Ethereum (ETH) recently dropped below the critical and psychological support level at $3,000, raising concerns for ETH bulls. This development comes amid the continued decline in revenue generated on the Ethereum network.

Ethereum Crashes Below $3,000

Ethereum is down below $3,000, with this downtrend believed to be due to several factors. One is the outflows, which the Spot Ethereum ETFs have been experiencing since they began trading on July 23. Data from Farside Investors shows that these funds again experienced a net outflow of $54.3 million on August 2.

These funds haven’t had the desired impact on ETH’s price that they were expected to have, with Ethereum down over 10% since they began trading. Data from Soso Value shows that these funds have suffered cumulative net outflows of $510.7 million since they launched. Grayscale’s Ethereum Trust (ETHE) has been individually responsible for these outflows, with $2.12 billion flowing out of the fund since its launch.

This has put significant selling pressure on ETH, leading to its recent downtrend. ETH’s price has also dropped below $3,000 thanks to the downtrend in the broader crypto market led by Bitcoin. Ethereum was bound to suffer a significant decline following Bitcoin’s drop as data from the market intelligence platform IntoTheBlock shows that both assets currently have a strong price correlation.

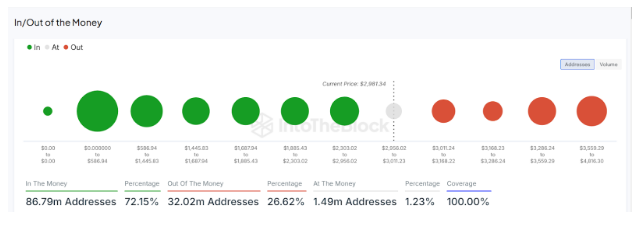

Ethereum’s drop below $3,000 is undoubtedly worrisome for investors, considering how much lower it could drop. However, ETH has quickly reclaimed the $3,000 level these past three months whenever it drops below this crucial support zone. As such, this time may not be any different, especially with data from IntoTheBlock indicating a strong demand for Ethereum at this price level.

If Ethereum fails to hold this range, the second-largest crypto token risks dropping to as low as $2,700, a more crucial support zone for ETH considering that 11.11 million addresses bought the token at an average price of $2,647.

Ethereum’s Revenue Drops To New Lows

Data from Token Terminal shows that Ethereum’s revenue has dropped to new lows, down by 40.4% in the last 30 days and 44.8% annually. Fees earned on the network have not been impressive either. Over the last 30 days, Ethereum users have paid $92.97 million in fees, a 32.8% decline and 38.3% at an annual rate.

This drop in Ethereum’s revenue and fees can be attributed to the decline in the network’s active daily users. Further data from Token Terminal shows a 9.8% drop in Ethereum’s monthly active users. The same goes for the weekly and daily active users, with 20.1% and 15.3% drops, respectively.

At the time of writing, Ethereum is trading at around $2,979, down over 5% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Pexels, chart from TradingVIew