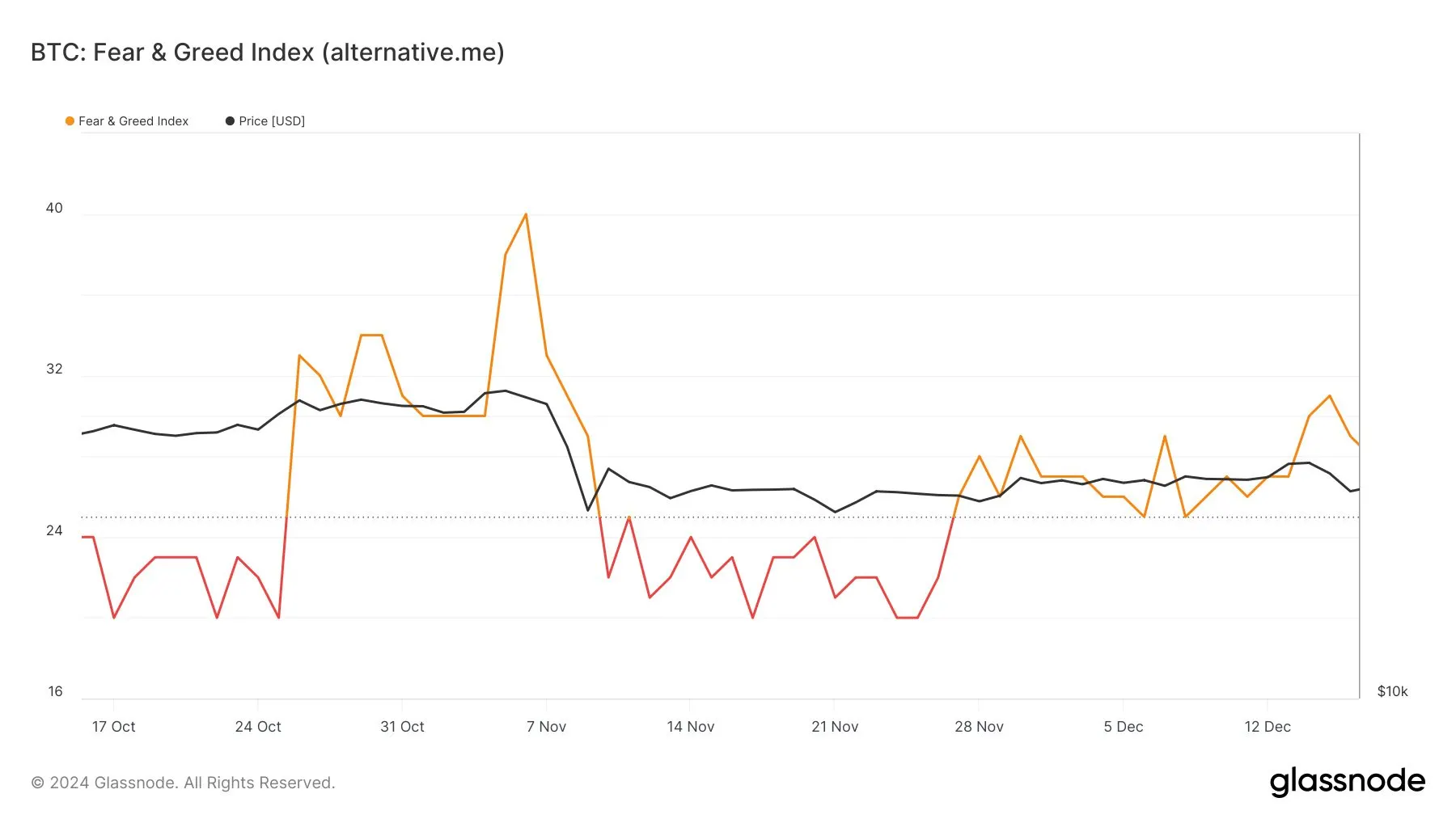

In a dramatic turn that echoes the darkest days of the crypto winter, the Fear & Greed Index has plummeted to a staggering 17 out of 100 on Tuesday, plunging deep into the "Extreme Fear" territory.

This level of investor sentiment is even more extreme than what was seen amid the catastrophic collapse of FTX in November 2022, reflecting deep-seated uncertainty that currently grips the industry as the U.S. grapples with recession fears.

The Fear & Greed Index is a frequently cited metric designed to gauge overall market sentiment, based on an analysis of various factors including volatility, trading volume, social media sentiment, and market momentum. A reading of 0 indicates extreme fear, while 100 represents extreme greed.

The recent plunge in the index follows a renewed wave of turmoil in the crypto market. The crypto market on Monday saw over $1 billion in liquidations wiping out positions held by nearly 280,000 traders.

Bitcoin, the market's bellwether, plummeted by nearly 15%, while Ethereum suffered an even steeper decline, losing nearly 24% of its value.

The mass selloff in equities and the crypto market was triggered by the Bank of Japan's 25 basis point interest rate hike and a weak U.S. jobs report, which sparked concerns of an economic downturn. The contagion effect from these events has sent shockwaves through the industry, leaving many projects and investors reeling.

Tuesday's reading of 17 is even lower than it was surrounding the implosion of crypto exchange FTX, which sent the crypto market into a tailspin. The index bottomed at 20 at the time.

The exchange, founded by Sam Bankman-Fried, was once considered one of the most promising platforms in the industry. However, a series of reckless bets and fraudulent activities led to its downfall. FTX was found to have misused customer funds to prop up its affiliated trading firm, Alameda Research.

When the market turned against FTX, a virtual bank run ensued, leading to the exchange's bankruptcy. The collapse of FTX triggered a contagion effect, with other crypto firms suffering significant losses and many investors losing their life savings.

The current situation resembles that dark period, with the sharp decline in the index suggesting that market participants are bracing for further downside and are reluctant to take on new positions.

Edited by Ryan Ozawa.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.