Goldman Sachs says Jerome Powell's speech at Jackson Hole on Friday could deliver some surprises.

It wouldn't be the first time he used the event as an opportunity to reset investors' expectations.

Markets are eyeing rate cuts of 100 basis points between now and the end of the year.

All eyes are on Jerome Powell's speech at the Federal Reserve's Jackson Hole Symposium on Friday, and Goldman Sachs says the central bank's chairman could still surprise investors despite their confidence in the Fed's path for the rest of the year.

It wouldn't be the first time Powell used his Jackson Hole speech as an opportunity to reset the market's expectations.

In 2022, when inflation was hitting a 40-year high, Powell delivered a short but direct eight-minute speech that reinforced the Fed's path to raising interest rates to combat inflation even though the stock market was in the middle of a painful bear market.

Bond yields surged, and the S&P 500 lost nearly 8% in the week after Powell's hawkish Jackson Hole speech.

But with inflation almost under control and the labor market showing signs of deterioration, Powell could strike a much different tone on Friday.

And according to Goldman Sachs, there are a few ways the Fed boss could catch markets off guard.

"Possible dovish surprises could include a more concerned take on the labor market or any suggestion that the high level of the fed funds rate is inappropriate in light of the progress made on inflation," David Mericle, a Goldman economist, said in a note on Tuesday.

Such an event would likely be bullish for the stock market, as it would reinforce the idea that the Fed will start to cut interest rates at its Federal Open Market Committee meeting in September and that the bar for a cut of more than 25 basis points or a string of consecutive cuts is lower than most expect.

The CME FedWatch tool suggests investors see 100 basis points of rate cuts through the rest of this year.

On the other hand, Powell could shock markets to the downside if he adopts a more hawkish tone than investors expect.

"A possible hawkish surprise might be highlighting instead that broad financial conditions are still quite easy, which could imply that the high level of the funds rate, while perhaps unnecessary, is not an urgent problem," Mericle said.

Mericle ultimately expects Powell to be more dovish in his Jackson Hole speech, given the weak July jobs report and recent data that indicates inflation is falling closer to the Fed's long-term target of 2%.

The recent downward revision to employment growth of 818,000 jobs also doesn't help the Fed's case for remaining hawkish.

"This might mean expressing a bit more confidence in the inflation outlook and putting a bit more emphasis on downside risks in the labor market," the note said. "Powell might also reiterate that the FOMC is watching the labor market data carefully and is well positioned to support the economy if necessary."

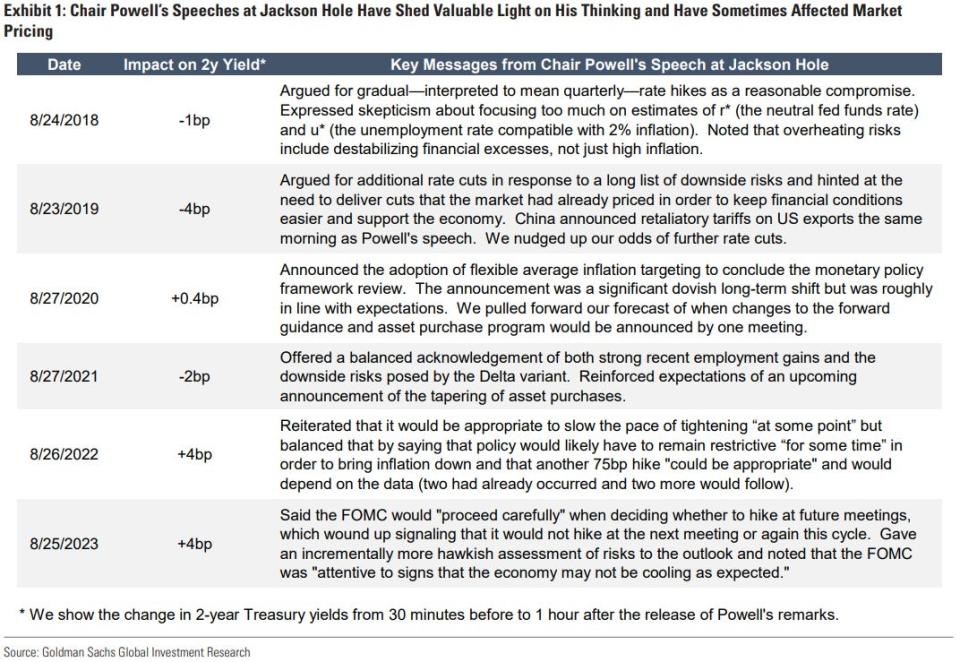

Goldman Sachs also gave a rundown of Powell's Jackson Hole speeches and their impact on Treasury yields since he became the Fed chairman in 2018.

Read the original article on Business Insider