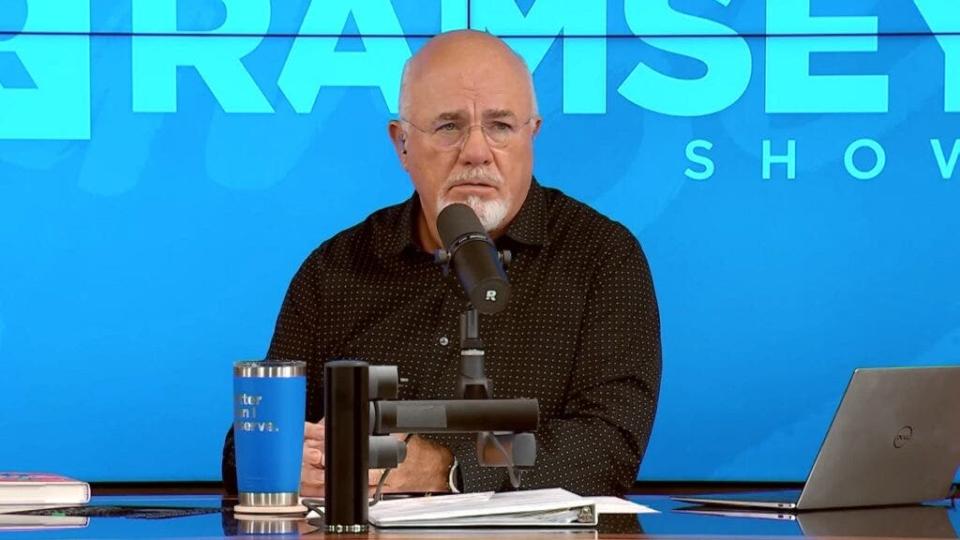

Financial expert Dave Ramsey has a clear message for anyone trying to figure out why they’re not making progress with their money: You could be wasting $5,000 a year on things you don't need. In a recent tweet, Ramsey pointed out that spending just $13.70 daily on unnecessary purchases adds up to that much in a year.

Don't Miss:

The average American couple has saved this much money for retirement — How do you compare?

Can you guess how many Americans successfully retire with $1,000,000 saved? The percentage may shock you.

It might not seem like much at first glance – after all, what's $13.70 a day? Maybe it's a coffee, a takeout lunch, or something you picked up online without thinking twice. Ramsey's point is that those small, everyday expenses can silently drain your bank account over time, preventing you from reaching bigger financial goals.

The Impact of Small Spending

How to waste $5,000 a year:

Spend $13.70 a day on things you don't need.— Dave Ramsey (@DaveRamsey) September 3, 2024

Ramsey's tweet puts into perspective how easy it is to lose track of your spending when done in small amounts. Many people don't realize how quickly those "little" purchases can add up. $13.70 a day may not feel like much, but when multiplied by 365 days, you've spent $5,000 on things you likely didn't need.

Trending: Teens may never need wisdom teeth removed thanks to this MedTech Company – Be an early investor for just $300 for 100 shares!

For someone struggling to save for an emergency fund, pay off debt, or build long-term wealth, that $5,000 could make a significant difference. Many people think they're not spending much on a daily basis, but once they take a closer look, they realize how many small purchases are eating away at their finances.

Simple Changes, Big Results

Ramsey offers straightforward advice to cut back on unnecessary spending: Be purposeful. Ensure your money is going toward something worthwhile, like paying off debt, saving for a down payment on a home, or setting up an emergency fund. Create a budget, keep track of your expenditure, and monitor it.

See Also: The number of ‘401(k)' Millionaires is up 43% from last year — Here are three ways to join the club.

What Could You Do With $5,000?

Think about what an extra $5,000 a year could do for you. Maybe it's the difference between living paycheck to paycheck and having a savings cushion. It could help pay off high-interest debt, contribute to retirement, or allow you to take a vacation without going into credit card debt.

Ramsey often declares that "Your number one wealth-building tool is your income," emphasizing that true financial success comes from prudent saving and investing, not indebting oneself to creditors like Sallie Mae or Best Buy.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

Ramsey examines how common it has become to rely on debt to fund wants and investments, pointing out that "when you give your income to someone else, you don't have it anymore."

He challenges the idea that debt is normal, particularly calling out the flawed thinking behind student loans and credit card rewards. With humor, he says, "Oh, Sallie Mae's been with us for 15 freaking years in our spare bedroom," highlighting how long student debt can weigh people down.

Read Next:

Founder of Personal Capital and ex-CEO of PayPal re-engineers traditional banking with this new high-yield account — start saving better today.

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Dave Ramsey Says You're Wasting $5,000 A Year If You 'Spend $13.70 A Day On Things You Don't Need' originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.