Investors throw around the buzzword "game-changing" far too often. It's rare when a company can create something truly groundbreaking that will change its industry substantially. QuantumScape (NYSE: QS) is attempting to do what nobody else has accomplished: Bring solid-state battery technology to electric vehicles (EVs). If it's successful, in a timely fashion, long-term investors would likely witness generational returns.

If you casually flip through QuantumScape's investor presentation, it might make your head spin with some of its testing data. Let's simplify what exactly QuantumScape's technology could potentially do within the EV battery industry.

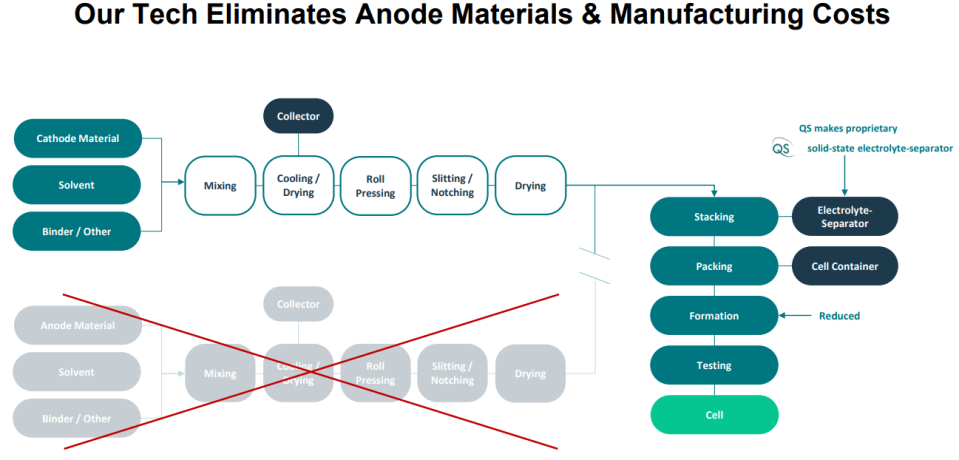

At the core of long-term successful companies, you'll find at least one similarity: They solve critical problems. QuantumScape's potential solid-state battery technology solves numerous problems. Its battery technology would improve charging times, extend EV range, remove a chunk of the bill-of-materials to lower costs, and increase safety.

When it comes to solving problems in EVs, QuantumScape's solid-state battery technology could be a complete homerun.

Extended cash runway

Like many young companies in the EV industry, QuantumScape finds itself in a race against time. It not only needs to overcome challenges unique to being a first mover in solid-state EV battery technology, it needs to scale and commercialize its batteries before it runs out of capital and investor interest.

The good news is that QuantumScape not only just bought itself more time -- it inked a deal with Volkswagen's wholly owned battery company PowerCo that gives it a straightforward path to commercial production.

More specifically, after QuantumScape meets certain technical progress, and after PowerCo has made an advance royalty payment, the former will grant the latter the license to mass-produce battery cells based on QuantumScape's platform.

The non-exclusive license will enable PowerCo to produce up to 40 gigawatt-hours (GWh) per year, with an option to double that to 80 GWh annually, which would be enough to supply one million vehicles per year.

Here's the crucial takeaway from the deal between QuantumScape and PowerCo: Management expects the capital-light licensing arrangement to push its cash runway into 2028, adding 18 months of funding and time to its previous mid-2026 guidance.

Make or break in the near term

As QuantumScape extends its cash runway, the company faces a critical couple of years that will determine its future. In 2024, it has already shipped a new prototype battery called Alpha-2, which was a key milestone. The next step this year will be beginning the production and slow ramp up of its first commercialized product, the QSE-5.

The low-volume QSE-5 isn't expected to generate revenue in 2024. But analysts predict that in 2025, as volumes increase, it should generate roughly $5 million in revenue -- a number that's expected to jump to $58 million in 2026.

While that revenue generation fails to even meet PowerCo's $130 million royalty advancement, if stipulations are met, it's a huge step for a pre-revenue company with years of cash runway remaining.

What's holding QS back?

As the great Warren Buffett once quipped, be "fearful when others are greedy, and greedy when others are fearful." Now could be the right time to finally buy QuantumScape. The broader industry is engulfed in doom and gloom after the transition to EVs has hit a speed bump due to higher prices, interest rates, and continued range anxiety. But savvy investors are capable of looking at the broader picture to see that despite the recent speed bump, an incredible evolution has still taken place over a short time.

According to Cars.com's "Industry Insights Report," using 2019 as a baseline before COVID-19 threw the auto industry into flux, demand for EVs has surged by a staggering 930% thanks to more product choice, improving access to charging, increased consumer awareness, additional state and federal policies, tax incentives, and advances in battery technology.

During those five years, and especially recently, QuantumScape has given investors a path to commercialization with PowerCo, a way to generate revenue through royalty payments, an extension of its cash runway, and proof that its technology could solve massive problems facing the EV industry.

QuantumScape isn't far enough into its story to reward investors over the near term. It has many challenges and a slow ramp up of production. It faces growing competition and remains a highly speculative investment, but if the company wins its race against time and commercializes its products ahead of the competition, long-term investors will be highly rewarded.

Should you invest $1,000 in QuantumScape right now?

Before you buy stock in QuantumScape, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and QuantumScape wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $717,050!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 29, 2024

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Volkswagen Ag. The Motley Fool has a disclosure policy.

It Might Finally Be Time to Buy This Game-Changing Stock was originally published by The Motley Fool