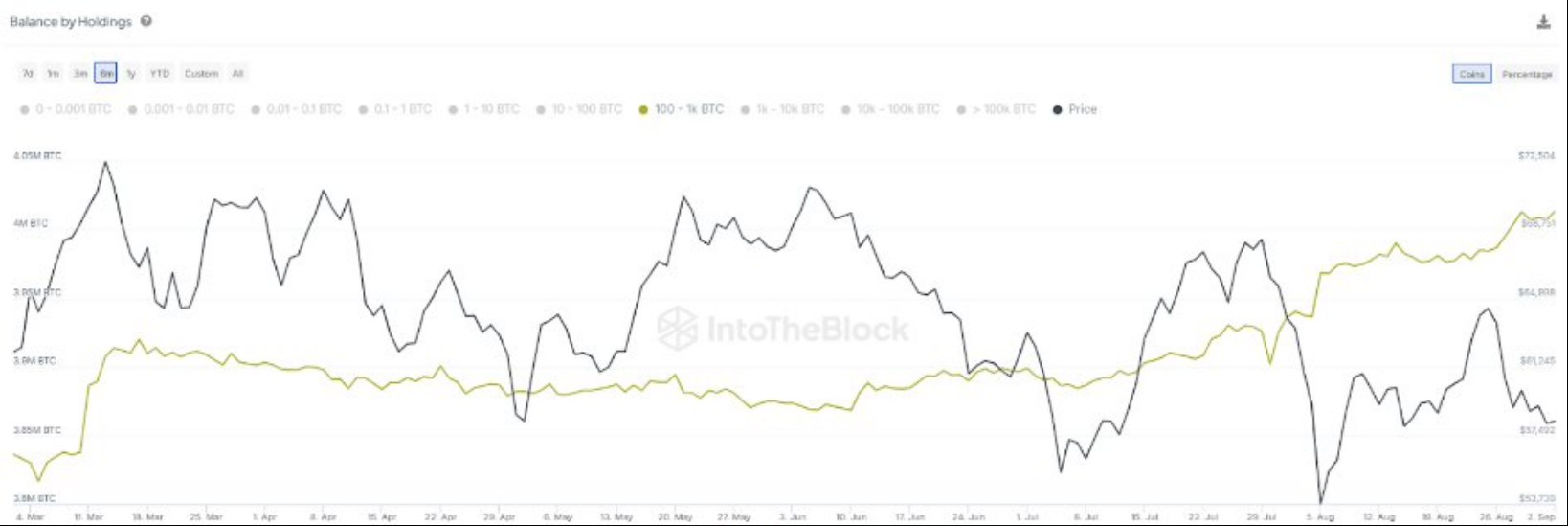

Recent data illustrates the interesting trend in Bitcoin ownership, where addresses that hold between 100 and 1,000 BTC control approximately 20.3% of the circulating supply.

This would amount to a total of about 4.01 million BTC, which is a considerable surge of 5% compared to the 3.82 million BTC it had just six months ago.

The rising accumulation by major holders shows strong interest in the cryptocurrency market; hence, this also reflects the greater institutional adoption and confidence in Bitcoin as an asset.

Addresses holding between 100 and 1,000 BTC now control 20.3% of the circulating supply, equivalent to 4.01 million BTC.

This marks a 5% increase from 3.82 million BTC six months ago, highlighting growing accumulation by large holders pic.twitter.com/JwkxBgWmDS

— IntoTheBlock (@intotheblock) September 8, 2024

The Rise Of Institutional Interest

The world of cryptocurrency is changing, and right at the forefront of that change is institutional interest. It has just been shown in a recent Coinbase survey that nearly one-third of institutional respondents have increased their crypto holdings over the past year.

Consequently, there is a surge in confidence: 64% of those already invested are expected to invest even more resources into cryptocurrencies in the next three years.

This is the most important sentiment, because it means long-term commitment to digital assets and, especially, Bitcoin, which is still perceived as “digital gold.”

Bitcoin: The Big Players

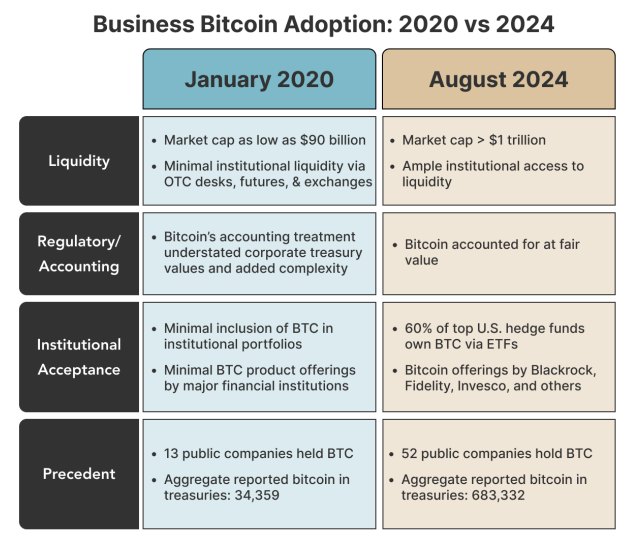

Significantly, key financial giants such as Grayscale and BlackRock have been leaving no stone unturned in the crypto space. Grayscale’s Bitcoin Trust saw billions invested into it, while BlackRock’s foray into Bitcoin ETFs simply legitimized the asset class.

The greenlighting of spot Bitcoin ETFs by the US Securities and Exchange Commission has been a game-changer, with such funds gathering more than $25 billion in assets within one month of their launch.

Such a surge of institutional money does not only tame volatility in the market but also greatly increases the credibility of Bitcoin as a mainstream form of investment.

Corporate Strategies And Massive BTC Adoption

While this is the case, and as the appeal of Bitcoin continues to rise, many companies have started rethinking their treasury strategies.

According to River, a Bitcoin technology company, in about 1.5 years, an estimated 10% of US-based companies could invest about 1.5% of their cash reserves, approximately $10.35 billion, into Bitcoin. This hypothesis has been based on the premise that companies need to combat inflation and hunt for asset diversification.

The future of Bitcoin is, therefore, bright and very attractive to corporate finance. Such rapid growth in BTC holdings among major addresses may indicate that big investors position themselves for long-term gains.

Featured image from Ranker, chart from TradingView