It's no secret that Nvidia's (NASDAQ: NVDA) stock price has surged in recent years thanks largely to its association with artificial intelligence (AI), particularly the massive spending being done to expand data center computing power. Along with the price surge has come a surge in valuation for the stock.

If you are the type of investor who doesn't like buying hot stocks at hefty valuations but still wants some exposure to the spending jump related to AI and data centers, Johnson Controls (NYSE: JCI) might be the answer. Here's why this heating, ventilation, and air-conditioning (HVAC) specialist offers a great AI-related alternative to high-priced Nvidia.

Wall Street upgrades Johnson Controls

Johnson Controls stock received some positive ratings from heavyweight Wall Street investment companies recently. Bank of America analysts upgraded the stock to a buy rating and increased the price target to $80 (from $76), while Morgan Stanley analysts initiated coverage on Johnson Controls with an $85 price target and an overweight rating.

Analysts at both firms mentioned positive indicators involving end-market exposure for Johnson Controls. Bank of America's analyst asserted that Johnson Controls will generate 14% of its revenue from data centers this year. At the same time, Morgan Stanley's analyst said the company's solutions help building owners create efficiency gains -- a good theme as property owners seek to cut costs.

The AI/data center angle is relevant to the HVAC sector. Robust HVAC solutions are needed to maintain a controlled environment in data centers so equipment can perform optimally.

That's one reason why HVAC companies' shares have generally outperformed this year. However, Johnson Controls has underperformed its immediate peers, Trane Technologies (NYSE: TT) and Carrier Global (NYSE: CARR).

It also trades at a valuation discount to its peers.

Opportunities for a new CEO

One reason the stock underperformed the competition was management's patchy record with guidance. Johnson Controls missed its own estimates on earnings in 2022 and sales in 2023. That pattern continued in its fiscal 2024 (which ended Sept. 30, 2024). During its fiscal Q2 earnings call in May, management maintained its guidance for full-year organic sales growth in the mid-single-digit range, only to cut it to approximately 3% in its Q3 report released on July 31.

It's unclear if the company's disappointing execution is why activist hedge funds are taking positions in the stock. Still, we know George Oliver announced he would retire as CEO in conjunction with that same third-quarter report. Hopefully, its next leader will be able to take advantage of the company's significant growth opportunities.

Why Johnson Controls can outperform

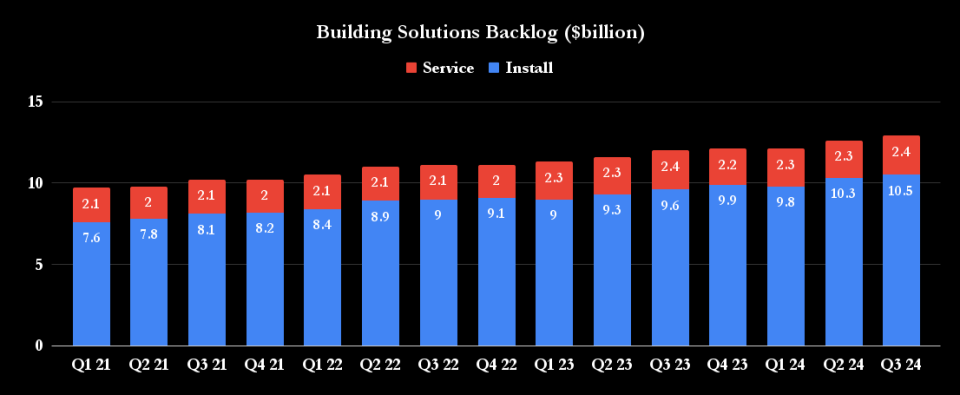

While organic sales growth of 3% isn't what investors expected this year, the company's orders and backlog continue to grow. Oliver noted "strong demand for our data center solutions," and asserted, "We have built a leading position in data centers in North America, due to a unique and compelling customer value proposition."

Alongside the growth in data center demand to support the computing power needs of AI, Johnson Controls has an excellent growth opportunity coming from the trend of retrofitting buildings as owners strive to cut costs and reduce their carbon footprint. These efficiency gains are also being driven by the increasing use of digital technology in buildings, and the company continues to see strong adoption of its OpenBlue digital platform.

Restructuring to focus on its core business

A third catalyst that could lift its stock price comes from the company restructuring to focus on its core commercial and industrial HVAC business, not least by agreeing to sell its residential and light commercial HVAC business to Bosch in a transaction valued at $8.1 billion. (Johnson Controls will receive $6.7 billion.)

Alongside the sale of its air distribution technologies business, Johnson Controls will divest businesses responsible for about 20% of its overall sales, becoming a much more focused company in the process.

A stock to buy

After those divestitures, an even larger share of the company's revenue will come from data centers and AI, while the underlying growth from the race to net zero will continue to support order and backlog growth.

Johnson Controls may not be as exciting a stock as Nvidia, but the company looks undervalued given its potential. Investors can expect good returns from the stock if management delivers on the opportunities outlined above.

Should you invest $1,000 in Johnson Controls International right now?

Before you buy stock in Johnson Controls International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Johnson Controls International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $729,857!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and Nvidia. The Motley Fool recommends Johnson Controls International. The Motley Fool has a disclosure policy.

Forget Nvidia, Buy This Magnificent Stock Instead was originally published by The Motley Fool