The cable television industry's cord-cutting conundrum is nothing new. People have been steadily canceling their cable service since 2013, in fact. Cable companies have largely been offsetting this customer attrition by growing the very business that's slowly killing cable TV. That's high-speed internet -- or broadband -- which makes it possible to pipe other sources of video entertainment into your home.

However, cable companies' broadband business is also now hitting a wall. That doesn't mean mere stagnation. Comcast's (NASDAQ: CMCSA) Xfinity internet service shed 110,000 domestic high-speed internet subscribers during the second quarter of the year, plus another 10,000 business broadband accounts. Charter Communications' (NASDAQ: CHTR) Spectrum lost 154,000 residential broadband customers in Q2, only offsetting this loss with the addition of 5,000 new business accounts. In both cases, these subscriber losses extend and accelerate trends that first took shape in the middle of last year.

The data begs one key question: Given that high-speed internet is at the heart of the reason cable television is on the defensive in the first place, where the heck are these broadband customers going?

Keep reading. The answer might shock you.

Where cable's internet customers are going instead

In the industry's infancy, cable companies were best suited to offer broadband service, simply because their beefy coaxial cables were able to deliver more digital data all the way to a customer's home. Phone lines worked too, but phone companies' DSL service speed was ultimately crimped by their skinnier phone lines.

As time has marched on, however, so has the technology behind high-speed internet. Ultra-fast fiberoptic connections are now common, and in some locales wireless connectivity is just as fast as wired connections.

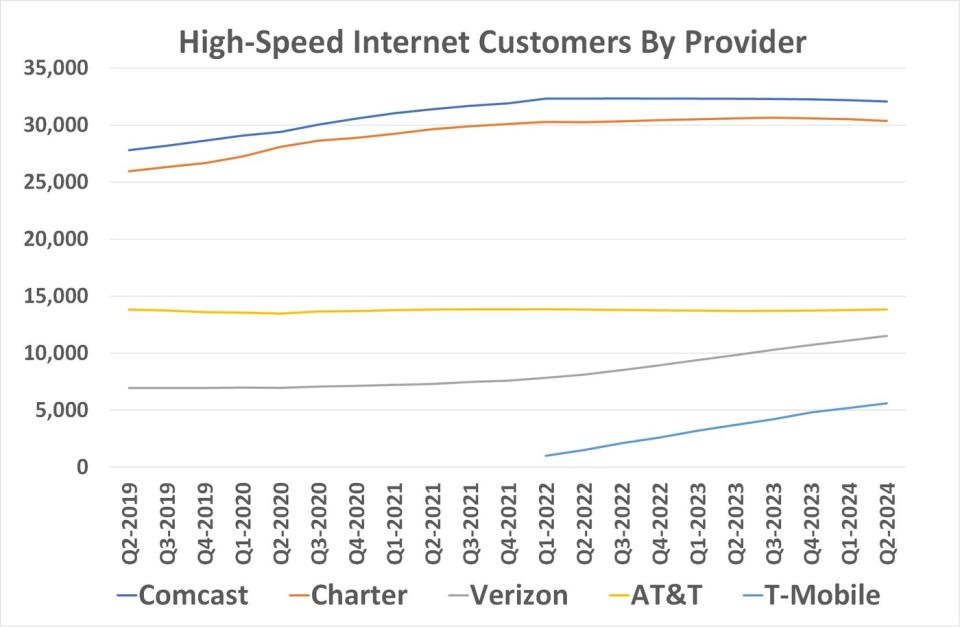

But it's not cable companies like Charter's Spectrum and Comcast's Xfinity setting up the infrastructure for those alternative connections. Telecom outfits like Verizon Communications and AT&T, and even mobile service provider T-Mobile US, have been making these investments. Now they're reaping the benefits. The graphic below tells the tale.

To put the trends into numerical perspective, while Comcast and Charter collectively lost 269,000 broadband subscribers in the second quarter of this year, Verizon added nearly 400,000, as did T-Mobile. AT&T picked up a little over 50,000. In all five cases, last quarter's results extend nascent trends.

It's also worth highlighting that many of these newly acquired customers don't even use a physical line to connect to the web. Roughly one-third of Verizon's broadband customers and all of T-Mobile's enjoy what's called fixed wireless access (or FWA) service, which maintains high-speed internet connections wirelessly, rather than through poles and lines that may not be convenient to extend all the way to a residence or office.

Take the trends at face value

Clearly Verizon, AT&T, and T-Mobile are far from dethroning Comcast's Xfinity and Charter's Spectrum as co-leaders of the broadband arena. There's also no denying that the cable giants' high-speed internet businesses aren't exactly imploding. Most of yesteryear's subscribers are still around.

All big trends start out as small ones, though, and somehow these trends look like they could last a while as more consumers figure out that they can get a cheaper, comparable (or even better) service from a phone company than they can from a cable company.

The implication for investors is simple enough -- for traditional telecoms like Verizon and AT&T that were struggling with the mobile phone market's saturation, there's now a promising growth engine in place. There are a lot of cable broadband customers left to poach.

Charter and Comcast are at the other end of this spectrum. More than one-fifth of Comcast's revenue comes from its high-speed internet arm, while nearly half of Charter's top line is driven by its broadband service. With their hold on this industry slowly slipping away in the wake of cable television's ongoing challenges, there's not a great bullish case for owning either name. The only real reasonable argument for owning Comcast stock is its forward-looking dividend yield of 3.1%, but even then, it feels like the company could struggle to continue paying this dividend and also invest in itself as needed.

Bottom line? Things are exactly what they look like they are here.

Should you invest $1,000 in Comcast right now?

Before you buy stock in Comcast, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Comcast wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $638,800!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 6, 2024

James Brumley has positions in AT&T. The Motley Fool recommends Comcast, T-Mobile US, and Verizon Communications. The Motley Fool has a disclosure policy.

Comcast and Charter Lost Another 269,000 Broadband Customers Last Quarter. Where On Earth Are They Going? was originally published by The Motley Fool