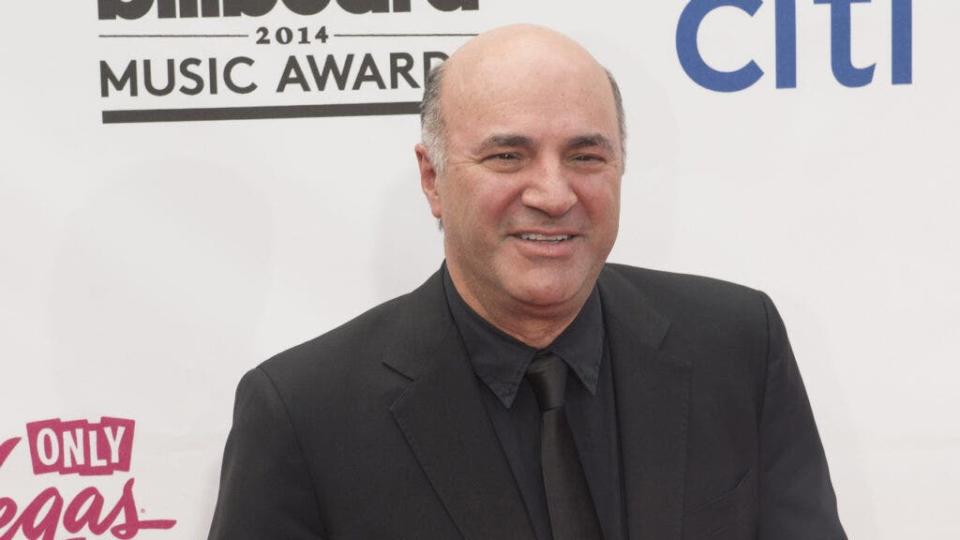

The FIRE (Financial Independence, Retire Early) movement is popular as many Americans make early retirement their goal. However, Kevin O'Leary, entrepreneur and investor from "Shark Tank," has chosen not to retire early, and his reasons extend beyond financial concerns.

O'Leary told CNBC he initially retired at age 36 after selling his first company, achieving substantial financial success. But he found retirement unfulfilling. "Working is not just about money," he said. "People don't understand this very often until they stop working. Work defines who you are."

Don't Miss:

The average American couple has saved this much money for retirement — How do you compare?

How much money will a $200,000 annuity pay out each month? The numbers may shock you.

O'Leary notes that working offers benefits beyond the financial gains of working more years. For instance, delaying retirement can increase Social Security payments, and staying employed provides valuable social interaction. "It gives you interaction with people all day long in an interesting way," he said. This engagement can be beneficial for mental health and longevity.

Regarding his plans, O'Leary is clear: he does not plan to retire. "I don't know where I'm going after I'm dead, but I'll be working when I get there, too," he commented.

Early retirement aspirations have gained significant traction in recent years, with several key trends emerging:

The share of U.S. workers planning to work beyond age 62 has decreased substantially, dropping to 45.8% in March 2024, the lowest level since 2014. This trend extends a downshift that began during the pandemic, indicating a growing preference for earlier retirement.

Trending: Can you guess how many retire with a $5,000,000 nest egg? – How does it compare to the average?

According to New York Fed researchers, the number of years Americans expect to continue working has plunged by 9.5% since March 2020. This decline has been observed across various demographic groups, suggesting a widespread shift in retirement intentions.

Americans increasingly want to retire before the traditional age of 65 and even before 62. This shift has been influenced by the COVID-19 pandemic, which prompted many to reassess their priorities and recognize life’s finite nature.

Factors contributing to this trend include:

Strong stock market performance and a robust housing sector have financially empowered many older individuals to retire comfortably.

Health issues post-2020, compelling numerous Americans to retire earlier than planned.

Changing perspectives on the value of work, with many individuals prioritizing early retirement over prolonged work commitments.

Most people retire between the ages of 61 and 64. Men tend to retire around 65, while women usually retire at about 63. Millennials and Gen Z prefer retiring earlier, often aiming for 60 or younger. On the other hand, many still think the ideal retirement age should be closer to 68 or 70.

Economic conditions and personal preferences shape these varied opinions on retirement timing. Consulting a financial advisor can help navigate these options and find the best retirement plan for individual needs.

Read Next:

This billion-dollar fund has invested in the next big real estate boom, here's how you can join for $10.

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Kevin O'Leary Warns Against Retiring Early And Says You Won't Understand It Yet, But 'Work Defines Who You Are' originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.