Making waves in the crypto industry today, Bittensor (TAO) is showing an impressive annual increase. The current explosion in artificial intelligence adoption has spurred more interest in cryptocurrencies, and Bittensor is conspicuously leading in this regard.

TAO has shown an amazing 1,000% price rise over the last year. The digital asset was up by a solid 65% this month. Looking ahead, CoinCodex projects a whopping 243% price rise, maybe reaching $1,827 by October 23, 2024, therefore inspiring investor hope.

Right now, Bittensor is trading at $525, slightly below the vital $530 threshold. This shows strong market mood since it indicates an 81% sustained upward push in the past week. Given the good technical indicators and a positive view of the next months, traders are excited to see how high TAO may get.

Strong Market Momentum

At the moment, Bittensor is riding a wave of strong upward progress. The price went up by 40% after a recent wedge exit, setting the asset up for more gains.

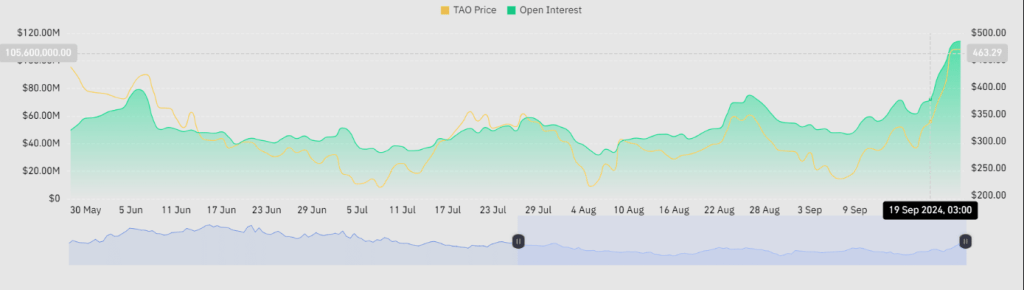

Bittensor’s futures open interest has gone from $61 million to $114 million, showing that investors are taking notice. This rise means that more investors are starting new positions, which means that money is coming into TAO.

Moreover, the recent price increase has been accompanied by heightened bullish signals. With liquidation for short positions at a yearly high of $1.45 million, people betting against the market are driven from their positions.

Long position liquidations, meantime, have been somewhat minimal, just $139,000 over the past week. This pattern shows increasing confidence among investors thinking about the future price movement of Bittensor.

Positive Mood And Price Projections

Expectations are that this optimism regarding Bittensor will hold. Furthermore, according to CoinCodex, this will result in an increase of up to 240% as the figures could rise to $1,827 come October 23, 2024.

The fear & greed index is little changed at 50, and technical indicators are close to neutral. Such a signal is an indicator that investors in the market are staying positive about the prospects of the coin registering more gains ahead.

With 16 of his 30 trading days posted in the green over the past 30 days, Bittensor has a 53% success record. Coupled with a 17.69% price volatility, this result suggests a healthy state of the market.

Bittensor: Strong Market Signals

Bittensor is fairly positioned within the AI coins sphere. Its phenomenal price pump and solid market signals give hope to traders about its prospects.

Hence, soaring open interest, a high liquidation rate on short positions, and positive projections for the price indicate that Bittensor may record decent profits in the coming months.

Featured image from X/@CryptoGirlNova, chart from TradingView