An influx of $2.5 billion in stablecoins is anticipated to potentially drive a significant surge in the Bitcoin price, as detailed in a new report by Markus Thielen, a market researcher at 10x Research.

Bitcoin Price Boost Is Incoming

In his latest research note, Thielen explains the critical importance of monitoring and analyzing crypto money flows, which provide crucial insights into market conditions that can either accelerate or inhibit Bitcoin’s price movements. “Traders are often caught off guard by price crashes, overlooking the critical signals these flows offer. However, the inverse is also true; a sustained increase in money flows can drive higher prices, but many also miss these indicators,” Thielen writes.

The researcher explains that money flows can predict price movements in both directions. In April 2024, signaled a price correction as “broad money flows largely paused.” Thielen adds, “a resurgence in certain money flows helped lift prices as markets approached bottoms. The critical factor was monitoring the sustainability of these flows, as rallies often lost momentum without continued support.”

The report highlights the most recent activities involving major stablecoin issuers. Thielen points out that last night, Tether minted $1 billion in USDT, categorizing it as an inventory build rather than immediate market issuance. This distinction is essential as it suggests a preparatory step for potential future market actions rather than immediate liquidity injection.

Moreover, the researcher details an important observation regarding recent issuances by Tether and Circle, which cumulatively amount to nearly $2.8 billion. Thielen interprets this as a strong indication of institutional investors deploying fresh capital into the crypto market, which historically signals bullish conditions for Bitcoin. “If this trend of issuance (not just minting) continues, Bitcoin could see further gains,” remarks Thielen.

Further supporting Thielen’s analysis, the on-chain analysis platform Lookonchain reported yesterday via X: “Tether Treasury minted 1B USDT on Ethereum again 20 mins ago. Over the past year, a total of 32B USDT has been minted by Tether Treasury!”

Additionally, Lookonchain may have found a reason for the large issuance of new stablecoins. The firm found that substantial amounts of USDT flowed to Cumberland. They remarked, “In just 8 days, Cumberland has injected 1.04B USDT into the crypto market! An hour ago, Cumberland received 141.5M USDT from Tether Treasury again and transferred it to major exchanges such as Kraken, OKX, Binance, and Coinbase.”

More Bullish Catalysts

Crypto analyst Miles Deutscher delivered another reason to be bullish on Bitcoin via X. He noted the current market conditions resemble the multi-month consolidation from 2023, suggesting a potential end to this phase based on similar chart formations and a sharp decline in retail interest.

“This feels eerily similar to August-October last year. Retail interest is evaporating fast (YT views have fallen off a cliff over the past week). Apathy amongst existing market participants. Lack of clear narratives (and the #Bitcoin price action looks identical too),” Deutscher stated.

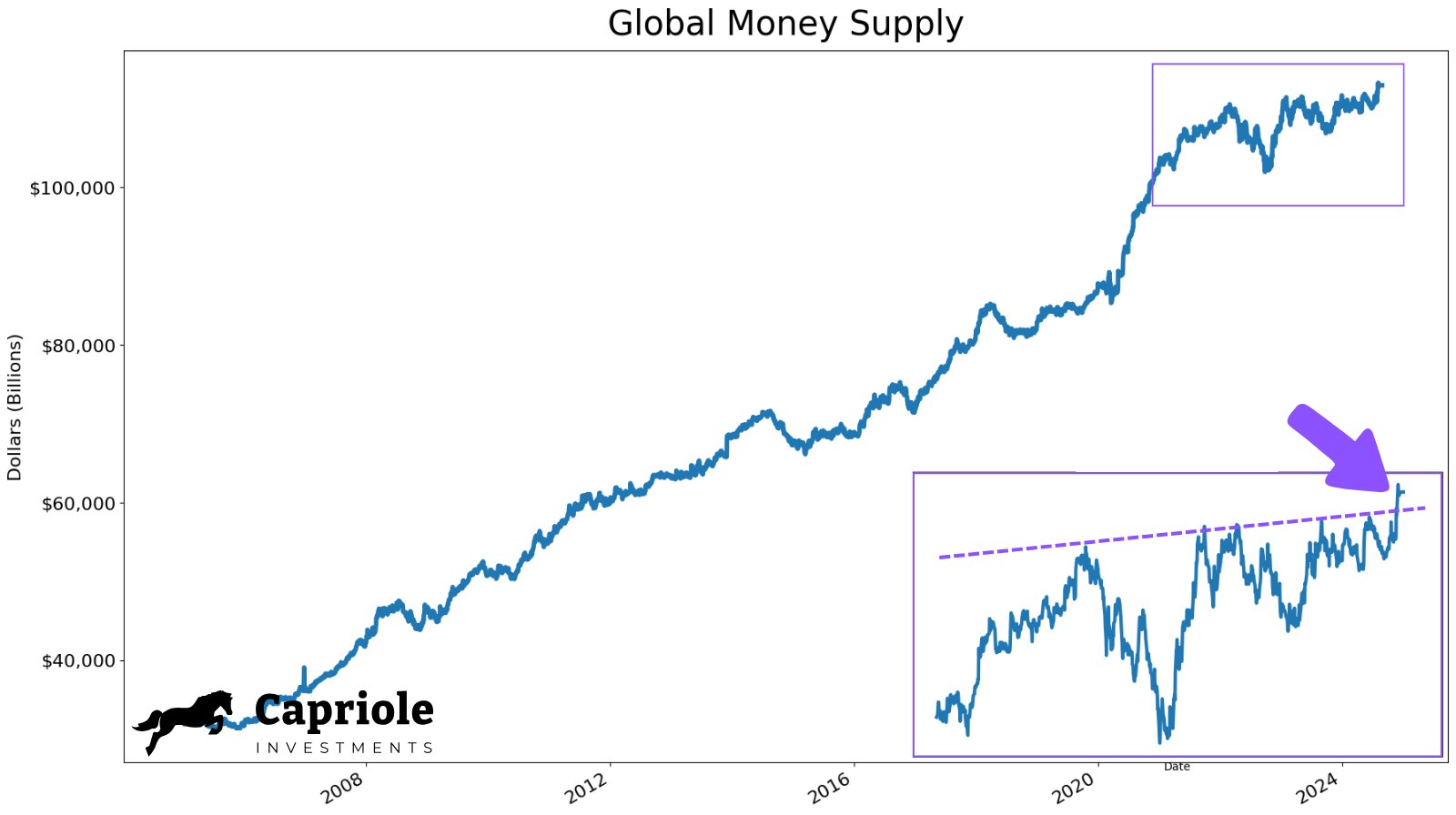

Charles Edwards, founder of Capriole Investments, added a macroeconomic perspective, noting the expansion of the global money supply as a historical driver for rising Bitcoin prices. “Global money supply is exploding up. Plus, we just broke out of a massive 4-year consolidation. What do you think this means for Bitcoin?” he posed rhetorically, suggesting a bullish outlook based on this factor.

At press time, BTC traded at $60,853.

Featured image created with DALL.E, chart from TradingView.com