The head of blockchain analytics platform CryptoQuant thinks Bitcoin (BTC) is right in the middle of a bull cycle, despite a dip to start the week.

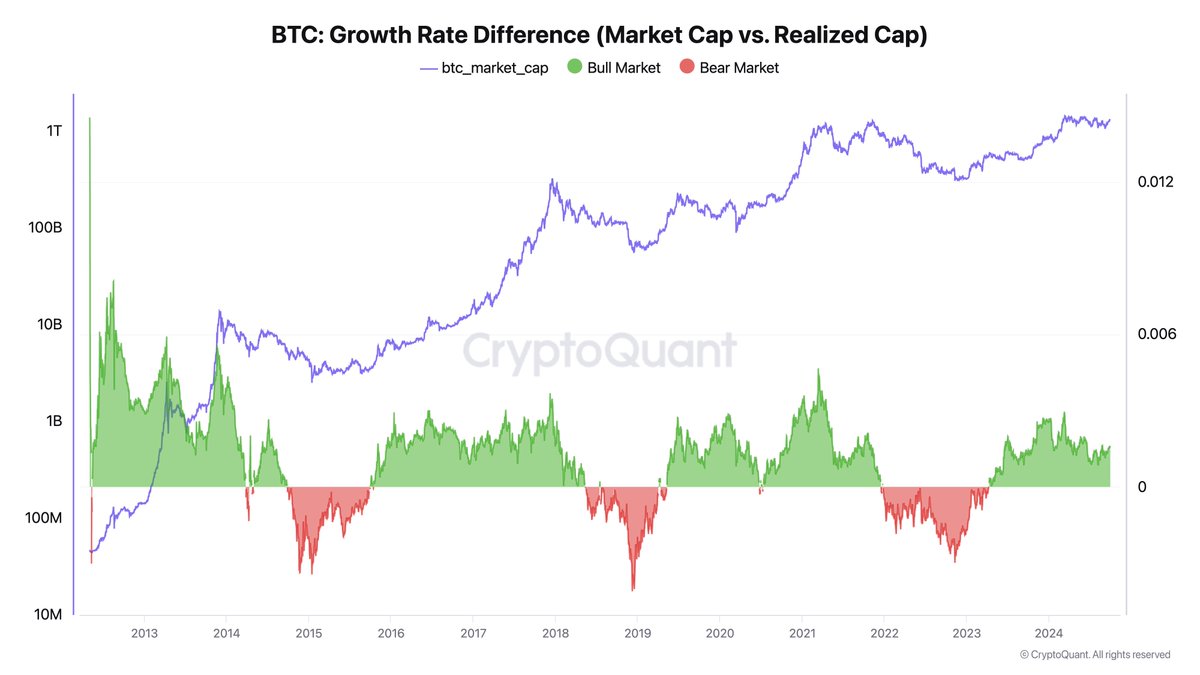

Ki Young Ju tells his 346,000 followers on the social media platform X that BTC’s market cap continues to grow faster than its realized cap, a trend that in past market cycles has lasted about two years during the bull phases.

If the pattern repeats, the current bull market could last until around April 2025, according to Ju.

The realized cap metric records the price of each Bitcoin when it last moved and aims to gauge how many holders are in profit or at a loss.

“Hey bears, I’m sorry, but Bitcoin is still in the middle of the bull cycle. When market cap grows faster than realized cap, it may signal a bull market; the reverse could indicate a bear market. This is likely due to more exchange trading in bulls and increased on-chain OTC (over-the-counter) activity in bears.”

Bitcoin is trading for $63,608 at time of writing, down 3.3% in the last 24 hours.

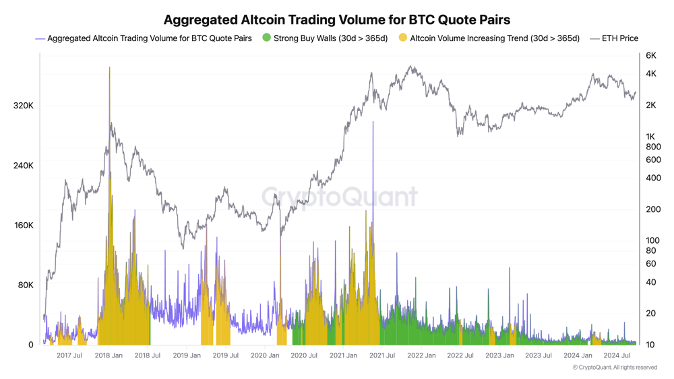

The analyst also says that “altseason” a phase when altcoins outperform Bitcoin, may be about to take off. At the approach of phase, traders tend to rotate capital from Bitcoin into altcoins in pursuit of greater returns.

“Asset rotation from Bitcoin to altcoins hasn’t started, but buy walls are getting stronger overall. I like the calm before the storm.”

However, Ju recently warned that the altcoin market could remain flat due to a lack of crypto innovation.

“An industry that does not promote dopamine is destined to decline. The crypto industry we once knew is now failing to provide any dopamine to both builders and traders. That is why it is in crisis. A new game for traders must emerge.

Only then can money flow into the market, and the industry can grow. The 2024 altcoin performance is dismal. Money is not flowing into the industry. If we do not create a new game to stimulate traders’ dopamine, the crypto industry we know will face a prolonged period of stagnation. I am genuinely concerned.”

Generated Image: DALLE3