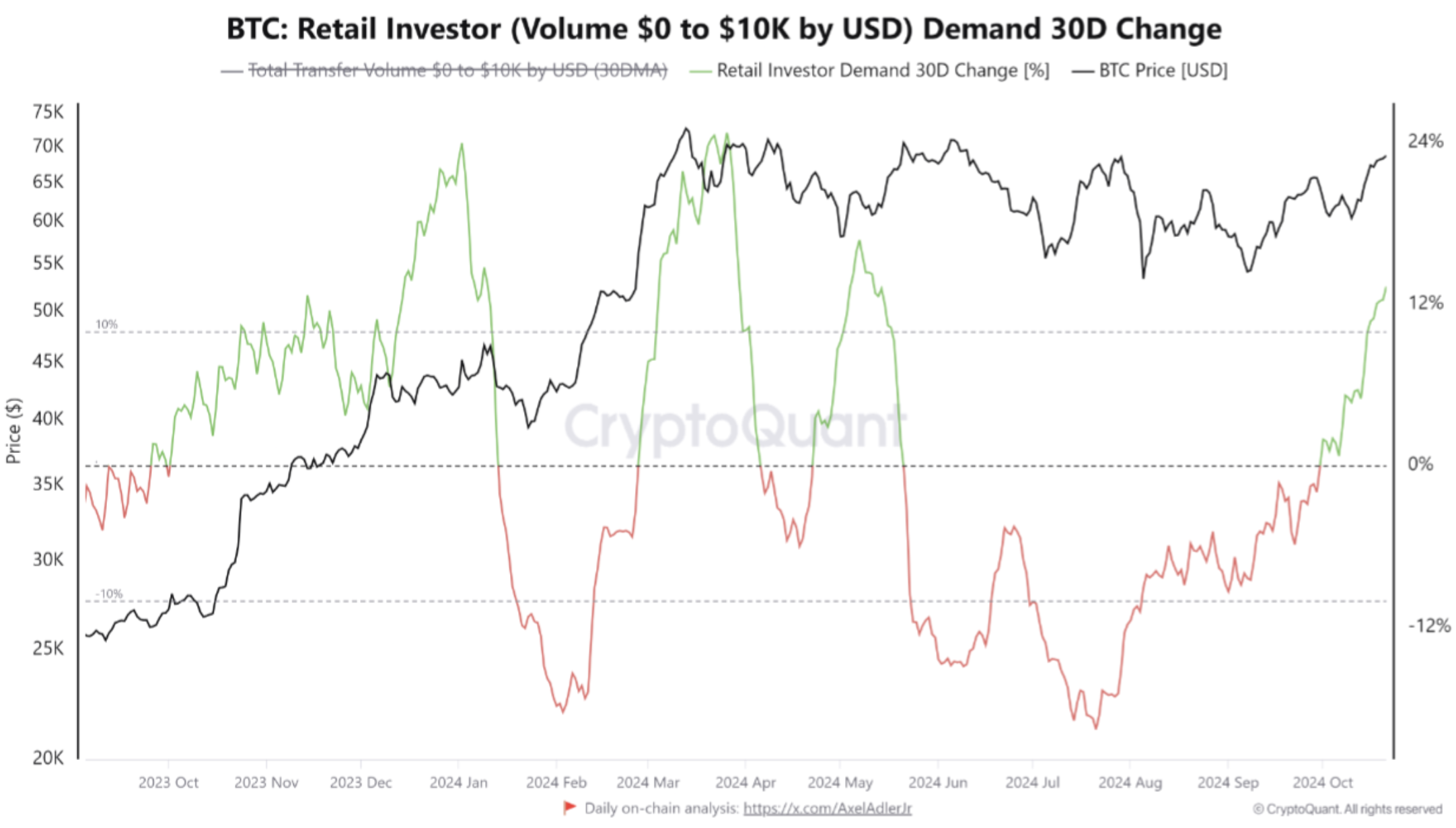

After four months of declining transaction volumes from retail investors, Bitcoin (BTC) retail on-chain activity shows signs of resurgence.

Will Bitcoin Benefit From Rising Retail Participation?

According to a recent analysis by on-chain analytics platform CryptoQuant, BTC transactions worth less than $10,000 are rising, reflecting a shift in the market’s sentiment from risk-averse to risk-on.

Tracking transactions under $10,000 helps gauge retail activity. Unlike institutional transactions driven by fundamentals and long-term outlooks, market sentiment and news often influence retail activity.

Per the analysis, Bitcoin’s retail demand struggled to rebound after the cryptocurrency’s all-time high (ATH) in March 2024. However, retail demand has surged 13% in the past 30 days with room for further growth.

During this same period, BTC gained approximately 7%, rising from $63,142 on September 22 to $67,346 by October 22. Both rising retail on-chain activity and price suggest a potential upside for BTC in Q4 2024.

The swift recovery of BTC and other cryptocurrencies following Iran’s offensive against Israel earlier this month also signals a return to risk-on behavior in the digital asset market.

It is worth noting that although retail on-chain activity diminished over the last four months, institutional investors continued to maintain “a high amount of transactions and absorption of coins.” The analysis reads in part:

This recent rise in bitcoin is causing small investors to return to trading, signaling the beginning of a pattern of lower risk aversion.

Is A Q4 2024 Rally On The Horizon?

The return of Bitcoin retail on-chain activity is an encouraging sign that suggests renewed interest among retail investors toward the leading digital asset. However, with the looming US presidential elections, there could be more volatility ahead for BTC price.

According to several crypto analysts and trading firms, the likelihood of a crypto Q4 2024 rally hinges on the results of the US presidential elections.

Bitwise CIO Matt Hougan recently remarked that “anything other than a Democratic sweep” would benefit BTC propel to $80,000 in Q4 2024.

Bitcoin dominance, a metric that measures BTC’s share of the overall crypto market, recently hit 58.9%, a new cycle-high. While this is promising for BTC’s future price, a further surge in dominance could harm altcoins’ performance. As a result, Q4 2024 may bring a new ATH for BTC but muted returns for altcoins.

It is also worth considering that the renewed retail demand for digital assets might be geography-specific, and not uniform worldwide.

For instance, in South Korea, BTC is trading at slightly lower prices than global prices due to a negative ‘kimchi premium,’ hinting low domestic investor sentiment toward digital assets. BTC trades at $67,346 at press time, down 1.4% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and Tradingview.com