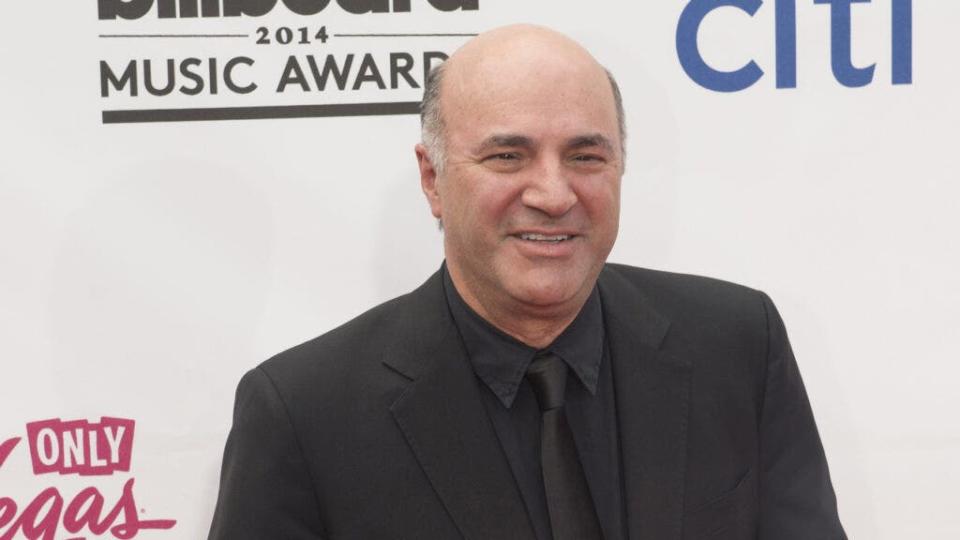

Kevin O’Leary, famously known as Mr. Wonderful from “Shark Tank,” recently shared an unexpected statistic that caught everyone’s attention – in the venture space, 70% of his returns come from companies led by women. He claims there's a good reason for that.

O’Leary openly shared that he’s learned a lot over the years about where to put his money for the best returns, and his experience has led him to an interesting conclusion – investing in women-led businesses pays off.

Don't Miss:

A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

Groundbreaking trading app with a ‘Buy-Now-Pay-Later' feature for stocks tackles the $644 billion margin lending market – here’s how to get equity in it with just $500

He explained that women entrepreneurs often have a strong focus on risk management and an ability to navigate complexities in ways that truly resonate with him as an investor.

“If they say, ‘I’ve got three kids,' I don’t care,” O'Leary said. To him, the fact that women have multiple responsibilities is a testament to their capability, not a deterrent.

He recognizes that women frequently balance a lot, whether it is work, family, or leading a team, and he views this as a great asset in business. “If you want something done, give it to a busy mother. They balance a lot of stuff in their lives,” he exclaimed.

Trending: One trailblazing female with an expertise in renewable energy built a company that's bringing the EV revolution to disadvantaged communities — here’s how you can invest at just $500

One key reason for the high returns from women-led companies is their ability to manage risk. He described how women are generally more cautious about growing their companies. They make smart, deliberate decisions rather than going for the high-risk, high-reward play. “They understand risk mitigation,” O’Leary said. This means they are less likely to make reckless decisions, which helps the businesses they run stay on course, even in tough times.

Trending: The global games market is projected to generate $272B by the end of the year — for $0.55/share, this VC-backed startup with a 7M+ userbase gives investors easy access to this asset market.

Another reason O’Leary loves investing in women-led ventures is their tenacity. He shared a story about a female entrepreneur who refused to leave the set of “Shark Tank” without securing his investment. Though he initially doubted her business, her persistence won him over. “She had balls,” O’Leary started explaining vividly, “she just wouldn’t stop, and I thought, if she’s doing this to me, what is she going to do when she gets out there in the real world? She’s a killer.”

That company ended up being one of his most profitable investments. For O’Leary, women entrepreneurs’ passion and drive often translate into great results for investors.

He added that, in his experience, women have an incredible ability to execute and get things done, even when dealing with challenges.

Read Next:

This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L'Oréal, Hasbro, and Sweetgreen in just three years – here's how there's an opportunity to invest at $1,000 for only $0.50/share today.

‘Scrolling to UBI': Deloitte's #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article 'If They Say "I've Got Three Kids," I Don't Care,' Says Kevin O'Leary. Claims 70% Of His Returns Come From Women-Led Companies. Here's Why originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.