The Bitcoin price has somewhat slowed down this weekend, failing to capitalize on its resurgent momentum from Friday, October 4. The premier cryptocurrency continues to hover around the $62,000 mark, reflecting a mere 0.3% decline in the last 24 hours.

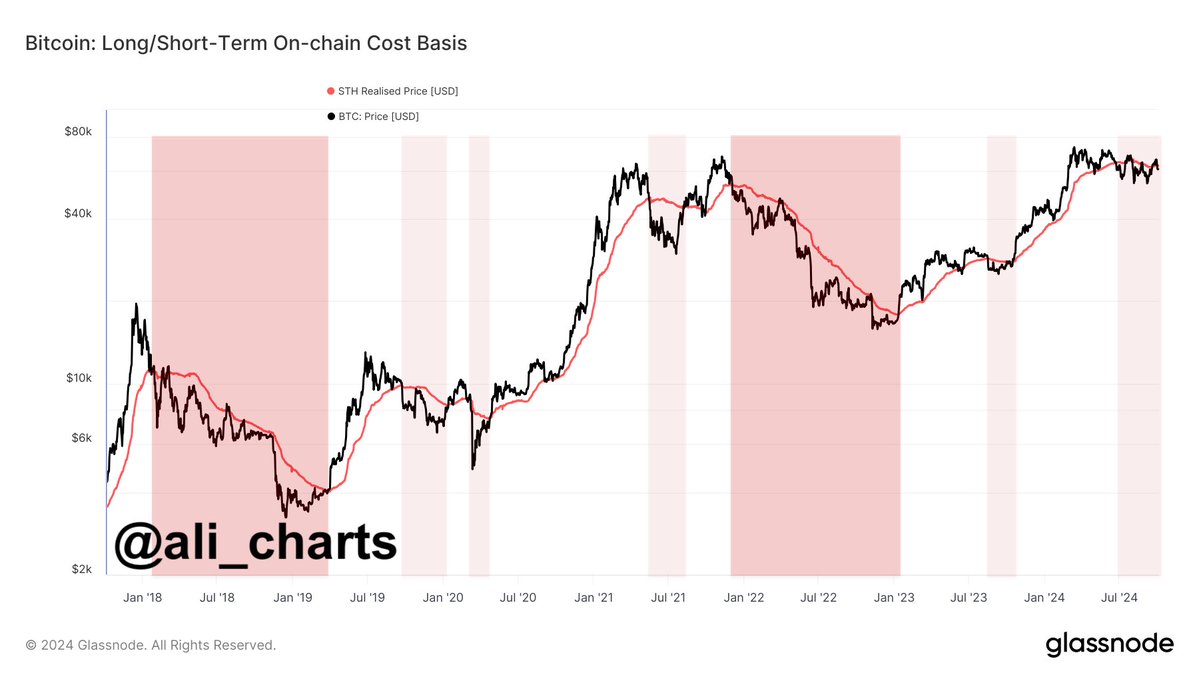

Recent on-chain data suggests that the price of Bitcoin might continue to turn in a sluggish performance, as short-term holders remain under pressure. Specifically, the market leader continues to trade under the realized price of short-term holders (STH).

What Does This Mean For Bitcoin Price?

In a recent post on the X platform, crypto analyst Ali Martinez revealed $63,000 as the realized price for Bitcoin short-term holders, explaining the relevance of this level to the asset’s long-term health. For context, the short-term holder realized price is a metric that measures the average price at which short-term investors purchased their BTC.

When the spot value of Bitcoin is higher than the short-term holders’ realized price, it indicates that most recent investors are in the green. Typically, this encourages the traders to buy more coins, precipitating a positive market sentiment and potentially triggering an upward price movement.

On the other hand, a fall beneath the STH realized price implies that most short-term holders are in unrealized loss. In this scenario, some investors may look to cut their losses by offloading their holdings, leading to downward pressure on price and further sell-offs.

According to Martinez, Bitcoin has been trading beneath the short-term holders’ realized price since June. With the current STH realized price at $63,000, the premier cryptocurrency appears to be at risk of further decline, especially in the short term.

BTC Holder Behavior Similar To 2016 And 2020

The overall outlook for Bitcoin’s price in the last quarter of 2024 has been quite positive. CryptoQuant revealed in its latest weekly report that the behavior of Bitcoin holders in the current cycle mirrors the 2016 and 2020 halving years, indicating a potential price growth for the market leader.

The on-chain analytics firm highlighted that the short-term Bitcoin supply increased following the launch of spot exchange-traded funds (ETFs) in early 2024. Although a cooling period followed after this spike, CryptoQuant pointed out that another rise in short-term supply could occur — if historical trends hold.

Featured image created by Dall.E, chart from TradingView

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.