Since July 29, the Bitcoin price has been struggling to regain the $70,000 mark, which has proven to be a formidable resistance barrier for the leading cryptocurrency. This resistance has been in place for the last two quarters of the year, after BTC hit anall-time high of $73,700 back in March this year.

Since then, the market has experienced price corrections and periods of consolidation, but recent bullish sentiment has sparked hope for a price resurgence as the year progresses.

Could $70,000 Be Within Reach?

Market analyst Rekt Capital has provided insights into Bitcoin’s current trajectory, emphasizing the recent uptrend and the potential for the cryptocurrency to regain the $70,000 mark.

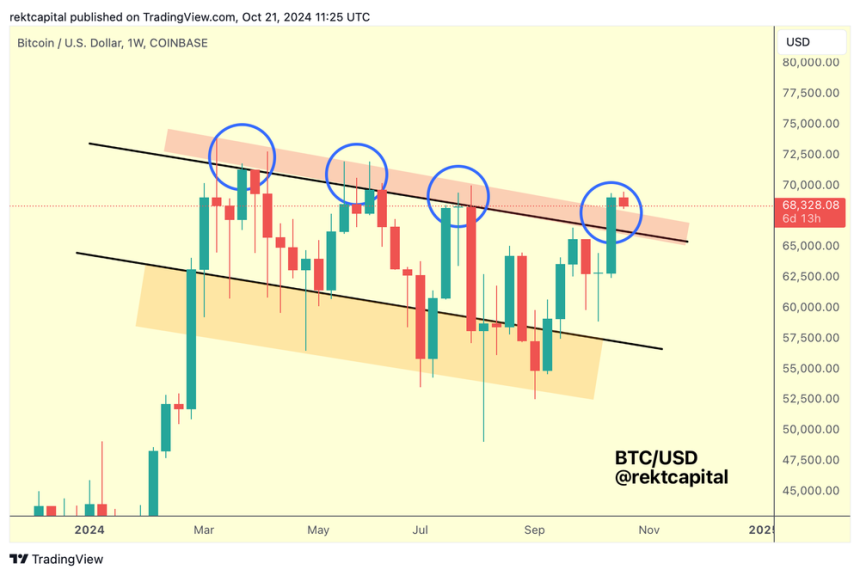

Notably, Rekt pointed out that Bitcoin has broken through a downtrending channel after surpassing the $65,000 level earlier this month, effectively invalidating a series of lower highs that had been established since mid-March.

This breakout signifies the end of the previous downtrend. Rekt noted that Bitcoin had repeatedly failed to break above the channel’s resistance, but the most recent weekly close has shifted market sentiment.

In his analysis, Rekt explains that Bitcoin is currently retesting its former resistance point above $69,000, suggesting that a successful retest could confirm the breakout and pave the way for further upside momentum.

Rekt further explains that the current retest of lower supportfloors could see Bitcoin’s price dip to around $66,300, which is the channel top. This level has previously served as a significant barrier, preventing the price from reaching higher levels.

Rekt pointed out that last week’s performance demonstrated the importance of this area, as Bitcoin closed above the lower high, setting the stage for a possible transition to higher levels if the aforementioned support holds.

Key Resistance Challenge Ahead For Bitcoin

If Bitcoin successfully retests this support level, the analyst expects that the next target would be the range high at approximately $71,500. This level marks a crucial challenge for Bitcoin, as it would signify the first attempt to breach the top of the re-accumulation range since June.

Rekt goes on to argue that a successful move towards the area high above these levels would demonstrate that the previous resistance is weakening, further boosting BTC’s prospects of reaching higher levels.

However, the question remains: how deep will any potential retracement be if Bitcoin faces rejection at the range high? Historically, since mid-March 2024, Bitcoin has encountered deeper rejections, with declines of 21% to 25% on August 5 and September 6 respectively.

Rekt concludes that BTC is moving deeper into a prior resistance area at $66,000, which may soon transform into support. A successful retest of this level could precede a significant reversal back to the $70,000 mark, reinforcing the bullish outlook for Bitcoin as it navigates through these critical price levels.

At the time of writing, BTC is trading at $67,350, registering a retracement of 2% in the 24-hour time frame.

Featured image from DALL-E, chart from TradingView.com