A new Bernstein Research report indicates that the cryptocurrency market, particularly Bitcoin (BTC), may experience a significant shift based on the outcome of theupcoming United States presidential election.

The analysis suggests that a potential victory for Donald Trump could catalyze a bottom in Bitcoin prices, leading to growth in the price of the leading cryptocurrency.

"We believe the Bitcoin price would bottom, only if the crypto market catches a bid on a likely Trump win, given [the] crypto market continuing to interpret only a Republican win as positive for crypto policy,” the report states.

This insight comes as cryptocurrency prices remain range-bound, or choppy within two particular price points, which Bernstein attributes to uncertainty surrounding the U.S. election.

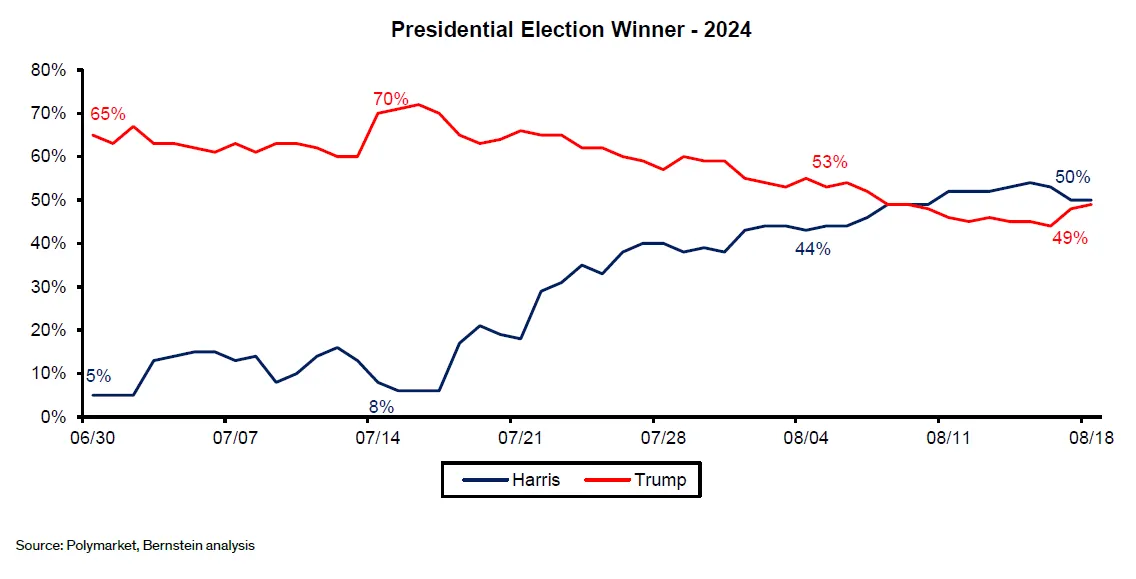

Fresh trends from Polymarket, the leading crypto prediction markets platform, show Republican candidate Trump and his expected Democratic challenger Kamala Harris in a close race, with Trump's shares rebounding in recent days following negative reactions to Harris' economic announcements. Harris has regained the lead on Polymarket over the last day, however, leading with a 51% chance compared to 47% for Trump.

Alongside election insights, the report highlights significant capital-raising activities among major U.S.-listed Bitcoin mining companies.

Marathon Digital Holdings (MARA) raised $300 million in convertible notes in part to purchase Bitcoin for its balance sheet, and last week confirmed that it purchased $249 million worth of BTC.

Meanwhile, Riot Platforms (RIOT) recently announced a $750 million at-the-market equity offering, and Core Scientific (CORE) secured $400 million in convertible notes for debt retirement and AI data center acquisitions. Bernstein’s Gautam Chhugani wrote that public U.S. miners have a leg up in the industry.

"U.S. listed Bitcoin miners have a natural advantage vs. private unlisted miners,” he wrote. “Whether miners pursue Bitcoin mining or AI data center growth, being able to raise debt/equity in the world's deepest capital markets presents a natural advantage versus non-U.S. miners, particularly in a capital intensive industry, poised for market consolidation."

The report also discussed the emerging "mullet strategy" among miners, where companies are pivoting towards AI data centers while maintaining Bitcoin mining operations. This approach is gaining traction with institutional investors, the report notes, as they are more familiar with data center economics than cryptocurrency mining.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.