Bitcoin traders should hedge their BTC exposure by taking short positions in altcoin perpetual futures, according to 10X Research CEO Markus Thielen.

While the traditional buy-and-hold strategy may no longer deliver substantial profits, this alternative approach offers traders a way to mitigate risks and capitalize on evolving market dynamics, he wrote.

Thielen noted in a report Monday that Bitcoin's dominance has risen to 56% while altcoin dominance, excluding Ethereum (ETH) and stablecoins, has plummeted to just 16%.

This trend, which began in December 2022, suggests a structural bear market for altcoins that could persist for weeks or even months.

“Traders with access to altcoin options and perpetual futures markets can hedge their Bitcoin exposure by shorting a basket of perpetual futures of altcoins. This basket could include the ten most liquid altcoins outside Ethereum and Solana,” Thielen wrote. “Even though we're cautious about Bitcoin's upside potential in the short term, this hedging strategy remains promising, as we've highlighted several times this year.”

This strategy aims to capitalize on the ongoing trend of Bitcoin outperforming altcoins. The research firm also emphasized the importance of adopting a hedge fund-like approach in the current crypto landscape.

This involves focusing on short-term trading around macroeconomic events and managing downside risk rather than relying on traditional buy-and-hold strategies.

A key factor driving this recommendation is the persistent pressure from altcoin token unlocks, which is expected to continue flooding the market with supply. Monthly unlocks ranging from $2 billion to $5 billion are far outpacing Bitcoin inflows from ETFs and stablecoins, making it difficult for the market to absorb the selling pressure.

This approach mirrors Bitcoin risk management techniques employed by hedge funds in traditional financial markets.

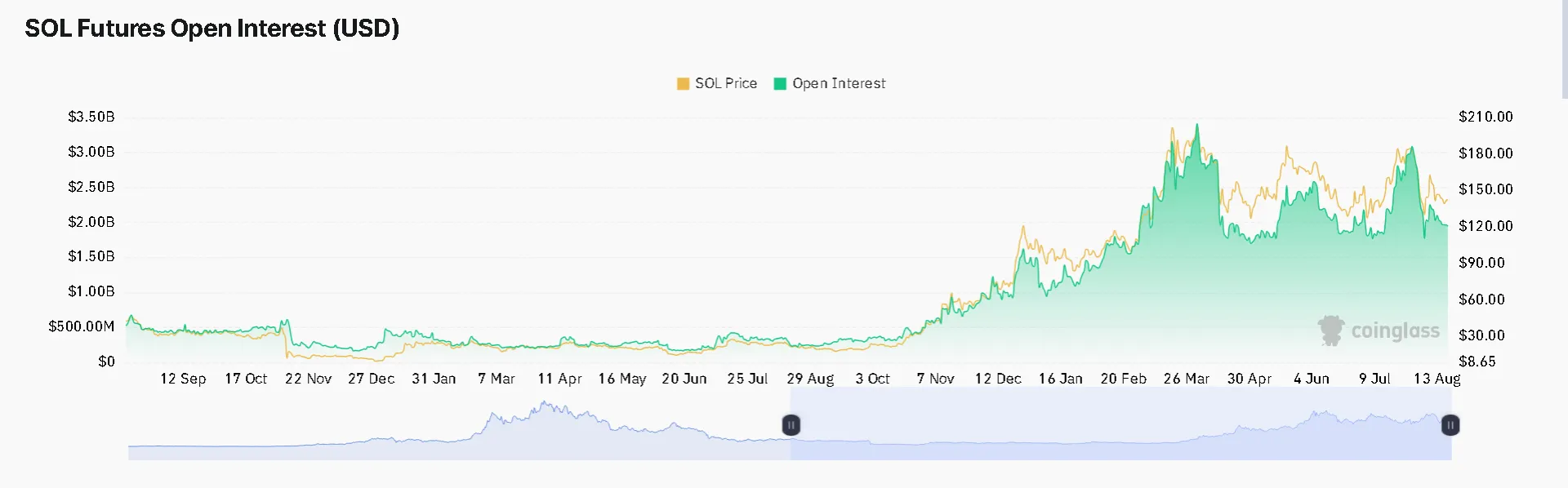

According to CoinGlass, Solana (SOL) futures open interest reveals a significant increase since October 2022. The open interest has grown from around $500 million to peak at over $3 billion in February 2024, before settling at approximately $2 billion in August 2024.

This substantial rise in open interest suggests growing trader engagement and potentially increased speculation in SOL futures markets.

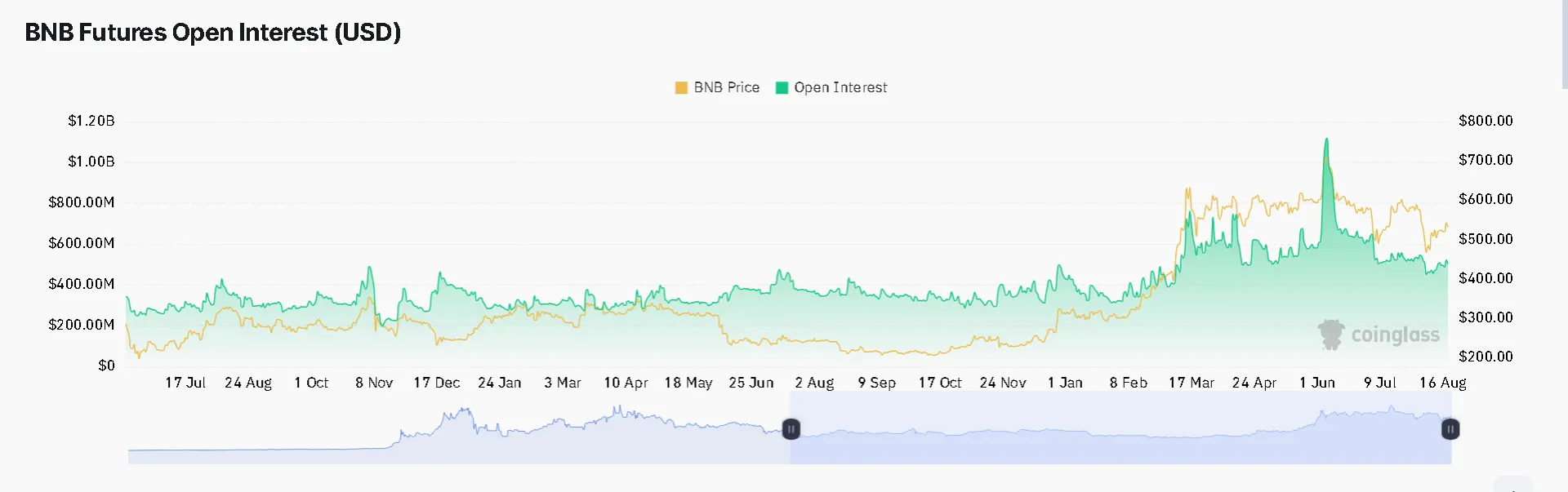

Similarly, the Binance Coin (BNB) futures open interest chart shows a notable uptrend since July 2022. The open interest has risen from about $300 million to reach peaks of over $1 billion in March and April 2024. And as of August 2024, it remains elevated at around $500 million.

This sustained increase in BNB futures open interest indicates heightened trading activity and market interest in BNB derivatives.

The report further states that Bitcoin is likely to continue outperforming a basket of altcoins, presenting a favorable trade setup for those able to implement this strategy through perpetual futures contracts.

Edited by Stacy Elliott.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.