A popular on-chain analyst says Bitcoin (BTC) is no longer looking bearish based on several key indicators.

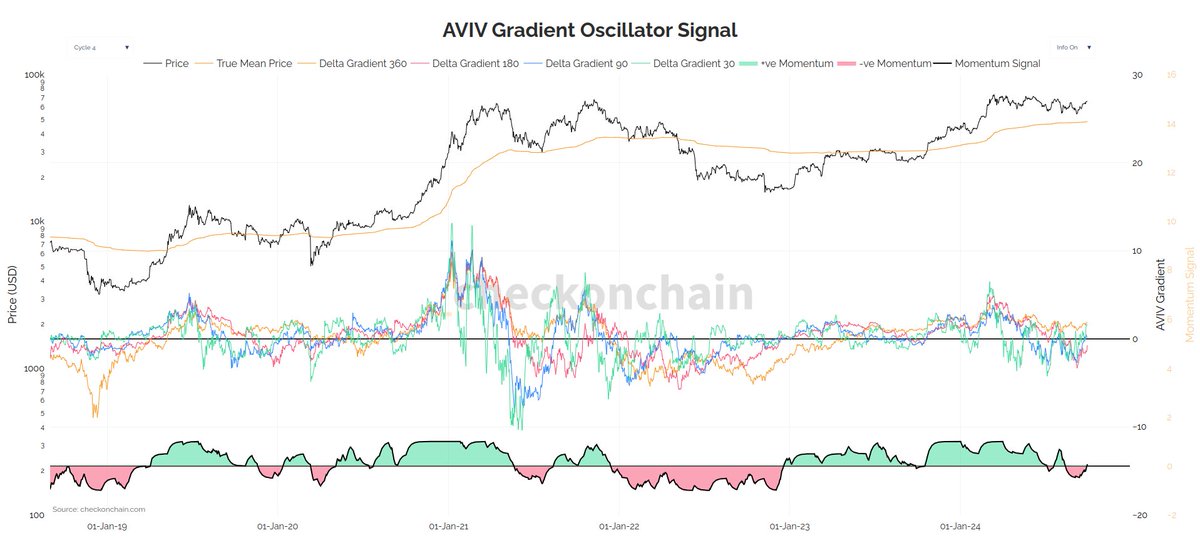

Pseudonymous on-chain sleuth Checkmate tells his 98,300 followers on the social media platform X that Bitcoin’s Active-Value-to-Investor-Value (AVIV) ratio has moved from a downtrend signal to a neutral one.

The AVIV is the ratio between the active capitalization, which excludes lost or inactive coins, and the realized capitalization of investors, the price at which the BTC was purchased. The indicator helps gauge whether Bitcoin is overbought or oversold.

“Bitcoin market momentum is back to neutral across multiple timeframes. Not strictly bullish, but no longer bearish (which is kinda bullish…relatively speaking).”

