Bitcoin has been on a rollercoaster ride ever since it reached its all-time high (ATH) of $73,737 back in March. However, regardless of that, several analysts and traders in the crypto community remain persistent in their bullish outlook for the asset. An example is Willy Woo, a well-known figure in the crypto sector. Earlier today, Woo shared his optimistic view on Bitcoin and insights on how high BTC’s price could potentially climb to hit this anticipated high mark.

Bitcoin Road To $700,000: Tough Or Smooth?

According to Woo in his latest post on Elon Musk’s social media platform, X, Bitcoin’s price projection can range dramatically based on the percentage of global wealth assets allocated to Bitcoin. In his explanation, Woo outlined two possible future scenarios for Bitcoin’s valuation: a more probable lower band and a highly unlikely upper limit.

Related Reading: Bitwise CIO On Bitcoin: ‘We’re Not Bullish Enough’ – Here’s Why

He pegs the “conservative” estimate for Bitcoin at roughly $700,000, assuming modest adoption and investment levels. This figure arises from a hypothetical allocation of a small percentage of global wealth into Bitcoin, reflecting a growing but cautious integration of Bitcoin into the broader financial sector

Woo’s analysis further delves into how institutional investors might influence Bitcoin’s value over time. Drawing from industry behaviors and recommendations, such as Fidelity’s suggestion that portfolios include 1-3% in BTC, Woo interprets these movements as signs of growing, although conservative, confidence in Bitcoin as a viable asset class.

He contrasts these figures with BlackRock’s 85% investment, highlighting a stark divergence in institutional strategies towards Bitcoin. The theoretical upper limit of Bitcoin reaching $24 million per unit, according to Woo, would require an unrealistically complete conversion of the world’s $500 trillion in wealth assets into Bitcoin.

He dismisses this scenario as improbable, focusing instead on the more grounded predictions supported by current investment trends and economic behaviors.

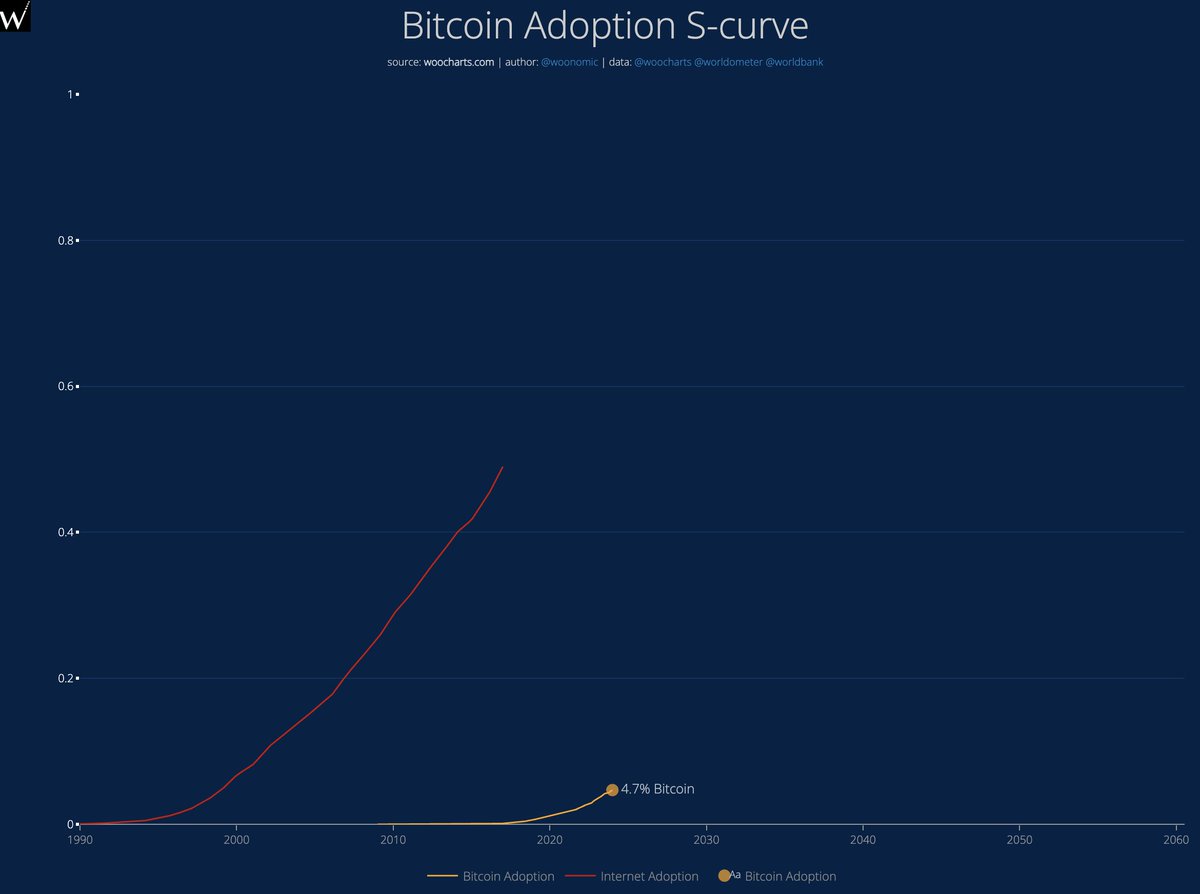

Woo explains that as Bitcoin’s adoption curve follows the classic S-curve of technological adoption, which currently sits at 4.7%, the potential for significant price increases remains viable as adoption grows towards the 16% to 50% range.

What The Future Holds

In his concluding thoughts, Woo speculates about a future where Bitcoin’s market capitalization could surpass all global fiat currencies.

This paradigm shift would transform investor priorities, moving away from fiat-based valuations towards a new economic model where major corporate assets could be measured against their BTC holdings, rather than traditional fiat metrics.

This shift, he argues, would mark a profound change in financial thinking, focusing on assets that can leverage Bitcoin’s stability and growth rather than merely surpassing its value.

Once the price produces a marketcap exceeding all the fiat in the world you won’t be interested in ultimate price. That’s a fiat mindset based on current realities.

After this inflection point, you’ll only be looking for investments that can beat BTC. For starters these are…

— Willy Woo (@woonomic) August 1, 2024

Featured image created with DALL-E, Chart from TradingView