is for selling, so large exchange inflows from them can be a sign that these chain validators are participating in a selloff.

Miners have constant running costs in the form of electricity bills, so selling from them is a regular occurrence, as without it, they can’t keep their operations going.

This regular selling is usually of a scale readily absorbed by the market, so there may be no visible negative effect on the asset’s price. Large and sustained exchange inflows, though, can be something to note, as they may imply unusual selling pressure from this group.

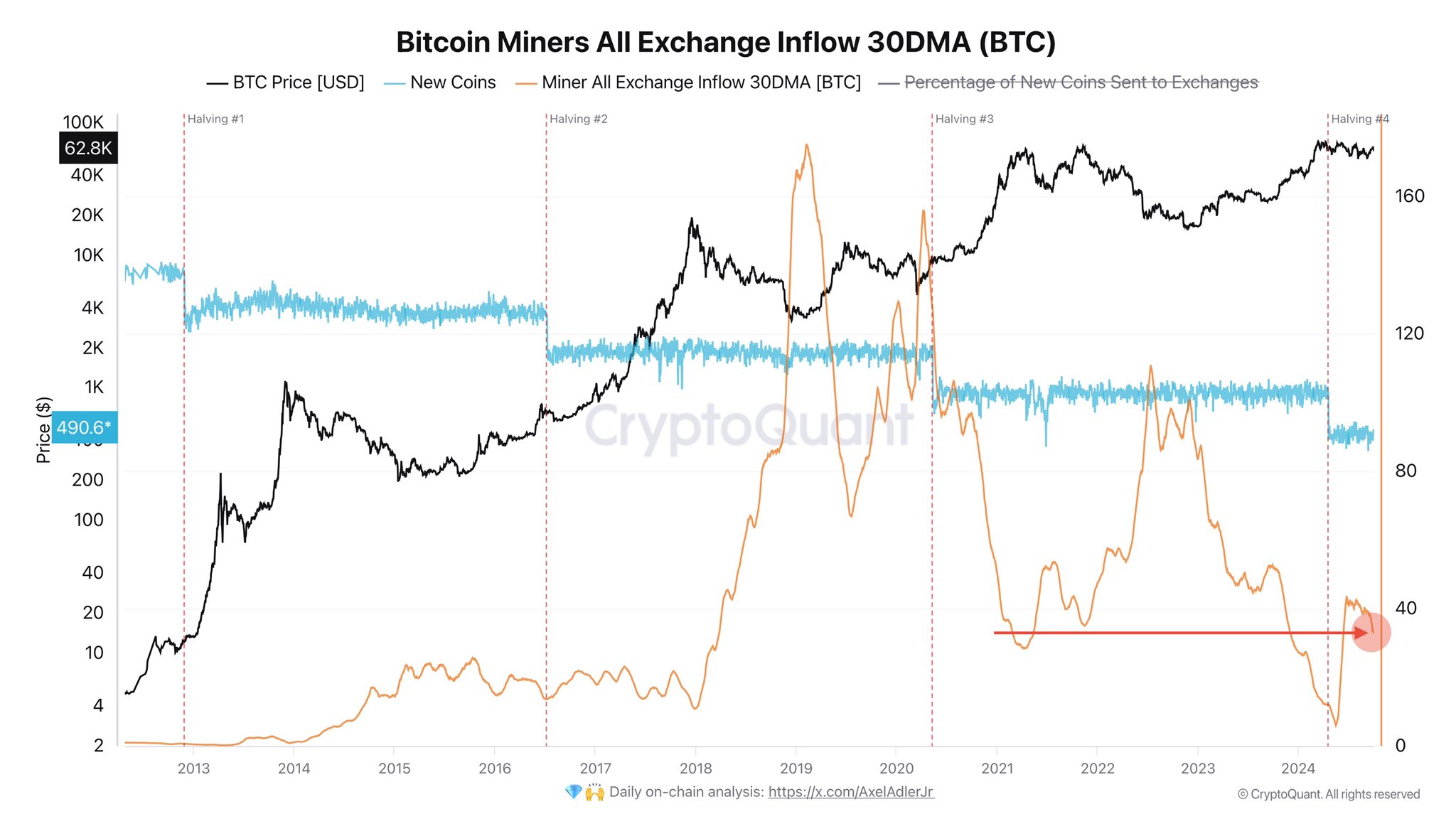

Here is the chart shared by the analyst that shows the trend in the 30-day moving average (MA) Bitcoin miner exchange inflows over the history of the cryptocurrency:

As the above graph shows, the 30-day MA of the Bitcoin miner exchange inflows had plunged to pretty low in the first few months of the year but then underwent a sharp reversal.

The reason for this increase could be that the fourth Halving occurred in April. Halvings are periodic events about every four years that permanently cut the BTC block subsidy in half.

In the chart, the analyst has also attached the data for the coin issuance on the network (colored in blue). From this metric, the effect of the Halving is apparent, as miners can suddenly only mint about half as many coins after each of these events as before them.

Miners make their income through two main sources, the transaction fees and the block subsidy, but most of the contribution generally comes from the latter. Thus, the miners depend on the block subsidy to make their income.

After the latest Halving, the miners naturally came under immense pressure because their revenue took a drastic hit. The exchange inflow trend would suggest that these chain validators had decided to sell off their reserves in response to this income squeeze.

The high inflows from the Bitcoin miners had continued for a while, but the 30-day MA of their exchange inflow has recently reversed, a potential sign that this cohort is finally pulling back on their selling. If this starts a sustained trend, then the cryptocurrency’s price might benefit from it.

BTC Price

Bitcoin has retraced much of its recent recovery during the last few days, as its price is now down to $60,300.

Featured image from Dall-E, CryptoQuant.com, chart from TradingView.com