Just days after former President Donald Trump and Vice President Kamala Harris faced off in their first debate, Polymarket odds have shifted to show Harris pulling ahead. However, an analyst at British multinational bank Standard Chartered believes a new Bitcoin all-time high price will come this year regardless of who wins the election.

At the time of writing, crypto bettors favor Democratic candidate Harris to win the 2024 Presidential Election in November by a narrow margin—50% to Republican rival Trump's 49%, according to Polymarket odds.

Still, the election is 54 days away and crypto gamblers on the decentralized prediction market have overwhelmingly favored Trump since February. It's also worth noting that U.S. citizens are banned from using Polymarket. Granted, some American voters have likely found ways to access it with VPN services, but it's likely that many people betting on the election aren't themselves registered U.S. voters.

But for what it's worth, more traditional polling has showed Harris pulling ahead of Trump for a while now.

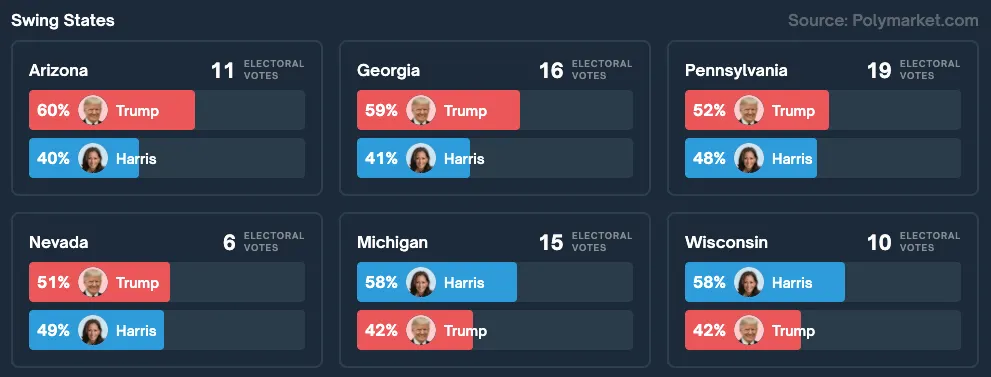

The crypto betting site also shows that Harris is trending ahead in two swing states: Michigan and Wisconsin, where Polymarket now rates her as having a 58% chance of taking the states' combined 25 electoral votes.

The vice president is now very close to flipping Nevada, which would earn her an additional six electoral votes. But Harris, who only just joined the race in July when President Joe Biden pulled out, still trails significantly in three other key states: Arizona, Georgia, and Pennsylvania, which account for a combined 46 electoral votes.

Many analysts have been saying that a second term for Trump would bode well for Bitcoin and the broader crypto industry. But Standard Chartered's Geoff Kendrick, global head of digital assets research, isn't convinced the difference would be that stark.

"First, we think progress on relaxing regulations—particularly the repeal of SAB 121, which imposes stringent accounting rules on banks’ digital asset holdings—will continue in 2025 no matter who is in the White House; it would just be slower under a Harris presidency," he writes in a note shared with Decrypt.

He added that while the outcome of the election is still relevant to crypto markets, it's now less so than before President Joe Biden dropped out of the race.

The bank is now predicting Bitcoin will hit an all-time high before the end of the year regardless of who wins—$125,000 in the event of a Trump victory and $75,000 if Harris wins.

"A Harris victory would likely trigger an initial price decline," Kendrick wrote, "but we would expect dips to be bought as the market recognizes that progress on the regulatory front will still be forthcoming, and as other positive drivers take hold."

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.