On-chain data shows Litecoin has recently seen a sudden exit of small hands, which can favor LTC’s price.

Small Litecoin Investors Have Been Displaying FUD Recently

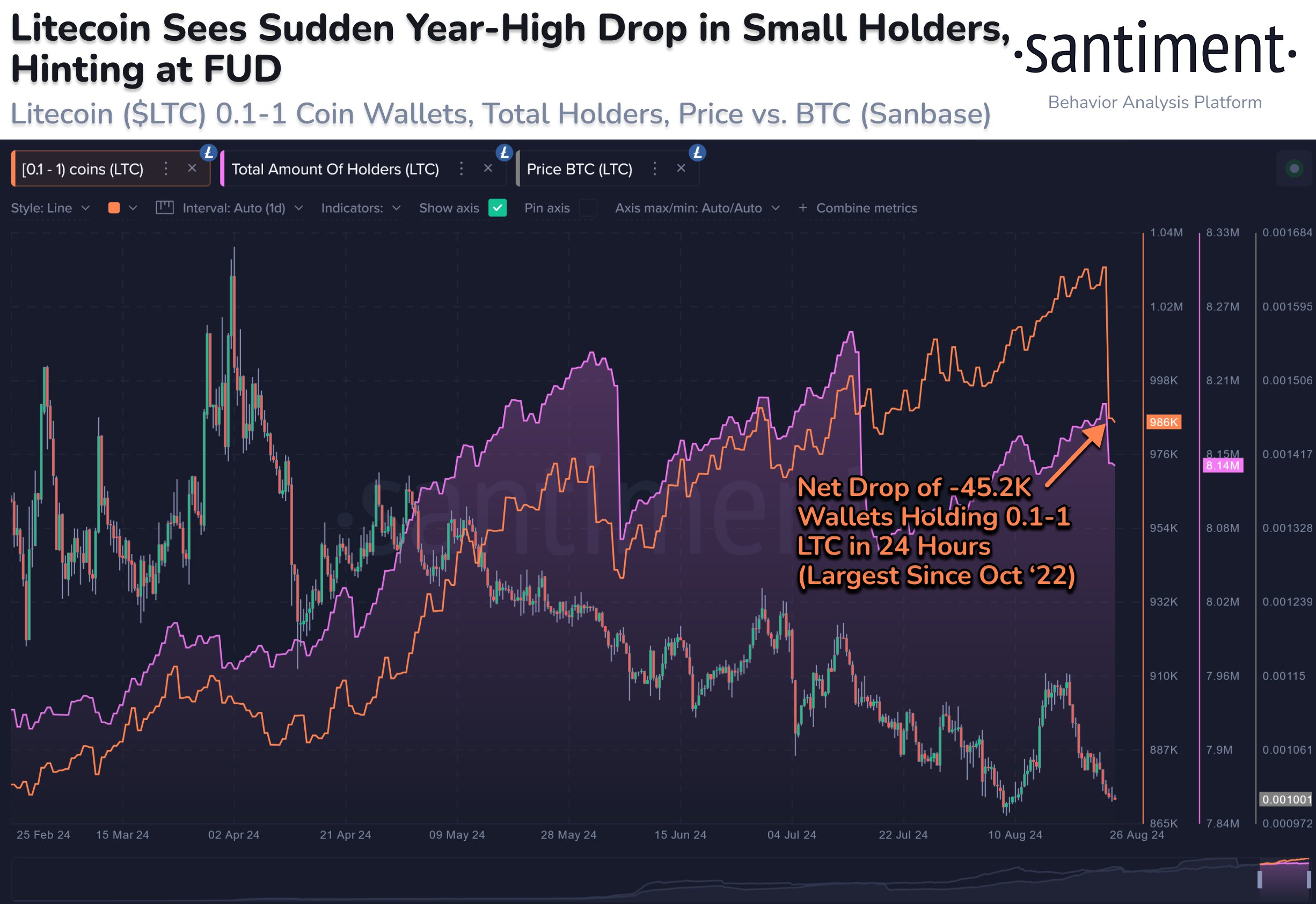

In a new post on X, the on-chain analytics firm Santiment discussed the latest shift in Litecoin’s userbase. A couple of relevant indicators are relevant here: Total Amount of Holders and Supply Distribution.

The first of these, theTotal Amount of Holders, measures, as its name suggests, the total number of addresses on the LTC network carrying some non-zero balance.

When this metric’s value goes up, new addresses with balance are popping up on the blockchain. This indicates that adoption is taking place, which can naturally be bullish for the asset.

On the other hand, the indicator’s value decreasing suggests some investors have decided to clear out their wallets, perhaps in an attempt to exit from the cryptocurrency completely.

Now, here is a chart that shows the trend in the Litecoin Total Amount of Holders over the last few months:

As displayed in the above graph, the Litecoin Total Amount of Holders has registered a sharp drop recently, a potential sign that many investors have decided to leave the asset.

While the decrease shows a departure from the network, the Total Amount of Holders contains no information about which type of investors are selling here.

This is where the second indicator comes in: theSupply Distribution. This metric tells us about the total number of addresses currently belonging to a particular wallet group.

In the chart, Santiment has attached the Supply Distribution data specifically for the investors with their address balance in the 0.1 to 1 LTC range. This is a small amount, so the only holders who qualify for this group would be the smallest of the hands: retail.

From the graph, it’s apparent that the Litecoin addresses falling within this range have recently seen their number go through a rapid decline. More specifically, around 45,200 retail addresses have suddenly cleared themselves out during this plunge.

Given this trend, it would appear that a good chunk of the decrease in the Total Amount of Holders has come from these small investors. While selling itself can be bearish, the fact that the retail holders are capitulating here may not be so bad.

As the analytics firm explains, “Small fish impatiently ‘jumping ship’ is often a turnaround sign for an asset to begin turning bullish once again.” Thus, whether this market FUD would lead to a rebound for Litecoin remains to be seen.

LTC Price

At the time of writing, Litecoin is floating around $62, down more than 4% over the last seven days.

Featured image from Dall-E, Santiment.net, chart from TradingView.com