The research team also removed Render, Mantle, THORChain, Pendle, Illuvium, and Raydium from their picks.

Key Takeaways

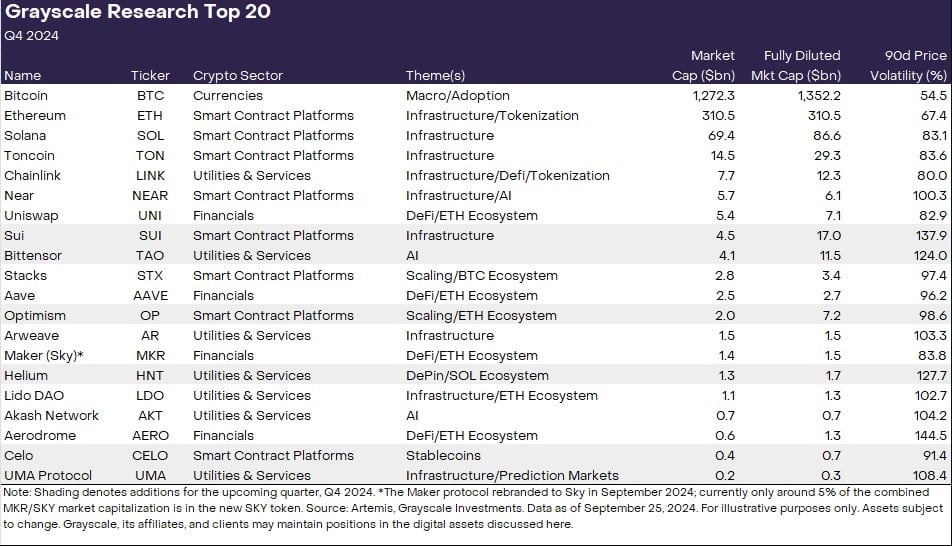

- Grayscale adds new cryptocurrencies like Sui and Bittensor to its top 20 list for Q4 2024.

- The list highlights themes such as decentralized AI and traditional asset tokenization.

As the year’s final quarter is only four days away, Grayscale Research has revealed its updated list of the top 20 crypto assets expected to excel in the next quarter. The revised list comes with six new altcoins, including Sui (SUI), Bittensor (TAO), Optimism (OP), Celo (CELO), Helium (HNT), and UMA Protocol (UMA).

Grayscale Research notes that these new additions reflect crypto market themes that the team “is focused on.”

“The Top 20 represents a diversified set of assets across Crypto Sectors that, in our view, have high potential over the coming quarter. Our approach incorporates a range of factors, including network growth/adoption, upcoming catalysts, sustainability of fundamentals, token valuation, token supply inflation, and potential tail risks,” the team wrote.

“Grayscale believes that these new additions, along with the existing assets in the Top 20, offer compelling investment opportunities with potential for growth and high risk-adjusted returns,” they added.

Based on the list, the focused areas are decentralized AI, high-performance infrastructure, as well as projects with “unique adoption trends.” Grayscale Research also highlights decentralized AI platforms, traditional asset tokenization, and the ongoing appeal of memecoins as key emerging themes.

According to the team, Sui is recognized for its 80% increase in transaction speed following a network upgrade while Bittensor is enhancing the integration of crypto and AI. Notably, Grayscale currently offers trust products for Sui and Bittensor, namely the Grayscale Sui Trust and the Grayscale Bittensor Trust, which were debuted last month.

Optimism, an Ethereum layer 2 solution, and Helium, known for its decentralized physical infrastructure networks, also made the list, while Celo’s transition to an Ethereum layer 2 network and its growing adoption in payment solutions are key factors in its inclusion.

The growth in Celo’s stablecoin usage was noticed not only by Grayscale Research but also by Vitalik Buterin. The Ethereum co-founder recently praised Celo’s milestone in daily active stablecoin addresses, driven by increased app adoption and demand in Africa.

UMA Protocol, supporting the Polymarket prediction platform, is the final addition. The presence of UMA on the list emphasizes the importance of oracles in blockchain predictive markets.

Bitcoin, Ethereum, and Solana are still in the spotlight

Established crypto assets like Bitcoin, Ethereum, and Solana still take the leading spots in Grayscale’s portfolio. The research team states that Bitcoin and the crypto sector have outperformed other segments this year, likely due to the debut of US spot Bitcoin ETFs and favorable macro conditions.

As noted in the analysis, Ethereum has underperformed Bitcoin but outperformed most other crypto assets. Despite facing competition from prominent blockchains like Solana, Ethereum maintains its dominance in terms of applications, developers, fee revenue, and value locked.

Grayscale Research expects the entire smart contract platform sector to grow, benefiting Ethereum due to its network effects. In addition to Ethereum’s high network reliability, security, and decentralization, the team believes that its regulatory status provides it a competitive advantage over competing networks.

Apart from making space for new crypto assets, the research team removed six ones from the list. These tokens are Render, Mantle, THORChain, Pendle, Illuvium, and Raydium. According to the team, while these assets still hold value within the broader crypto ecosystem, the revised list offers more compelling risk-adjusted returns for the coming quarter.

Grayscale Research also cautions about the inherent risks of crypto investments, noting the high volatility and unique challenges such as smart contract vulnerabilities and regulatory uncertainty.