Data shows the cryptocurrency sector as a whole has witnessed a high amount of liquidations following the volatility Bitcoin and others have gone through.

Bitcoin Has Recovered Back Above The $63,000 Level

Following the news of the US Federal Reserve cutting back on interest rates, Bitcoin has responded positively, with its price breaking above the $63,000 level.

The chart below shows what the asset’s recent performance has looked like.

The graph shows that after this 5% jump over the last 24 hours, the cryptocurrency is no longer far from reaching the highest level observed in August.

As is generally the case, the rest of the digital asset sector has also enjoyed a surge as this latest Bitcoin rally has occurred. Some of the altcoins like Solana (SOL) and Avalanche (AVAX) have even managed to notably outperform the number one coin.

A consequence of all the volatility in the market has been that the derivatives side has gone through some chaos.

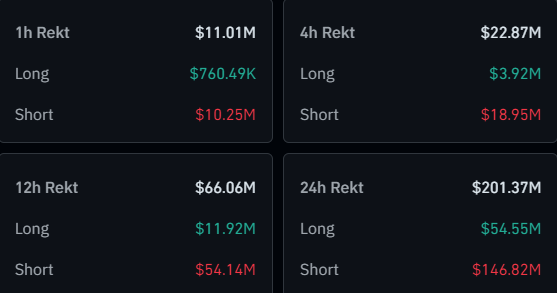

Crypto Derivatives Market Has Observed $201 Million In Liquidations Today

According to data from CoinGlass, a large amount of liquidations have occurred in the cryptocurrency derivatives market during the last 24 hours. “Liquidation” here refers to the forceful closure that any open contract undergoes after amassing a certain percentage of loss.

Here is a table that breaks down the data related to liquidations in the sector over the past day:

As displayed above, the cryptocurrency market as a whole has seen more than $201 million in liquidations during the last 24 hours. Out of these, about $147 million of the flush has involved short contracts.

This means the short investors were responsible for almost three-fourths of the total liquidations. This is natural because Bitcoin and other assets have seen a significant surge during this period.

A mass liquidation event like today is popularly known as a “squeeze.” As the latest squeeze has mainly involved the shorts, it would be called a short squeeze.

Events like these aren’t particularly rare in cryptocurrency because most coins can act volatilely and speculation is generally quite active. Compounded by the fact that many speculators aren’t afraid to touch leverage, large liquidations can easily occur.

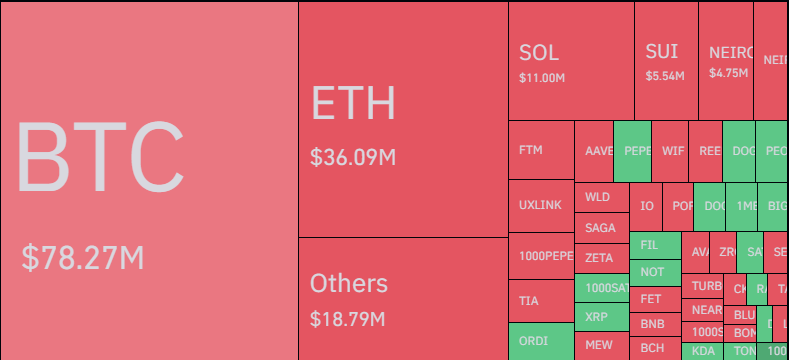

As for how the latest squeeze has looked regarding the contribution from the individual symbols, the heat map below reveals it.

As is the norm, Bitcoin has topped the charts with $78 million in liquidations, more than twice the $36 million Ethereum registered in second place. Solana has seen the most liquidations of the rest at $11 million.

Featured image from Dall-E, CoinGlass.com, chart from TradingView.com

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.