Cybersecurity compliance startup Vanta Inc. said today it has closed on a $150 million round of funding, cementing its status as a leader in the emerging “trust management” sector.

Today’s Series C round was led by Sequoia Capital and saw the involvement of new investors Goldman Sachs Ventures and J.P. Morgan, plus returning investors Atlassian Ventures, Craft Ventures, CrowdStrike Ventures, HubSpot Ventures, Workday Ventures and Y Combinator. All told, the company has now raised $353 million since it was founded in 2021, and its value now stands at a cool $2.45 billion.

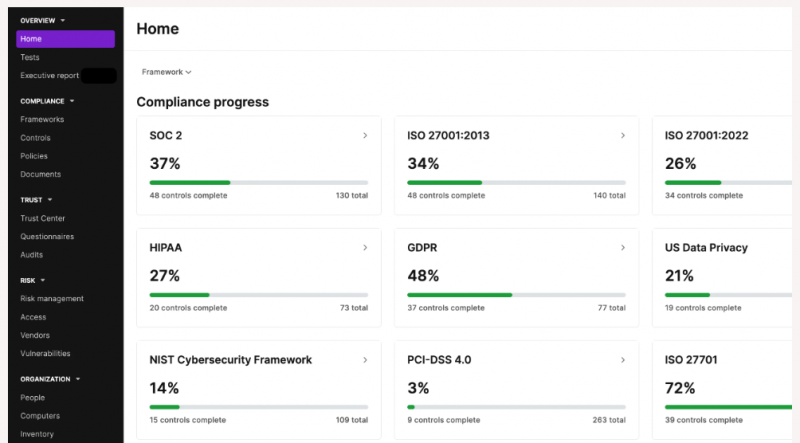

Vanta has created a suite of tools that help companies to comply with cybersecurity standards such as the SOC 2, the General Data Protection Regulation and the ISO 27001 regulation. Many companies are required to adhere to these standards in order to show that they’re processing and storing customer data in a way that’s safe and secure. But it can be a nightmarish task for larger companies to ensure they’re in compliance with those rules, especially when they’re racing to integrate new, data-hungry artificial intelligence applications and tools into their business processes.

That explains the popularity of Vanta, whose products include reporting tools that provide organizations with a unified view of their cybersecurity programs and their attack surfaces, so they can prioritize where they need to focus their efforts to ensure they remain compliant and eliminate any vulnerabilities in their computing stacks.

Its suite also comes with a risk management dashboard that surfaces key metrics via heat maps and other visualizations. These help security teams to see where they face the most risks, so they can coordinate efforts to plug any gaps in their cyber defenses. In addition, Vanta offers workspaces for team leaders to assign tasks to specific individuals, plus a reporting capability for executives that provides a complete overview of their compliance status.

In a recent update, Vanta debuted AI capabilities that help to relieve the burden on security teams, including AI-powered vendor security reviews, generative questionnaire responses and intelligent control mapping.

Prior to today’s round, Vanta had been making good progress, surpassing $100 million in annual recurring revenue for the first time in its fiscal 2024 year ending in January, doubling its customer base and growing its staff to more than 500 employees across its offices in North America, the U.K., Germany and Australia.

Vanta is led by Chief Executive Christina Cacioppo (pictured), who said today the company has emerged as the leader in trust management, “enabling thousands of customers to strengthen their security practices and ultimately grow their businesses.”

The startup claims more than 8,000 enterprise customers, including companies such as Atlassian Corp., Quora Inc., Intercom Inc., ZoomInfo Technologies Inc., Modern Life Inc. and SmartRecruiters Inc. It provided a number of testimonials from those customers, with Modern Life saying it saves over 100 hours per year on compliance and security-related tasks through Vanta’s automation, and SmartRecruiters claiming that its pre-teams save 20 hours per week through its streamlined security review processes.

Looking forward, Vantas said the funds from today’s round will help to accelerate its market momentum.

Goldman Sachs’ growth equity investor Mike Reilly said compliance has become critical for every business, especially the largest enterprises.

“We’re investing in Vanta because of their demonstrated platform approach, starting with automated compliance and rapidly adding new modules such as Trust Centers and Vendor Risk Management,” Reilly said.