Bitcoin can’t seem to leave the $60,000 price level as it continues to trade in uncertainty. On Saturday, August 3, the cryptocurrency experienced another sharp decline, briefly dipping below the $60,000 mark.

Although this drop lasted only a few minutes, it was quite significant, especially given that Bitcoin had traded above $62,000 earlier the same day. This fluctuation has notably impacted market participants, leading to the liquidation of numerous long positions.

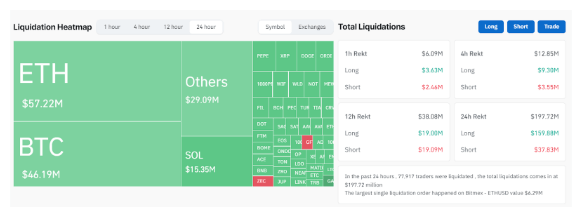

At the time of writing, over $197 million worth of leveraged positions have been liquidated in the past 24 hours. Notably, this figure soared to as much as $288 million during the peak of the selling pressure.

Bitcoin And Market Liquidations

The persistent inability of Bitcoin to maintain a stable position above $60,000 highlights the uncertainty and speculative nature of the cryptocurrency market. Traders and investors remain cautious, closely monitoring its price movements.

This cautious approach has likely been amplified by recent reports of repayments initiated by the bankrupt crypto lender Genesis Global Capital, which flooded the market with additional digital assets, primarily Bitcoin and Ethereum.

Considering Bitcoin and Ethereum’s dominance over the market, this cautious approach has inadvertently led to a lingering bearish sentiment surrounding other cryptocurrencies. Although Bitcoin and Ethereum experienced the highest liquidated positions, the impact has spilt over into other digital assets.

According to Coinglass data shown below, Ethereum led the market with $57.22 million worth of leveraged positions liquidated. Bitcoin followed closely with $46.19 million in liquidations and Solana with $15.35 million.

The total liquidation amount reached $197.72 million, with the majority ($159.88 million) in long positions. Most of these liquidations occurred on Binance, OKX, and Bybit, with $85.88 million, $65.83 million, and $16.47 million in liquidations, respectively, each exhibiting an 80% long liquidation rate.

Prevailing Bearishness

The crypto industry is no stranger to sporadic liquidations of such huge amounts. Considering the prevailing short-term bearish sentiment, most of these liquidations have repeatedly been on long positions. On June 24, the market witnessed almost $300 million worth of positions liquidated in under 24 hours. Similarly, over $360 million worth of positions were liquidated on June 7 when the Bitcoin price crashed from $71,000 to $68,000.

Recent market dynamics suggest that the industry might not be out of the woods yet concerning such liquidations. Bitcoin continues to struggle to hold above $60,000, a trend that could persist in the coming weeks. This is partly because Spot Bitcoin ETFs, which have historically been a catalyst for Bitcoin price surges, ended last week on a negative note. Specifically, they concluded Friday’s trading session with $237.4 million in outflows, the largest daily outflow since May 1.

Featured image from The Michigan Daily, chart from TradingView