Liquid restaking tokens and yield-bearing stablecoins face brief volatility but quickly recover.

Key Takeaways

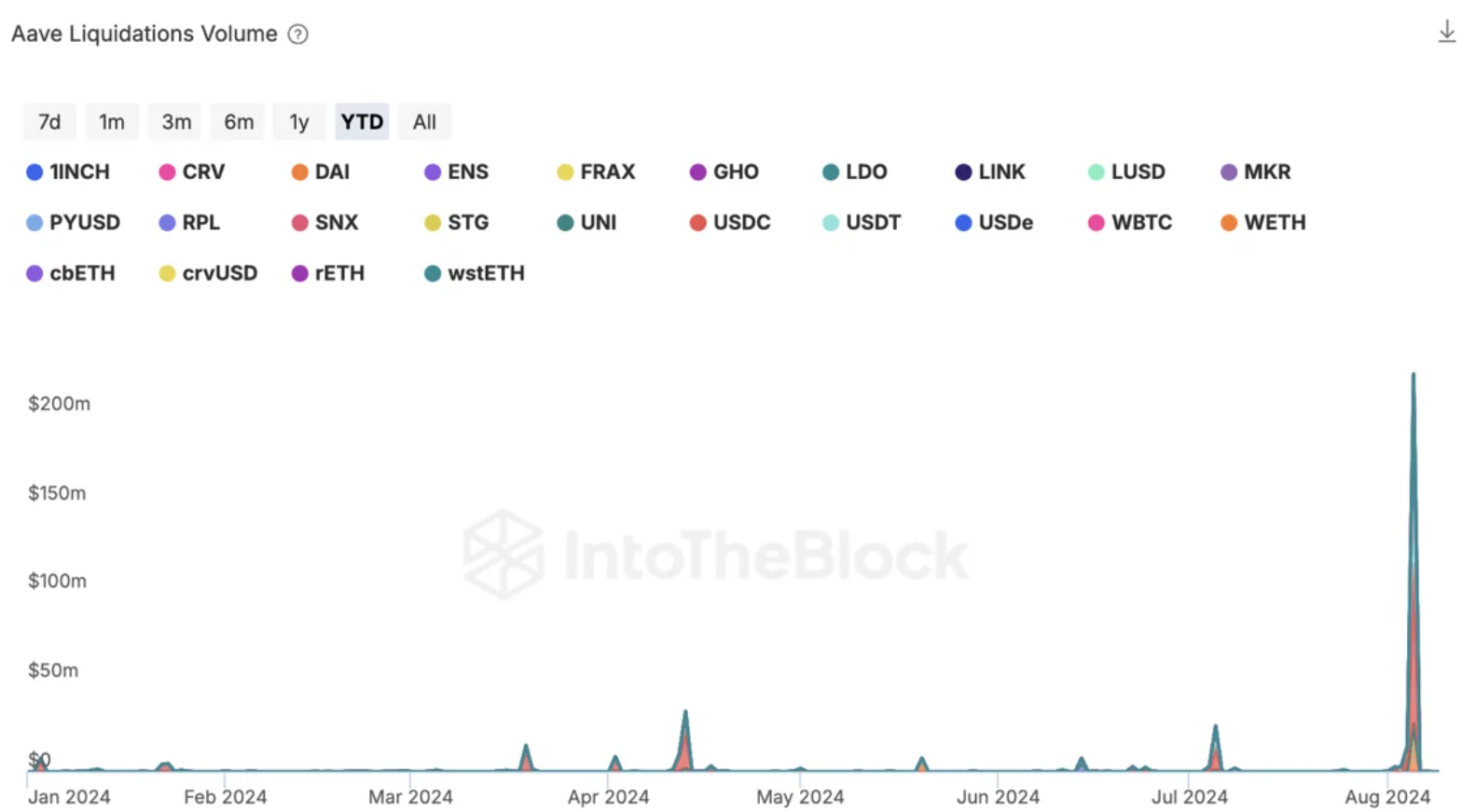

- Aave successfully executed $300M in liquidations during the market crash, contributing $6M in profits to its DAO.

- Liquid restaking tokens and yield-bearing stablecoins experienced brief depegs but quickly recovered, demonstrating market stability.

DeFi protocols demonstrated resilience during this week’s market crash, with Aave facing its largest liquidations ever amounting to $300 million on Ethereum mainnet. According to IntoTheBlock, most of the liquidations happened from stablecoin loans against wstETH collateral, the wrapped liquid staking token offered by Lido.

Despite ETH crashing by up to 25% within a week, liquidations were successfully executed, rebalancing the protocol and contributing $6 million in profits to the Aave DAO.

Notably, the settlement of hundreds of millions in liquidations occurred without relying on a central point of failure, all executed automatically by smart contracts.

Liquid restaking tokens (LRTs) and yield-bearing stablecoins experienced brief deviations from their pegs. EtherFi’s eETH, the largest LRT by market cap, depegged by up to 2% during Monday’s crash but recovered within six hours. Non-redeemable LRTs faced steeper depegs but also recovered most of their discounts.

Ethena’s USDe maintained its peg to the dollar, with its supply decreasing by $100 million due to redemptions. The stablecoin did not depeg by more than 0.5% despite the market volatility.

Overall, both new and established decentralized finance (DeFi) protocols successfully weathered the macro storm, demonstrating the industry’s ability to withstand harsh conditions without external interference.

Moreover, the total value locked (TVL) in DeFi applications shrunk up to 10% after the Aug. 4 crash but managed to recover all the value lost during the correction, standing at over $128 billion. In 2024, the TVL of DeFi applications rose 41%, according to data from DefiLlama.

The crypto market downturn was part of a broader global deleveraging event, triggered by the unwinding of the Yen carry trade following the Bank of Japan’s interest rate hike to 0.25%. This led to a spike in the Yen and widespread selling of assets, causing a correlation between crypto and stocks to hit a six-month high.