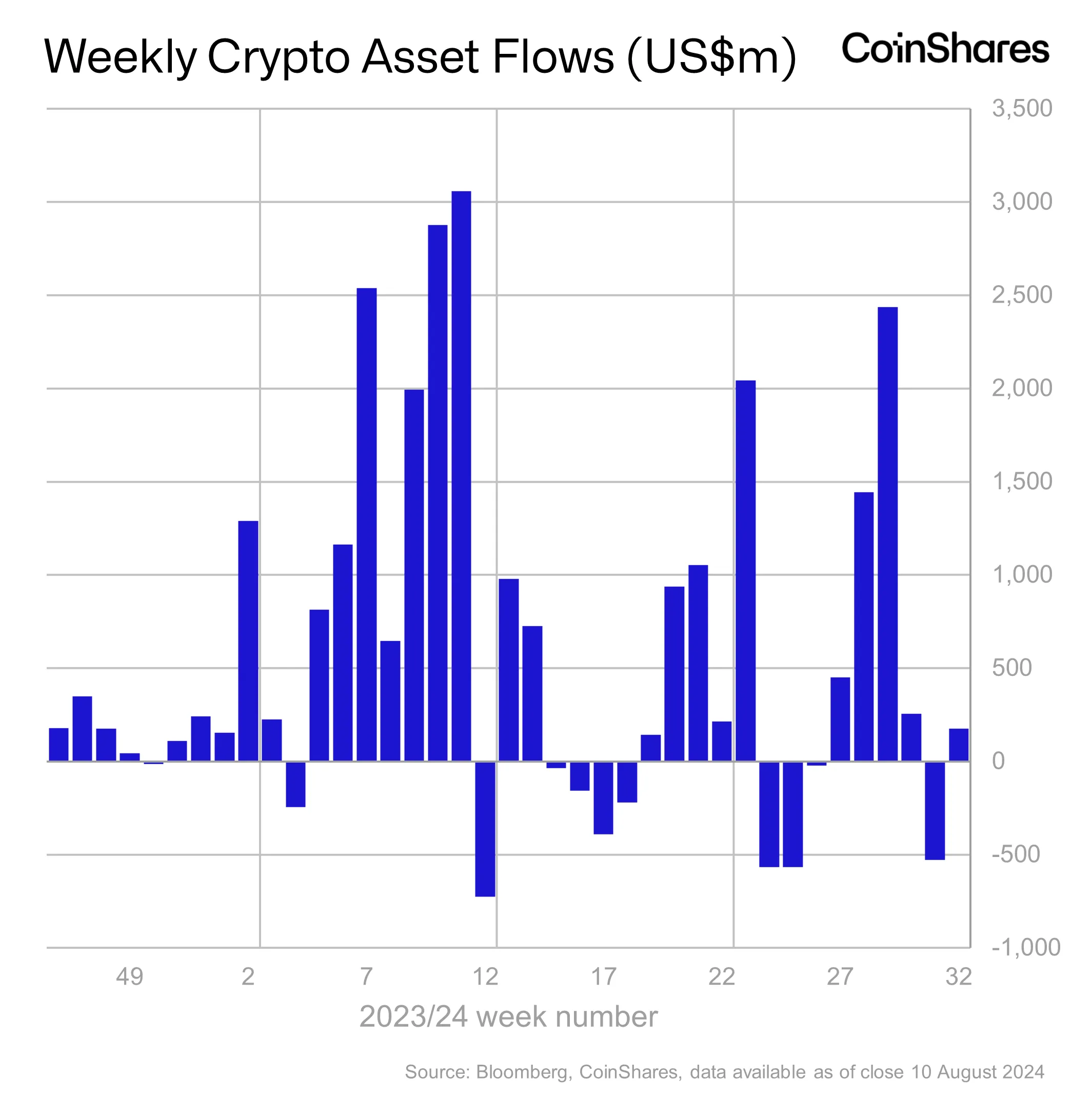

Digital assets manager CoinShares says that institutional crypto investors poured hundreds of millions in capital into digital asset investment products last week.

In its latest Digital Asset Fund Flows report, CoinShares says that institutional crypto investment products enjoyed $176 million in inflows last week due to investors viewing price weakness as an opportunity.

“Digital asset investment products saw inflows totaling US$176m as investors saw recent price weakness as a buying opportunity. Total Assets under Management (AuM) of investment products had fallen to US$75bn, wiping over US$20bn off in the correction, but it has since recovered to US$85bn. Trading activity in ETPs was much higher than usual at US$19bn for the week, versus US$14bn weekly average this year so far.”

According to CoinShares, regional reactions were unusually unanimously positive.

“Most notable was the US, Switzerland, Brazil and Canada with US$89m, US$20m, US$19m and US$12.6m respectively. The US remains the only country to see net outflows month-to-date totaling US$306m.”

Ethereum (ETH) institutional investment vehicles brought in $155 million in inflows last week, the most of any crypto asset.

“This brings its year-to-date inflows to US$862m, the highest since 2021, largely driven by the recent launch of US spot-based ETFs (exchange-traded funds).”

Bitcoin (BTC) brought in $13 million in inflows while multi-asset investment vehicles and Solana (SOL) brought in $18.3 million and $4.5 million, respectively.

Generated Image: DALLE3