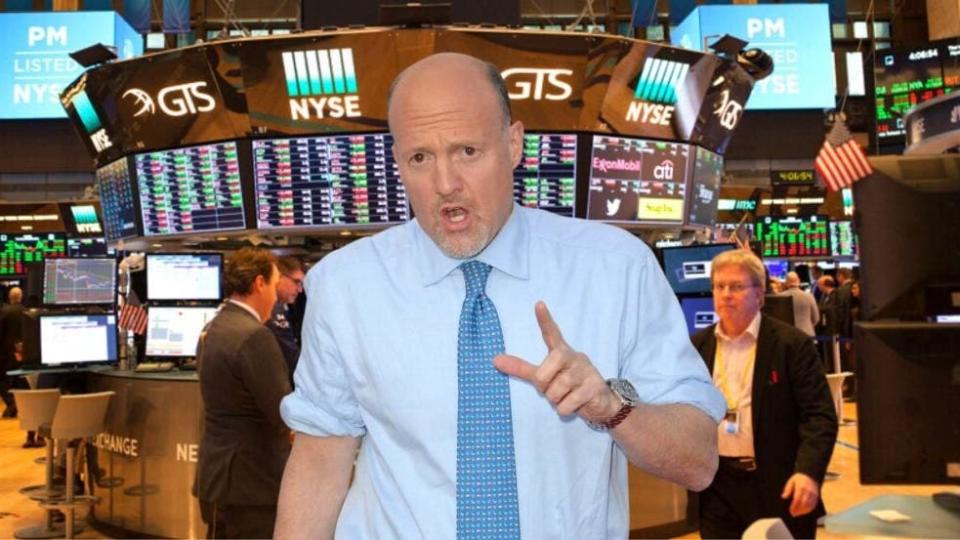

Jim Cramer, the widely recognized financial commentator, recently visited Twitter to share his understanding of the current stock market situation. He stressed that the recent uptick in stock prices isn’t due to strong fundamentals but the actions of the Japanese central bank, which have alleviated some market pressures.

I don't want anyone to think that any stock is going up this morning based on the fundamentals. It is the alleviating of the pressure from the Japanese central bank. We saw this nonsense many times back in the 90s. You could never tell who or where the sellers were coming from...

— Jim Cramer (@jimcramer) August 7, 2024

Don't Miss:

Can you guess how many retire with a $5,000,000 nest egg? – How does it compare to the average?

This startup is on the brink of a huge disruption to the $654 billion industry – Here’s how to invest in it before it fulfills its 800 pre-orders in the next 2 weeks.

This billion-dollar fund has invested in the next big real estate boom, here's how you can join for $10.

Cramer says this situation is similar to what happened in the 1990s when the market was often affected by unclear factors, and the real reasons for big stock sell-offs only became obvious later on.

He’s frustrated with how people quickly blame every market drop on fears of a coming recession. He thinks this is too simplistic and that investors must look beyond short-term market swings to understand what's happening.

This comes after the stock market’s recent plunge, which has sparked widespread speculation about a potential recession in 2024.

Trending: Elon Musk and Jeff Bezos are bullish on one city that could dethrone New York and become the new financial capital of the US. Investing in its booming real estate market has never been more accessible.

The State Of The Stock Market Now

Despite recent events, the stock market has proved its resilience throughout the year. Even with the recent downturn, it’s still up by 12.15% year-to-date and 19.06% over the past 12 months (at the time of writing).

These numbers suggest that while short-term declines can cause concern, they don’t necessarily indicate long-term economic issues. The market’s general strength has helped prevent more serious drops, so it’s important for investors to keep this broader perspective in mind.

Trending: During market downturns, investors are learning that unlike equities, these high-yield real estate notes that pay 7.5% – 9% are protected by resilient assets, buffering against losses.

Factors That Contributed To The Recent Stock Market Dive

The market recently took a sharp hit as the Nasdaq dropped 3.4%, the S&P 500 fell 3%, and the Dow Jones Industrial Average slid 2.6% due to a mix of factors, like rising geopolitical tensions, disappointing economic data from major global economies, and central banks tightening their monetary policies.

However, a key factor was the Bank of Japan’s recent decision to raise interest rates, strengthening the yen. This important decision can lower demand for Japanese exports and its currency, reducing investment in U.S. assets.

See Also: Don’t miss out on the next Nvidia – you can invest in the future of AI for only $10.

Are We In A Recession Now?

Many investors now wonder if the recent market behavior means a recession is coming. However, current economic data doesn't show we’re in a recession. While factors like rising inflation and stricter monetary policies are challenging, they don't suggest an immediate economic downturn.

Cramer's message reminds us that not every market drop signals a bigger economic crisis. It's easy to worry when stocks fall, but it's important to understand what's causing the changes before jumping to conclusions about the economy.

Read Next:

Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today!

Don’t miss the real AI boom – here’s how to use just $10 to invest in high growth private tech companies.

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Jim Cramer Says, 'We Saw This Nonsense Many Times Back In The 90s,' Must Stop Saying Every Tick Down Is From A Recession Scare' originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.