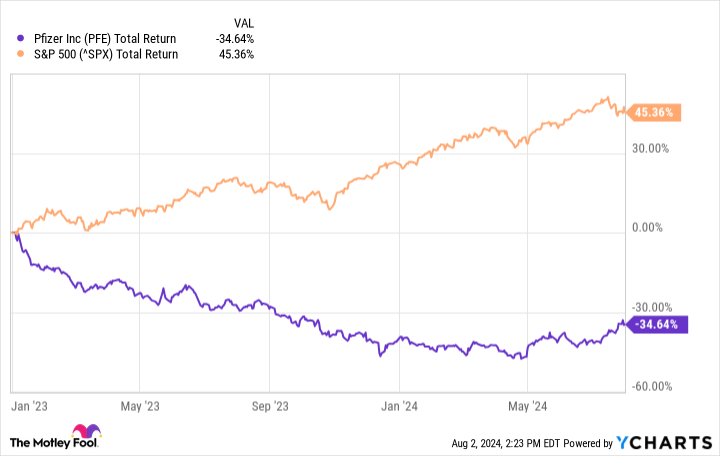

Pharmaceutical giant Pfizer (NYSE: PFE) has been in a bit of a freefall since early 2022, with shares down by 46%. Pfizer's revenue and earnings dropped off a cliff along with its coronavirus-related results as the pandemic started fading, which explains its poor performance over the past 18 months. However, there are clues that Pfizer is starting to make a comeback. That's an important takeaway from Pfizer's second-quarter results. Let's dig in.

PFE Total Return Level data by YCharts.

Revenue is finally moving in the right direction

In 2022, Pfizer generated $100 billion in sales, becoming the first company in the biopharmaceutical industry to manage this feat. Of course, the drugmaker pulled that off thanks to its work in the coronavirus field. It would always be a tough act to follow, especially as the pandemic started receding. That's why Pfizer's revenue has been declining on a year-over-year basis ever since -- until the second quarter of 2024. Pfizer's sales for the period came in at $13.3 billion, an increase of 2% year over year.

Things look even better once we exclude Pfizer's COVID-19 portfolio, without which the company's revenue would have grown by 14%. True, Pfizer completed the acquisition of cancer specialist Seagen for $43 billion in December. Seagen's approved products did contribute to Pfizer's top-line growth, but there was more to the story. Pfizer's pre-acquisition revenue might have also moved in the right direction in the first quarter. Several products contributed to Pfizer's performance in the second quarter, including its migraine treatment Nurtec ODT and Vyndaqel, which treats a heart disease called transthyretin amyloid cardiomyopathy.

There was even more good news for investors as Pfizer raised its full-year revenue and earnings guidance. The pharmaceutical giant previously expected revenue for the year to come in between $58.5 billion and $61.5 billion; the new projected range is $59.5 billion to $62.5 billion, a $1 billion increase. Its previous adjusted earnings-per-share guidance of $2.15 to $2.35 was upgraded to $2.45-$2.65.

The stock still looks like a great pick

Pfizer earned seven new approvals last year. Most of these aren't yet making a significant impact on its top line. The company is also developing newer products. Pfizer is dipping its toes in the weight loss market with its own GLP-1 candidate, danuglipron, which has produced encouraging results in a phase 2 study. Further, Pfizer's bet to boost its presence in oncology is still in its early stages.

That's why it acquired Seagen, which had several cancer drugs in development. In other words, there will be plenty of catalysts for Pfizer in the coming quarters as newer products slowly start making an impact and it records meaningful clinical progress.

In my view, Pfizer's sell-off had gone too far, and the company looked deeply undervalued. Pfizer's forward price-to-earnings ratio is a measly 10.8. The average for the healthcare industry is 18.3. Lastly, Pfizer is an excellent dividend stock. The company currently offers an incredible yield of 5.88%. It has increased its payouts by almost 17% in the past five years. Pfizer remains committed to rewarding its shareholders with regular dividends, as management highlighted once again during its latest earnings conference call.

Here's the bottom line: Value and dividend investors will find exactly what they are looking for with Pfizer. The company will eventually return to regular year-over-year growth as it replenishes its lineup of drug treatments.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $763,374!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 12, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool has a disclosure policy.

Is Pfizer Stock Ready to Bounce Back? was originally published by The Motley Fool