Infrastructure monitoring startup Grafana Labs said today it has raised a bumper $270 million via two separate funding transactions, as it looks to solidify its status as a leader in the observability industry.

Today’s round is said to have involved all of the company’s prior backers, led by Lightspeed Venture Partners, with participation from GIC, Sequoia Capital, Coatue, Lead Edge Capital, J.P. Morgan and K5 Global. In addition, CapitalG joined the round as a new investor. The new cash infusion brings Grafana’s valuation to north of $6 billion, and comes just over two year after it raised $240 million in its Series D funding round.

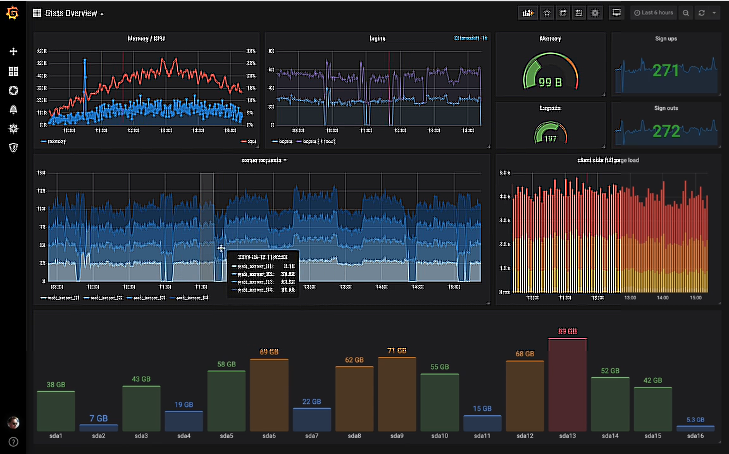

New York City-based Grafana Labs, officially named Raintank Inc., is the creator of Grafana Cloud, one of the most popular and widely used open-source platforms for information technology infrastructure monitoring. The platform works by grabbing telemetry data and operational data from customer’s infrastructure, such as servers and databases, and plotting this data into graphs that can help administrators identify patterns and trends more easily.

By plotting observability data as graphs, it makes it easier for teams to identify technical issues before they cause significant problems. When a potential problem is identified, an alert is generated and sent to the person most qualified to fix that issue.

Grafana also provides tools that are specific to different IT infrastructure platforms, such as the Kubernetes Monitoring in Grafana Cloud module. This is designed specifically to monitor Kubernetes clusters, and gives teams a way to visualize and analyze key metrics related to those environments, track resource usage and assess their behavior for any problems.

Grafana doesn’t stand still either, and is continuously adding to the capabilities of its platform to make it more useful. One of its most recent updates introduced a new feature called Adaptive Metrics, which uses artificial intelligence to reduce cloud infrastructure costs by identifying and eliminating unused metrics through aggregation.

Last year, the company acquired an AI startup called Asserts.ai Inc., which sold software that maps the relationships between IT infrastructure systems and their components in real time. This software forms the basis of Grafana’s Application Observability offering, which is designed to help teams get a better picture of the health of the underlying infrastructure that powers individual applications.

Another new tool announced recently is the open-source Grafana Beyla project, which deploys a daemon set in Kubernetes to help with instrumenting its application observability tools in that platform.

Grafana is clearly dead set on spreading its tentacles into every aspect of IT monitoring, and its business has grown rapidly as a result. According to the company, it has managed to grow its paying customer base to more than 5,000 companies in the last year, including big enterprises such as Dell Technologies Inc., Microsoft Corp., Salesforce Inc. and Citigroup Inc. Meanwhile, its annual recurring revenue has risen to more than $250 million, the company said.

Gaurav Gupta, a partner at Lightspeed Venture Partners, said the company has been on a tear, releasing numerous products and features to build what he believes is “clearly the strongest open-source observability platform on the market.” He added that “there’s nothing that compares to their capabilities in operational dashboarding.”

Going forward, Grafana plans to continue expanding its platform capabilities. The money from today’s round will be used to accelerate product development and fund strategic merger and acquisition opportunities, the company said.

Co-founder and Chief Executive Raj Dutt pointed out the incredible adoption of the company’s open-source platform too, which he said has grown to more than 20 million users globally.

“What I’m most proud of is that we have stayed true to our roots, while diversifying our revenue sources,” he said. “We believe with the right strategy, open source will win and we’re just getting started.”