Data shows the cryptocurrency derivatives market has suffered liquidations of more than $1 billion in the past day as Bitcoin has crashed to $52,000.

Bitcoin Has Plunged By More Than 15% During The Last 24 Hours

Bitcoin investors have been dealt a shock to open Monday, with the cryptocurrency having crashed by more than 15%, which has taken its price to the $51,500 mark.

The below chart shows how the recent trajectory has looked like for the asset:

From the graph, it’s visible that the latest sharp plunge in the BTC price is just an acceleration of the trend that the asset had already been witnessing since the last couple of days of July.

On the 29th, the cryptocurrency was floating around the $70,000 mark, meaning that it had come down by more than 26% in only a week. Following this drawdown, Bitcoin is now back to the same level as that just before the late February rally, which went on to culminate in a new price all-time high (ATH).

While BTC has had it bad during the past day, altcoins have in general had it even worse. Ethereum (ETH), BNB (BNB), and Solana (SOL), the three largest coins next to the original (excluding the stablecoin Tether), have all seen higher losses of 23%, 19%, and 21%, respectively.

With prices across the sector crashing down, it’s not surprising to see that long investors have taken a heavy blow over on the derivatives side of the market.

Crypto Liquidations Have Crossed $1 Billion, Majority Are Long Contracts

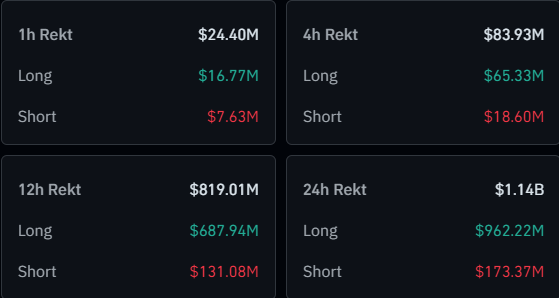

The latest volatility in the various assets has meant the derivatives market has gone through chaos over the past 24 hours, as the data from CoinGlass below shows.

As is visible in the table, a whopping $1.1 billion in cryptocurrency derivatives contracts have found liquidation in this period. “Liquidation” here naturally refers to the process any contract undergoes after amassing losses of a certain degree, where its platform forcibly closes it up.

An extreme majority of these liquidations, around 85% to be more precise, involved the long holders. This is a natural consequence of the market as a whole going through a crash.

Interestingly, though, despite the sharp plummet, $173 million in shorts still managed to get liquidated, which isn’t really a small amount. Thus, it would appear that a large amount of investors only put their bearish bets in when the crash was already finished.

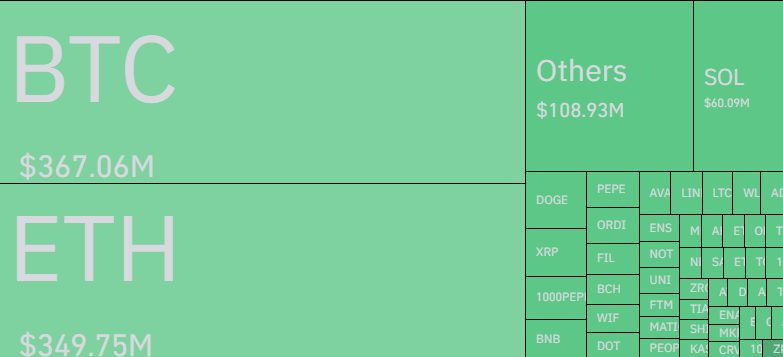

In terms of the individual symbols, Bitcoin and Ethereum have contributed to the mass liquidation event by nearly the same degrees, witnessing liquidations of $367 million and $350 million, respectively.

Clearly, BTC is still ahead, but by only a small amount, which is not usually the case. The reason behind ETH’s high liquidations may be the fact that the recent launch of the spot exchange-traded funds (ETFs) had put more attention on the second largest coin by market cap.

Featured image from Dall-E, CoinGlass.com, chart from TradingView.com