The iShares Bitcoin Trust dominates as market faces uncertainty.

Key Takeaways

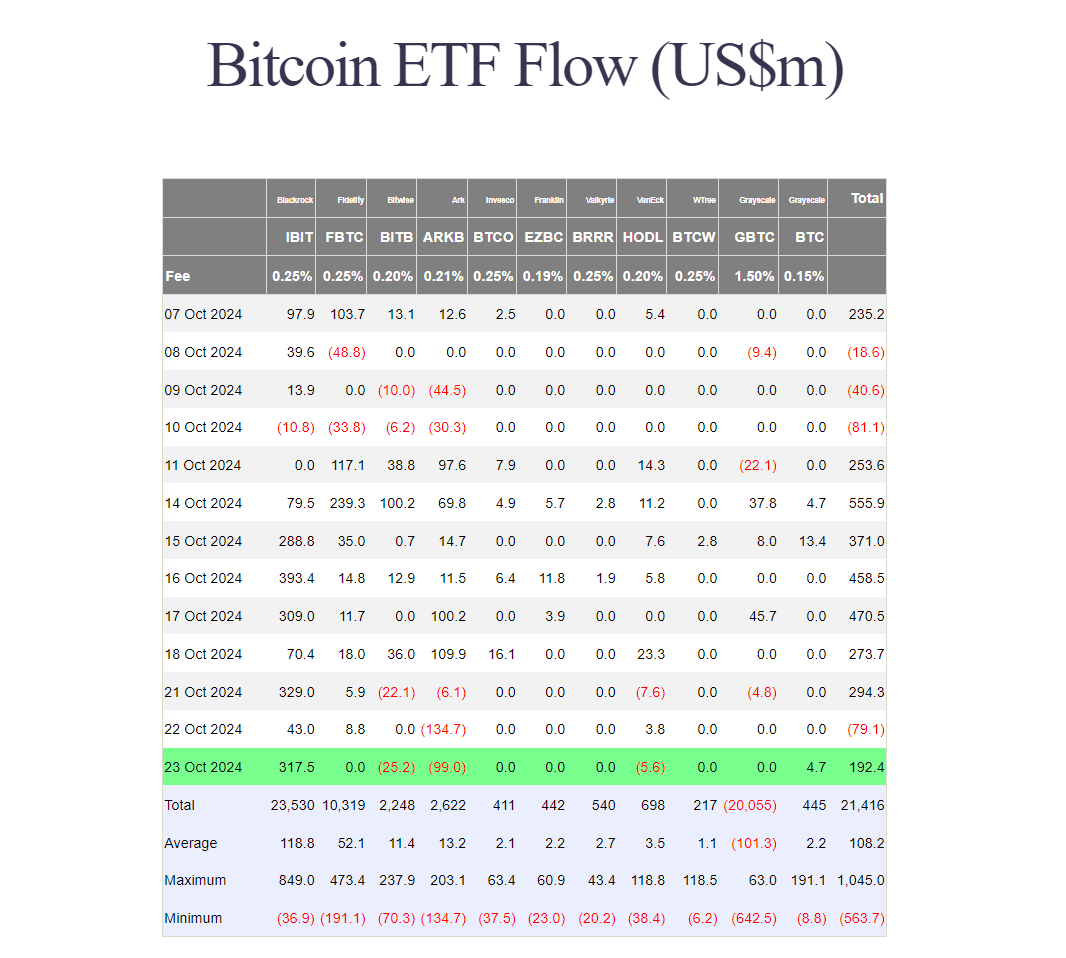

- BlackRock's iShares Bitcoin Trust garnered over $317 million in inflows, contrasting with losses in other ETFs.

- Bitcoin's price remains volatile, peaking at $69,500 last week and now around $67,000.

BlackRock’s iShares Bitcoin Trust (IBIT) keeps attracting investor interest, ending Wednesday with over $317 million in net inflows while most competing ETFs struggle to maintain their winning streak.

Trailing behind IBIT, Grayscale’s Bitcoin Mini Trust, the BTC fund, reported gains of nearly $5 million yesterday, according to Farside Investors data. In contrast, ARK Invest’s ARKB, Bitwise’s BITB, and VanEck’s HODL, suffered a combined loss of nearly $130 million.

With IBIT’s massive inflows and additional capital from BTC, the group of US spot Bitcoin ETFs reversed a negative trend yesterday, collectively drawing in around $192 million.

These funds have shown mixed trends this week, unlike last week when there was no net bleeding reported. Flows turned negative on Tuesday after $294 million in gains on Monday.

The ARKB fund, which enjoyed over $300 million in inflows last week, has been hit hard. The ETF has seen nearly $240 million in redemptions so far this week, almost wiping its gains from the previous week. Meanwhile, it seems that GBTC’s outflows have subsided; the fund saw only about $5 million in losses on Monday.

The latest performance coincides with Bitcoin’s price fluctuations. After peaking at $69,500 last week, Bitcoin has pulled back, now hovering around the $67,000 level, per CoinGecko.

Standard Chartered analysts are confident that the largest crypto will revisit its previous record high before the next president is selected, thereby boosting the chances of “Uptober.”

However, recent declines may dampen the “Uptober” outlook, especially with the US presidential election just around the corner. Bitcoin may face a “sell-the-news” scenario ahead of the key event.

As the election approaches, investors often speculate on how the results might impact various asset classes, including crypto. This anticipation can lead to increased volatility, with traders potentially selling off assets to lock in profits before election results are announced.

Bitcoin’s recent price fluctuations are more likely influenced by broader macroeconomic trends rather than direct political events. However, any significant news related to the election could trigger reactions from investors looking to adjust their portfolios based on perceived risks or opportunities. Some analysts predict that a Trump victory could lead to a surge in Bitcoin prices due to his pro-crypto stance.

As soon as the election is over, the market is likely to take little rest as the next FOMC meeting occurs, when the Fed makes its interest rate decision.

The central bank is expected to cut rates by 25 basis points as part of its ongoing monetary policy adjustments, which analysts suggest could further boost Bitcoin’s prices.