As Bitcoin is currently still struggling to reclaim major highs, a recent analysis of its fundamentals has highlighted a possible buying opportunity for Bitcoin based on insights from the Non-Realized Profit metric.

A CryptoQuant analyst known as Darkfost highlighted this metric’s importance in a recent post on the CryptoQuant QuickTake platform, mentioning what its trend means for investors.

According to the analyst, the Non-Realized Profit metric offers a window into the unrealized gains or losses held by Bitcoin investors, which can influence future market movements.

Understanding The Current Zone In Non-Realized Profits

The Non-Realized Profit metric is often used to calculate the difference between the current price of Bitcoin and the price at which each coin was last moved, without accounting for coins that have been sold.

High values in this metric suggest that investors hold significant unrealized profits, which could lead to increased selling pressure as they may choose to realize these gains.

Conversely, negative values indicate that many investors hold positions at a loss, potentially signaling a market bottom and a favourable entry point for new investors.

According to the CryptoQuant analyst, the Non-Realized Profit metric is mostly in the negative zone. This situation implies that many Bitcoin holders are either at break-even points or experiencing unrealized losses.

Historically, such conditions have been associated with market bottoms, where the asset is considered undervalued. This scenario could present a strategic “opportunity” for investors looking to enter the market or increase their holdings.

According to Darkfost, what sets the current market apart is that the unrealized profits have reached unprecedented highs compared to previous cycles, even while in the negative zone.

This anomaly suggests that the ongoing market cycle may differ from past Bitcoin patterns. The analyst cautions that while this could lead to unique investment opportunities, it also introduces potential risks due to the deviation from established trends.

Bitcoin Continuous Struggle Below $70,000

After briefly touching the $64,000 price level yesterday, Bitcoin has faced correction once again, falling back below this price mark—currently, the asset trades for $62,340, down by 1.8% in the past 24 hours.

This decline in performance from Bitcoin appears to have also dragged the global crypto market cap along with it, with the overall market cap valuation of crypto currently down by 3.3% in the past day to $2.26 trillion.

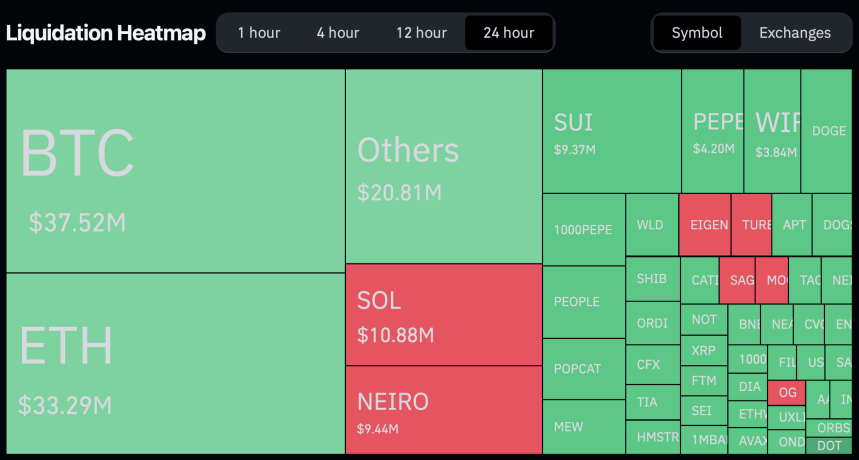

The plunge has had a severe impact on traders, most especially the ones on long positions. According to data from Coinglass, in the past 24 hours, 59,005 traders were liquidated, with the total liquidations sitting at $176.57 million.

Out of the total liquidations, long positions account for $130 million, while short positions account for only $45.91 million.

Featured image created with DALL-E, Chart from TradingView