Bitcoin has experienced a volatile week, with prices oscillating between a local high of $69,500 and a low of $65,000. After weeks of excitement and upward momentum, the market has cooled off, and BTC is currently consolidating below the critical $70,000 level. This consolidation phase is crucial as traders assess the next potential move for Bitcoin.

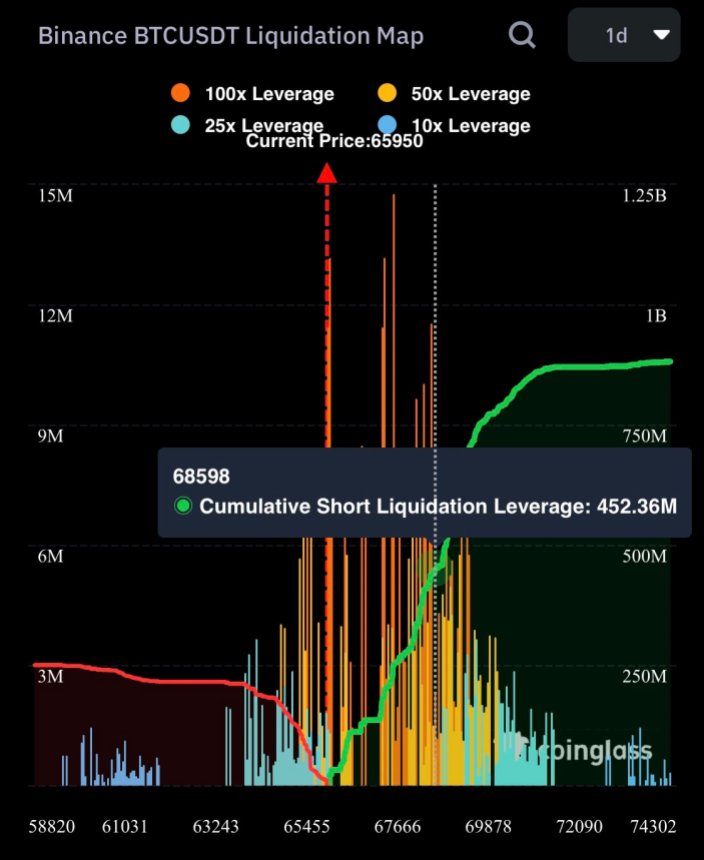

Analyst Ali Martinez has shared significant data from Binance, highlighting the high risk for short positions at the $68,500 mark. When such risk levels are present, the price often seeks liquidity, which suggests that it may gravitate toward supply zones. This behavior indicates that the market is potentially targeting areas where sellers may be positioned, which could lead to further fluctuations in price.

The interplay between these resistance and support levels will determine Bitcoin’s trajectory. A decisive move above these levels could signal Bitcoin’s next phase, making it critical for investors to remain vigilant.

Bitcoin Short Squeeze Looms

Bitcoin is reaching a pivotal moment, with the market buzzing with expectations for a potential push toward all-time highs. Martinez recently shared crucial data on X, revealing that a significant number of short positions are at risk of liquidation, particularly around the $68,598 mark. The cumulative short liquidation leverage at this price level is approximately $452.36 million, indicating that a substantial amount of capital could be affected if the price continues to rise.

This scenario sets the stage for a bullish outlook, as overleveraged short positions suggest that Bitcoin could find liquidity at supply levels. This could trigger a cascade of buying pressure. When the price breaks above the key $69,000 mark, it could lead to a wave of Fear of Missing Out (FOMO) among traders and investors watching from the sidelines.

The liquidation of these short positions could propel Bitcoin’s price higher, strengthening the bullish narrative. Market participants closely monitor this critical threshold, as a decisive break above $69,000 could ignite a surge toward previously untested highs.

Maintaining awareness of both market dynamics and key price levels is essential for traders looking to navigate the volatility. The next few days could prove crucial as Bitcoin approaches this significant moment, and how it reacts to these overleveraged positions may determine its trajectory in the coming weeks.

BTC Liquidity Levels

Bitcoin (BTC) is currently trading at $67,100 after a week marked by volatility and uncertainty. The price has pushed above the $66,000 level, signaling strength and hinting at a potential rally in the coming weeks. This upward movement reflects renewed optimism in the market, as investors look for signs of sustained bullish momentum.

However, it’s essential for BTC to maintain its position above the $65,000 mark. If the price fails to hold this level, a sideways consolidation may occur, allowing the market to gather liquidity before making its next move. This consolidation phase could set the stage for a surge in buying activity as traders look to capitalize on potential opportunities.

A break above the key $70,000 level would further strengthen the bullish outlook, potentially initiating a new uptrend. Such a movement could attract additional investment and excitement in the market, as traders and investors respond to the breakout.

Featured image from Dall-E, chart from TradingView