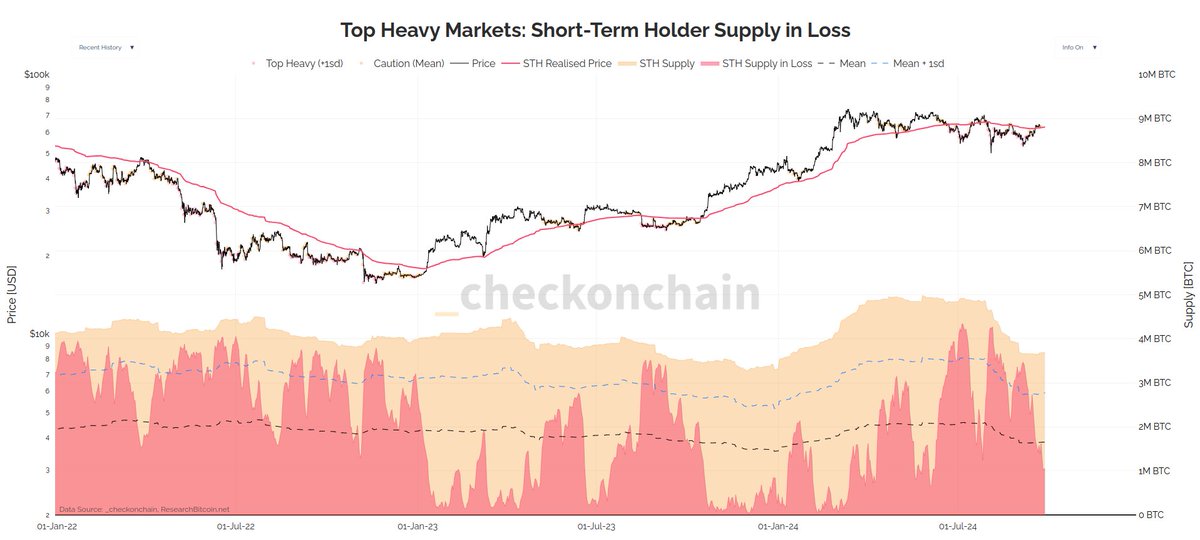

Next, the analyst says the Bitcoin short-term holder (STH) supply metric, which tracks the amount of coins held for less than 155 days, is starting to flash bullish.

“Based on short-term holder supply, the Bitcoin market is no longer ‘top heavy.’ This means the majority of recent buyers are back in profit, and all things being equal, is more likely to improve sentiment.”

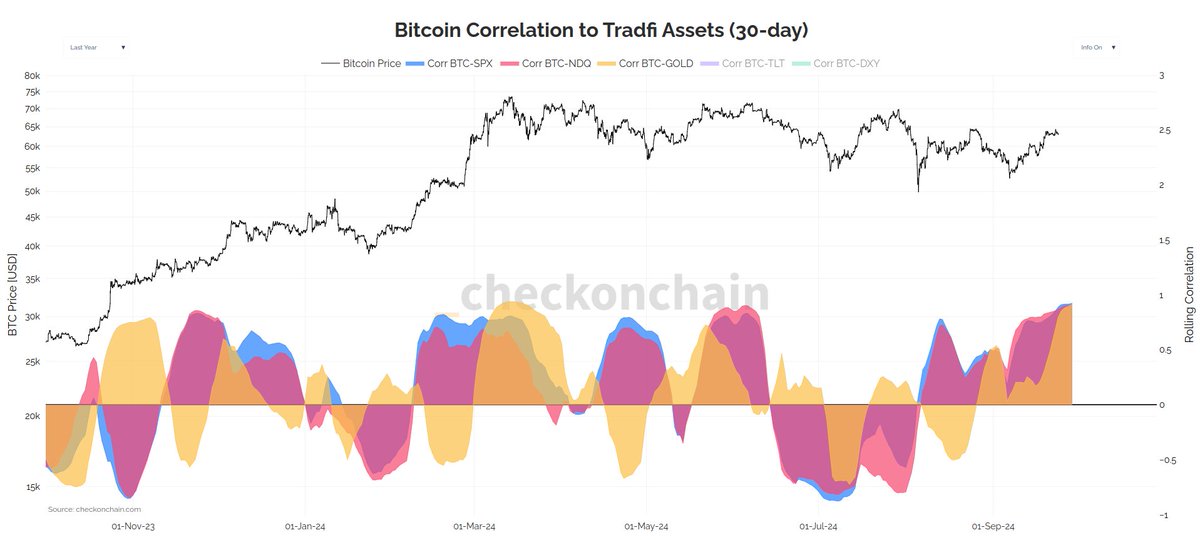

Lastly, the analyst says that Bitcoin seems to be moving in tandem with gold and stocks, which are in an uptrend.

“Bitcoin is currently very correlated with Gold, and equities over the last 30-days. Which I suppose is kinda good, considering those assets are all hitting new ATHs (all-time highs).”

Bitcoin is trading for $60,994 at time of writing, down 4% in the last 24 hours.